[ad_1]

Be part of Our Telegram channel to remain updated on breaking information protection

Balancer has joined the rising checklist of DeFi protocols exploited by cybercriminals this yr. The Ethereum automated market maker has been on the receiving finish of a $900k loss on August 27.

Balancer is conscious of an exploit associated to the vulnerability under.

Mitigation procedures have drastically diminished dangers, however are unable to pause affected swimming pools.

To forestall additional exploits, customers should withdraw from affected LPs.https://t.co/PDzX32gqeS https://t.co/b4CSqVFbDg

— Balancer (@Balancer) August 27, 2023

This information comes shortly after unveiling a vulnerability that has already impacted a number of swimming pools. Balancer’s staff has posted on X (previously Twitter) that because the affected collections couldn’t be paused, customers should withdraw their holdings from the affected liquidity swimming pools as quickly as doable.

Balancer has acquired a essential vulnerability report affecting quite a few V2 Swimming pools.

Emergency mitigation procedures have been executed to safe a majority of TVL, however some funds stay in danger.

Customers are suggested to withdraw affected LPs instantly.https://t.co/PDzX32gqeS pic.twitter.com/F1f649Wz3L

— Balancer (@Balancer) August 22, 2023

Blockchain safety skilled Meir Delov revealed the id of the attacker. He said that the attacker continues his operation and has moved greater than $600k to a selected handle.

The attacker continues along with his operation, approx $900K affected, greater than $600K moved to this address0xB23711b9D92C0f1c7b211c4E2DC69791c2df38c1 pic.twitter.com/inNqH4zel2

— Meir Dolev (@Meir_Dv) August 27, 2023

Quickly after the exploit, the precise handle acquired two transfers in DAI stablecoin value $636,812 and $257,527, making a complete lack of $893,978.

Withdraw Funds Shortly – Balancer

Balancer unveiled the problems on August 22, warning customers in regards to the prevalent exploits and urging them to withdraw their property from LPS earlier than going through any harm. The assistance in danger have been these deployed on Optimis, Ethereum, Avalanche, Gnosis, zkEVM, Fantom, and Polygon.

On the day of the warning, only one.45 of the entire property have been in danger, that means $5 million value of cryptos have been susceptible. $2.8 million of these property contained in the TVL have been additionally in danger, prompting Balancer to warn its customers on X (previously Twitter).

Whereas the mitigated swimming pools are secure, customers should transfer their property to secure collections or withdraw. Unmitigated swimming pools have been in danger. With that, Balancer urged customers to exit instantly.

Over $204 Million Misplaced to DeFi Hacks in Q2 Alone

For the reason that starting of 2023, the DeFi area has been on the receiving finish of quite a lot of hacks.

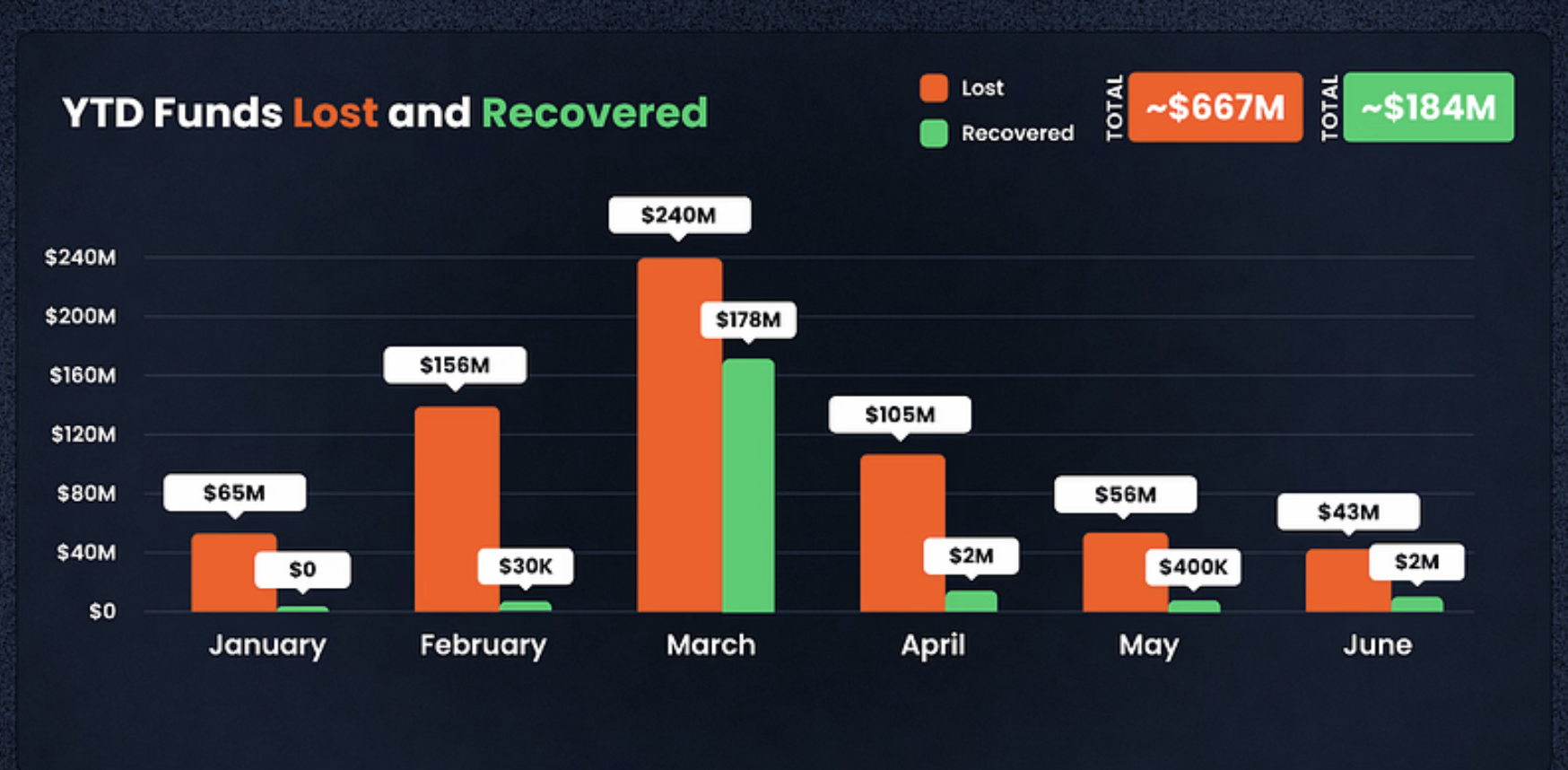

In Q2, DeFi suffered losses value $204 million, in accordance with a report by De. Fi Rekt. IT reported a complete loss in Q2 of 2023 of $204 million, making the entire year-to-date loss $677 million.

This loss is seven instances the loss the crypto financial system suffered in the identical quarter final yr.

The largest hack of the yr, nonetheless, was suffered by Euler in Q1, which led to a lack of $197 million.

Q3 faired a bit higher, because the surge in Crypto costs in July 2023, due to Ripple’s partial victory over SEC, has led to a 70% lower in crypto scams, in accordance with a report by Chainalysis, which was performed in July this yr.

Associated

Wall Avenue Memes – Subsequent Massive Crypto

Early Entry Presale Stay Now

Established Group of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Greatest Crypto to Purchase Now In Meme Coin Sector

Staff Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link