[ad_1]

OnlyFans, the well-known grownup content material subscription platform, has made a daring transfer into the world of cryptocurrencies. Its dad or mum firm, Fenix Worldwide, just lately revealed its vital funding of practically $20 million in Ether (ETH) in 2022.

In accordance with official monetary filings submitted to the UK company registry, Fenix Worldwide acquired practically $20 million price of ETH over a two-year interval.

Whereas the corporate’s funding in Ether demonstrates its progressive strategy, it wasn’t proof against the market’s inherent volatility. By the top of November 2022, the worth of Ether had plummeted by $8.5 million, resulting in an impairment loss on the funding.

The remaining carrying quantity of Ethereum stands at $11.434 million, reflecting the broader developments and uncertainties within the cryptocurrency market.

OnlyFans Ventures Past Conventional Choices

The transfer to put money into Ether aligns with OnlyFans’ broader technique of diversification and technological innovation. Investing in intangible belongings with an “indefinite helpful life” showcases the corporate’s willingness to embrace rising applied sciences like blockchain, positioning itself on the forefront of {industry} developments.

The disclosure about Fenix’s buying a considerable quantity of Ether has not appeared to supply a elevate but to the value of the crypto. On the time of writing, ETH was buying and selling at $1,636, down -0.8% within the final 24 hours, and sustaining a slight 2.2% loss within the final seven days, information from crypto market tracker Coingecko exhibits.

The monetary filings provide a glimpse into OnlyFans’ multi-faceted efficiency. Regardless of the challenges posed by its cryptocurrency funding, the corporate reported spectacular monetary outcomes for the 12 months ending November 2022.

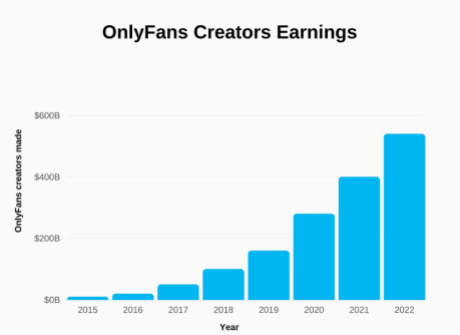

Supply: SignHouse

With income surpassing the $1 billion mark, pushed by an inflow of over 50 million new customers and greater than 1,000,000 content material creators, OnlyFans solidified its place as a revenue-generating powerhouse. Customers collectively spent an astounding $5.5 billion on the platform.

OnlyFans Pioneers NFT Integration And Celeb Buying and selling Playing cards

Leonid Radvinsky, the visionary entrepreneur of Ukrainian origin who acquired OnlyFans in 2018, has reaped the rewards of the platform’s surging recognition.

The filings unveil that Radvinsky amassed dividends approximating $485 million because the inception of the earlier 12 months, in step with the escalating demand for OnlyFans’ choices.

This current crypto enterprise will not be the corporate’s first stride into the digital asset area. In early 2022, OnlyFans facilitated a pioneering transfer by enabling verified creators to interchange their profile footage with Ethereum-based non-fungible tokens (NFTs).

Bitcoin slides again into the $25K area. Chart: TradingView.com

Furthermore, in June of the identical 12 months, former OnlyFans executives unveiled Zoop, a star buying and selling card platform leveraging the Ethereum scaling answer Polygon. Zoop allowed customers to commerce 3D digital taking part in playing cards depicting their favourite celebrities.

The disclosure of Fenix Worldwide’s Ethereum holdings dovetailed with an industry-wide pattern, as grownup content material creators started flocking to Buddy.tech, a decentralized social media platform rooted within the cryptocurrency realm. This rush underscores how crypto’s current surge has not solely captured monetary markets’ consideration but additionally influenced sectors far past typical investments.

Featured picture from Verità e Affari

[ad_2]

Source link