[ad_1]

On-chain knowledge exhibits the Bitcoin transaction quantity has plunged to a 3-year low, an indication that is probably not optimistic for the cryptocurrency.

Bitcoin Transaction Quantity Has Continued To Be Low Just lately

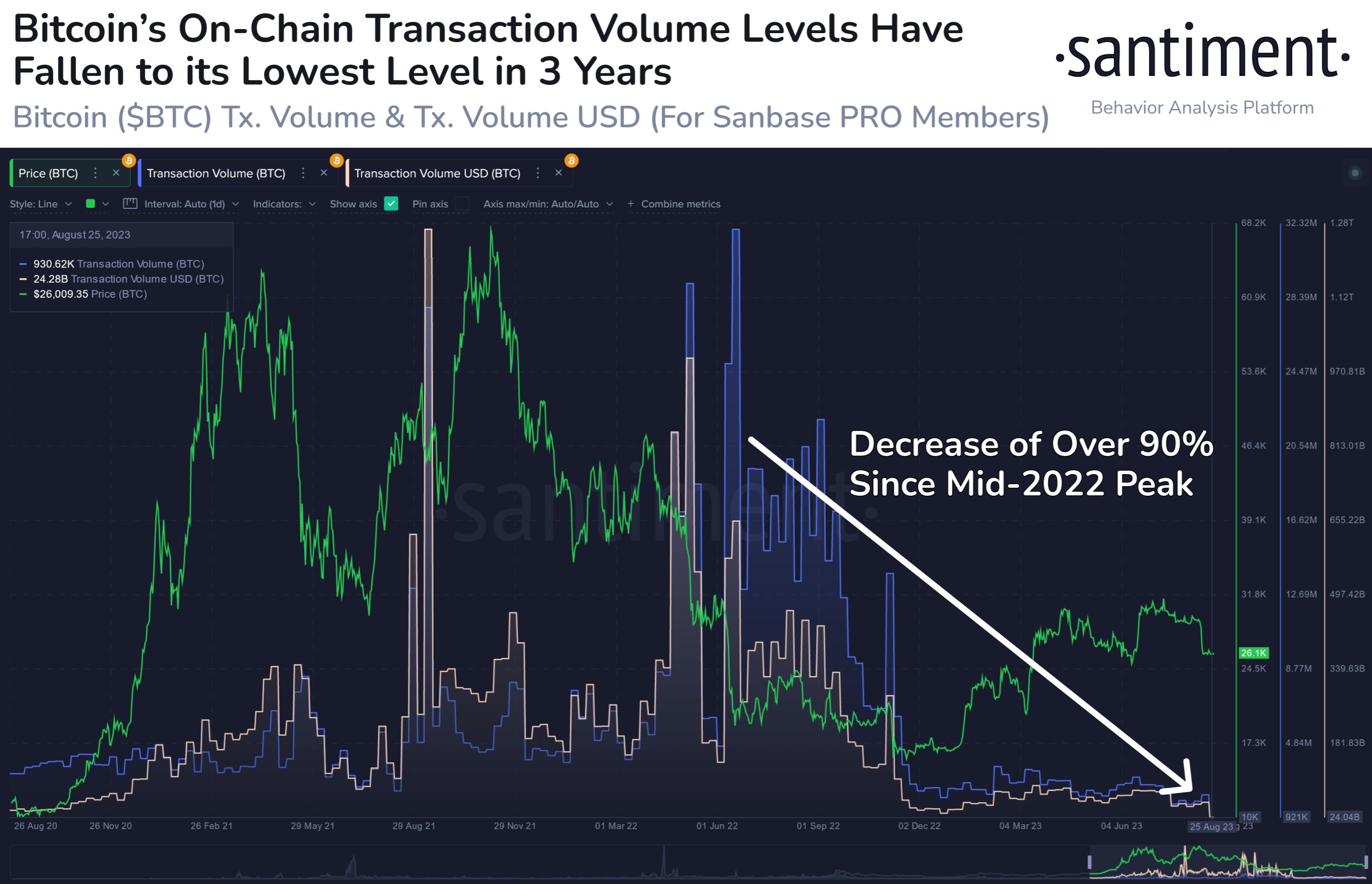

In accordance with knowledge from the on-chain analytics agency Santiment, the BTC transaction quantity has seen a decline of 90% for the reason that peak in mid-2022. The “transaction quantity” right here refers to a measure of the day by day whole quantity of Bitcoin that’s being moved round on the blockchain.

This metric accounts for every type of transactions, whether or not they be peer-to-peer (P2P) ones, trade deposits or withdrawals, or the charges that miners obtain. As such, the indicator can present a glance into how energetic the blockchain as an entire is presently.

When the worth of this metric is excessive, it signifies that a lot of cash are getting concerned in transactions on the community proper now. Such a pattern can recommend that the merchants are actively taking part available in the market presently.

Alternatively, low values suggest the chain isn’t observing a lot exercise in the intervening time, a attainable signal that the market contributors have little curiosity within the cryptocurrency.

Now, here’s a chart that exhibits the pattern within the Bitcoin buying and selling quantity over the previous few years:

Appears like the worth of the metric has been fairly low in latest days | Supply: Santiment on X

As displayed within the above graph, the Bitcoin transaction quantity had final been at excessive values in the course of the bear market crashes final 12 months, however for the reason that worth lows following the FTX crash, the indicator has remained at low values. That is even supposing the cryptocurrency has noticed a rally this 12 months.

Typically, buyers discover volatility to be thrilling, so they have a tendency to make extra strikes than standard throughout such durations. That is the rationale why the indicator had seen massive spikes in the course of the aforementioned crashes.

It will seem, nonetheless, that the rally has did not ignite any notable curiosity within the cryptocurrency, because the community’s utilization has continued to be at fairly low ranges all through this era.

Just lately, the Bitcoin transaction quantity has additionally seen an extra decline, which has taken its worth towards the bottom in round three years. In all, the indicator’s worth has dropped by greater than 90% for the reason that mid-2022 peak, which is a fairly staggering quantity.

The analytics agency notes that this decline within the community exercise could not essentially be bearish for the cryptocurrency, however it’s naturally nonetheless a sign that there’s FUD current among the many merchants proper now.

It now stays to be seen whether or not the Bitcoin transaction quantity will proceed to remain at low values within the close to future, or if a renewal of curiosity could lastly occur. The latter might possible convey again some contemporary volatility for the coin’s worth.

BTC Value

Bitcoin hasn’t moved an excessive amount of for the reason that crash as the #1 ranked cryptocurrency continues to be buying and selling across the $26,000 mark.

BTC has continued to be locked in consolidation just lately | Supply: BTCUSD on TradingView

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, Santiment.internet

[ad_2]

Source link