[ad_1]

TL;DR

MEV, brief for Miner Extractable Worth (or Maximal Extractable Worth), refers back to the further earnings miners can receive by manipulating transactions (including, eradicating, reordering). Methods to amass MEV embody DEX arbitrage, liquidation, front-running, back-running, and sandwich assaults.The Affect of MEV: Entrance-running and sandwich trades result in poor consumer expertise and extra important losses, however DEX arbitrage and lending liquidation will help the DeFi market attain equilibrium sooner and preserve market stability.Continued Progress of the MEV Market: After Ethereum’s The Merge, solely Ethereum, utilizing Flashbots’ block proposer, obtained over 206,450 ETH in MEV earnings (as of early July 2023).Flashbots, as a significant power within the MEV house, launched MEV-Geth, enabling miners and searchers to share MEV earnings. MEV-Enhance distributes MEV amongst proposers, builders, and searchers whereas safeguarding transactions from entrance working. MEV-share goals to permit customers, wallets, and DApps to seize generated MEV. MEV-SGX employs SGX-trusted {hardware} to interchange the trusted MEV-Relay position, attaining permissionlessness. SUAVE makes an attempt to deal with centralization dangers posed by MEV, offering transaction sequencing and block building companies to all present chains as a devoted chain.New Variables within the MEV Market: Chainlink, the biggest Oracle platform, goals to mitigate MEV points by transaction sequencing on the Oracle community stage. The emergence of UniswapX successfully resolves the “sandwich assault” drawback however introduces new considerations like MEV scrutiny.

MEV Clarification

MEV, brief for Miner Extractable Worth (or Maximal Extractable Worth), refers back to the further earnings miners can receive by manipulating transactions (including, eradicating, reordering). In a typical public blockchain, all transactions are initially submitted to the mempool, ready to be included in a block. Miners/validators, because the entities chargeable for block creation within the blockchain ecosystem, have important energy to determine which transactions are included in a block. Initially, miners type transactions by transaction charges from highest to lowest to find out the order of inclusion. Nevertheless, it was later found that by monitoring transactions within the mempool, miners might add, take away, or reorder transactions in a block to realize additional earnings past block rewards, giving rise to MEV.

In sensible phrases, specialised searchers usually use advanced algorithms to determine revenue alternatives. Since these searchers compete brazenly throughout the mempool, once they determine MEV alternatives, they improve transaction charges to make sure their transactions are included. Miners and searchers then share the MEV earnings.

In accordance with the extensively held view inside CGV, MEV acquisition methods range and embody DEX arbitrage, liquidation, front-running, back-running, and sandwich assaults. Charge-sniping assaults may happen on blockchains utilizing probabilistic finality consensus algorithms (resembling Bitcoin and Ethereum 1.0, which use PoW consensus algorithms).

DEX arbitrage entails exploiting value variations between completely different DEXes. By using the atomic transaction characteristic of blockchains, one should buy on a low-price DEX and promote on a high-price DEX, attaining risk-free arbitrage.Liquidation in lending protocols happens when the collateralization ratio falls beneath a predetermined threshold. The protocol permits anybody to liquidate the collateral, instantly repaying the lender. Throughout liquidation, debtors usually pay substantial liquidation charges, a part of which turns into MEV alternative.Entrance working entails monitoring worthwhile transactions and submitting the identical transaction with the next payment to make sure the submission precedes the unique transaction, thus gaining revenue. Broadly, entrance working entails inserting a transaction earlier than one other to revenue.Again working pertains to AMM-based DEXes with important slippage in giant trades. After a big commerce, the market is imbalanced. Backrunning entails including a transaction after the massive commerce to purchase belongings at a value decrease than the market equilibrium.Sandwich buying and selling combines entrance working and again working. It entails shopping for at a low value earlier than a big commerce after which promoting at a excessive value after the commerce raises costs, yielding substantial revenue.Charge Sniping Assault: The latest surge within the BRC-20 market led to Bitcoin community congestion and rising transaction charges, prompting considerations about Charge Sniping assaults. On PoW consensus blockchains, if potential earnings are important, miners can roll again or reorganize latest blocks, reordering or together with particular transactions to realize extra revenue. Word: Ethereum, previous to The Merge, additionally used PoW consensus however referred to it as “Time Bandit”.

Affect of MEV

MEV has destructive and constructive results, damaging customers and even the complete blockchain community whereas fostering larger market equilibrium and effectivity.

1. Constructive AspectsDEX arbitrage and lending liquidation can help the DeFi market in reaching equilibrium sooner and sustaining market stability. Like conventional finance, MEV searchers are conditions for an environment friendly monetary market. For this class of MEV, the features of MEV searchers come from the market itself.

2. Unfavorable AspectsFront-running and sandwich trades result in poor consumer experiences and extra important losses. Aggressive MEV searchers bidding on fuel can congest the community and elevate fuel charges.

A extra extreme concern for probabilistic finality PoW chains is the potential for fee-sniping assaults. Time-bandit assaults violate the blockchain’s precept of “immutability,” critically compromising community safety and stability. This has raised considerations throughout the BTC group concerning the present state ensuing from the Ordinals protocol.

For PoS chains, notably regarding the present ETH2.0, MEV might result in centralization of validators. Bigger staking swimming pools achieve increased MEV earnings, leading to extra sources to boost MEV extraction functionality, resulting in the Matthew impact and eventual validator centralization, thereby reducing safety.

Growth Historical past of MEV

Early Beginnings (2010-2017):

In 2015, Bitcoin core developer Peter Todd launched the “Exchange By Charge (RBF)” idea on Twitter, which was the precursor to the entrance working talked about earlier. RBF prompt that customers might change an present transaction by submitting a brand new transaction with increased transaction charges and not less than one an identical enter.

Constructing upon RBF, the Bitcoin group step by step explored the idea of payment sniping. Charge sniping entails miners deliberately re-mining a number of earlier blocks to realize the charges initially earned by the miner who initially created these blocks. Whereas the probability of efficiently re-mining earlier blocks is small in comparison with extending the chain with new blocks, this technique could possibly be worthwhile if the charges of earlier blocks are extra precious than the transactions within the miner’s present mempool. Charge sniping was later prolonged to the EVM mannequin and described because the “Time Bandit” assault within the “Flash Boys 2.0” paper.

Formal Emergence (2018-2019):

MEV arises solely when there’s competition within the state or when submitted state transitions are unconfirmed. Bitcoin lacks a shared state and has strictly outlined state transitions, limiting MEV on Bitcoin to payment sniping and double-spending assault makes an attempt. In distinction, Ethereum, with Turing-complete good contracts, provides considerably extra MEV alternatives.

In 2016, EtherDelta, Ethereum’s first DEX, launched a sub-matching order e-book design, offering wide-ranging MEV alternatives, though they weren’t absolutely exploited then.

In 2017, the primary algorithmic stablecoin on Ethereum, DAI, emerged, introducing the idea of liquidations to DeFi and creating occasional however important MEV alternatives (Spike MEV). In 2018, Hayden Adams based Uniswap, Ethereum’s first AMM-based DEX. The AMM mechanism depends on MEV extractors to keep up market effectivity, considerably rising MEV alternatives.

The Rise of Flashbots (2019-2021):

In April 2019, “Flash Boys 2.0” was printed, bringing MEV analysis into the mainstream. In direction of the top of 2019, a gaggle of like-minded digital nomads fashioned Pirate Ship, later renamed Flashbots, utilizing a robotic emoticon as their brand.

In January 2021, Flashbots Public sale (mev-geth and flashbots relay) was formally launched. Driving the wave of the DeFi Summer season, extracted MEV noticed important development.

Present State: Numerous MEV Panorama, Flashbots Main

Because the MEV market expands, quite a few initiatives have joined the fray. Flashbots presently helps the Ethereum mainnet, prompting widespread Layer1 and Layer2 options to check Flashbots and experiment with implementing MEV auctions. Some initiatives are taking different approaches, resembling encrypting transaction swimming pools to deal with the MEV drawback comprehensively. Flashbots continues to innovate, following the early 2021 launch of Flashbots Alpha, introducing Flashbots Shield, MEV-Enhance, MEV-Share, and the upcoming SUAVE part.

The Dimension of the MEV Market

In principle, the potential MEV earnings from user-submitted transactions could possibly be limitless. Nevertheless, figuring out the precise magnitude of MEV earnings shouldn’t be attainable by finite calculations, because the MEV earnings that folks uncover kind the decrease sure of potential MEV. The realized MEV (REV) is usually used to estimate the potential MEV market state of affairs. This represents the MEV that has been efficiently extracted and realized by numerous methods.

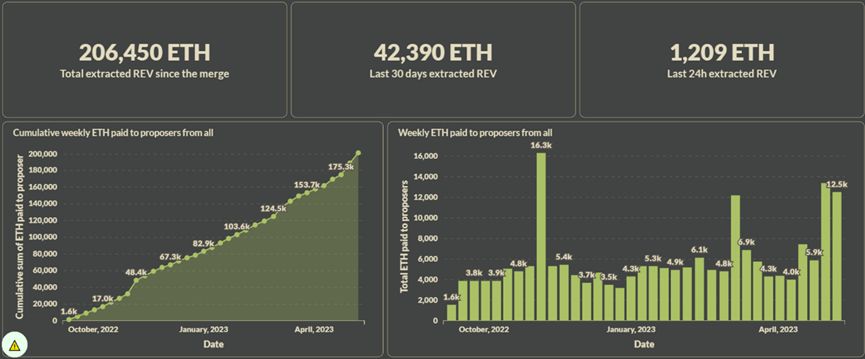

Statistics of the MEV Market After Ethereum’s “The Merge”, Supply: https://discover.flashbots.web/In accordance with knowledge supplied by Flashbots, as of early July 2023, after Ethereum’s “The Merge,” a complete of 206,450 ETH in realized MEV (REV) extraction has been achieved. Nevertheless, this determine solely accounts for the MEV earnings obtained by block proposers, and the earnings of searchers haven’t been factored in.

Wouldn’t or not it’s higher with out market competitors?

Primarily based on the historic expertise amassed all through human society, the idea of the “invisible hand” is usually a better option generally. Nevertheless, few would deny that market economies aren’t universally relevant and might result in severe penalties when misused in sure particular domains.

The elevated fuel costs attributable to entrance working are rooted in Ethereum’s pricing mechanism. Can fuel costs be saved at a set stage to keep away from the searcher’s precedence fuel public sale?

However, a transparent consequence of doing so could be collusion off-chain, the place searchers with MEV alternatives might bribe miners to incorporate their transactions earlier, resulting in the emergence of small-scale off-chain markets. This contradicts Ethereum’s open, permissionless ideology.

After all, we might guarantee miners/validators within the community are licensed with some type of authority to ensure they received’t act maliciously, however this introduces a powerful assumption of belief and would remodel the system right into a permissioned chain.

In abstract, CGV believes that, whereas sustaining Ethereum’s present traits, it could be tough to utterly remove the MEV drawback.

The way to Mitigate the Adversarial Results of MEV

Protocol-Degree Precedence-Primarily based Scheduling (PBS) – Ethereum Neighborhood Resolution

In PoS, validators take turns proposing blocks, and consensus amongst validators determines whether or not the block is written to the chain. In PoW, miners carry out the block proposal and consensus duties, although the essence is identical.

PBS goals to deal with the centralization of validators attributable to the present MEV. Within the default MEV course of, block mills have two duties: 1) constructing the optimum block from out there transactions (block constructing) and a pair of) proposing the block with proof of labor or stake to the community (block proposing). In circumstances the place MEV has not been completely exploited, step 1) usually entails sorting transactions by payment measurement, merely incorporating them into the block. As MEV earnings develop, bigger swimming pools of miners/validators seize extra MEV earnings, resulting in a Matthew impact and elevated centralization. Moreover, the precise block-producing entity in decentralized swimming pools features the MEV alternative, excluding different members from revenue sharing. This inequality undermines the adoption of decentralized mining swimming pools, additional rising centralization throughout the consensus community.

Roles concerned in MEV could embody:

1. Producer: Block mills (Miners, validators)

2. Proposer: Block proposer (Selects blocks constructed by builders with the very best MEV)

3. Builder: Block builder (Determines block content material)

4. Searcher: Searches for MEV in transactions

5. Person: Submits transactions doubtlessly containing MEV

Presently, many roles are held by the identical entity, resembling in the usual Ethereum consensus course of, the place the producer, proposer, and builder are in the identical position.

Vitalik’s Early Options

In 2021, Vitalik proposed two options, every with a definite focus. It’s essential to notice that the options mentioned on this part are Ethereum protocol-level options enforced by the protocol relatively than non-public negotiations like in Flashbots’ options.

PBS seeks to realize these 5 targets:

1. Proposer non-trustworthiness: Builders don’t must belief Proposers.

2. Builder non-trustworthiness: Proposers don’t must belief Builders.

3. Weak proposer non-trustworthiness: Proposers don’t require excessive computational sources or technical problem.

4. Unstealability of bundles: Proposers can’t steal earnings from the submitted block contents.

5. Easy and safe consensus: Consensus stays safe, ideally with out modifying the present block proposal mechanism.

Resolution 1

Builders create bundles and ship bundle headers to proposers, together with the bundle physique hash, cost to proposers, and builder’s signature.Proposers choose the highest-paying bundle header, signal, and publish a proposal containing that bundle header.Upon seeing the signed proposal, builders publish the entire bundle.

Analyzing the 5 targets:

Proposers can obtain funds from builders however forestall builders from acquiring MEV earnings, as an example, by delaying proposal launch till late slots, giving builders inadequate time to publish full bundles, and failing to satisfy objective 1.Submitting bundle headers ensures proposers obtain funds from builders, satisfying objective 2.Involving fundamental community communication and signatures, objective 3 is met.Proposers can’t completely entry bundle contents, solely headers, assembly objective 4.Introducing the brand new position of builder necessitates modifying forking guidelines, doubtlessly rising the complexity of forking choice from 2 to three, introducing additional uncertainty, and failing to satisfy objective 5.

Resolution 2

Builders create bundles and ship bundle headers to proposers, together with the bundle physique hash, cost to proposers, and builder’s signature.Proposers choose bundle headers from these seen and create a signed declaration for the chosen headers.Builders, upon seeing the declaration, publish the corresponding bundle our bodies.Proposers select a bundle header from their signed checklist and publish a proposal containing it.

Analyzing the 5 targets:

Solely together with full bundles in proposals ensures the completion of builder funds to proposers, satisfying objective 1.Builders might publish a number of high-paying bundle headers with out submitting precise bundle our bodies, rendering proposers unable to publish legitimate bundles, not assembly objective 2.With out limiting the variety of bundles accepted, extreme bundle our bodies obtained by proposers might result in excessive community bandwidth utilization, not assembly objective 3.Proposers pre-sign declarations, limiting them to proposing a finite checklist of bundles for the slot, stopping revenue theft, and satisfying objective 4.Builders don’t immediately interact in consensus, and proposers’ habits stays much like earlier than, with out a rise in forking conditions, satisfying objective 5.

Evolving Paths — Two-Slot PBS vs. Single-Slot PBS

The 2 paths correspond to enhancements and refinements of Vitalik’s early proposals, specifically Two Slot PBS and Single Slot PBS, which correspond to Options 1 and a pair of.

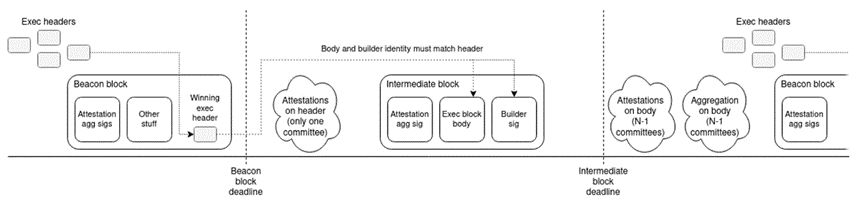

Within the Two Slot PBS strategy, a brand new sort of block known as the “Intermediate Block” is launched to retailer the contents of the profitable builder’s block. In Slot n, the proposer will suggest a daily Beacon Block containing a dedication to the profitable builder’s block contents. Then, in Slot n+1, the profitable builder will suggest the Intermediate Block, which incorporates the content material of the awarded block. These two blocks are components of a bigger block, splitting into two phases (slots) for completion. The primary stage resembles the block header, whereas the second stage constitutes the precise block physique. If no Beacon Block exists, no builder wins the bid, and there can be no subsequent Intermediate Block.

Each of those blocks require attestation voting from the Committee. A single committee votes on the Beacon Block, whereas all remaining committees throughout the slot vote on the Intermediate Block. Votes for every block (whether or not Beacon or Intermediate) will seem within the subsequent slot’s block.

If a builder doesn’t see the Beacon Block, it might point out a delayed launch, and the builder received’t publish the Intermediate Block. Moreover, to forestall potential losses attributable to delayed Beacon Block appearances, the proposal employs well-defined Fork Alternative Guidelines to reject such Beacon Blocks that come up after a sure time period.

Two Slot PBS Scheme Design, Supply: https://ethresear.ch/t/two-slot-proposer-builder-separation/10980

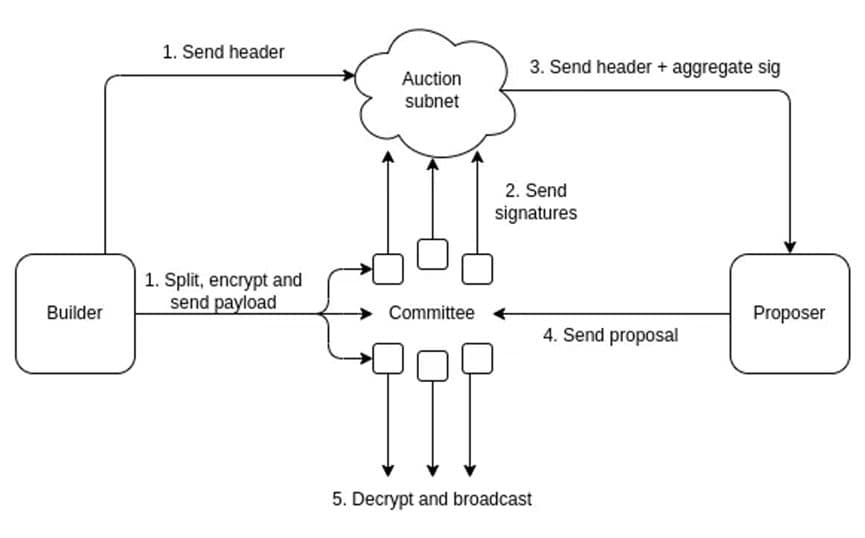

Single Slot PBS makes use of a decentralized committee as an middleman to retailer the content material of blocks. The builder sends the bundle header to the Public sale subnet and concurrently sends the chunk-encrypted bundle physique to the committee. The proposer sends a proposal as soon as the committee’s voting surpasses the brink. Upon receiving the proposal, the committee decrypts and broadcasts the bundled physique, enabling the completion of Proof of Block State (PBS) inside a single slot.

Single-slot PBS design, Supply:https://ethresear.ch/t/single-slot-pbs-using-attesters-as-distributed-availability-oracle/11877

Ethereum’s want for protocol-level Proof of Block State (PBS) goes past addressing MEV considerations.

Implementing PBS on the protocol stage in Ethereum might shake the muse of consensus and introduce numerous new points. Why is there an insistence on modifying the protocol layer relatively than searching for options above the protocol? It may be perceived that the Ethereum group’s intentions usually are not solely targeted on speedy features, as PBS holds significance for Ethereum’s long-term growth past simply assuaging MEV points.

Within the context of PBS, proposers are relieved of transaction ordering, enabling a stateless strategy that doesn’t require storing Ethereum’s full state. They solely must validate the transactions throughout the blocks packaged by the builder by Merkel proofs. With the emergence of initiatives like Danksharding, the long run burden of storage is predicted to develop. The statelessness attribute is pivotal, lowering storage calls for for proposers and enabling larger decentralization by permitting extra people to take part.

Ethereum’s proposal of PBS aligns with the spirit of EIP-1559 from earlier years. Miners/validators, performing as arbiters of transaction content material inside blocks, wield important privilege. If miners/validators accumulate extreme earnings, centralization might intensify, resulting in an imbalance of energy that impacts the safety of the complete consensus community. PBS’s goal is to decrease the place of miners/validators, curbing their revenue and dispersing energy among the many individuals.

Moreover, within the PBS resolution facilitated by Flashbots’ MEV-Enhance, belief assumptions associated to the Relay might lead to transaction censorship points. This severely undermines Ethereum’s imaginative and prescient of censorship resistance and permission-lessness.

Transaction evaluate can account for as much as 80%, Supply: https://www.mevwatch.information/

Protocol-level Proof of Block State (PBS) in Ethereum eliminates needing a trusted relay and might implement builder compliance by proposer constraints. This compels the builder to incorporate censored transactions by Proposers’ enforcement or direct inclusion, thereby enhancing Ethereum’s resistance to censorship.

In abstract, protocol-level PBS in Ethereum achieves the allocation of pursuits between builders and proposers, reducing the barrier for proposers to take part. This will doubtlessly elevate Ethereum’s decentralization stage whereas enhancing its resistance to censorship. Nevertheless, it doesn’t essentially enhance the general consumer expertise.

Flashbots—Dominant within the MEV Subject

Flashbots goals to alleviate MEV points by a market public sale, offering earnings to MEV contributors.

In Flashbots’ official documentation, it’s categorized into 1) Flashbots Public sale, 2) Flashbots Information, 3) Flashbots Shield, 4) Flashbots MEV-Enhance, and 5) Flashbots MEV-Share. Nevertheless, in actuality, MEV-Enhance is a part throughout the Flashbots Public sale.

We are going to describe the event of Flashbots chronologically.

The Flashbots Public sale includes two phases: MEV-Geth for ETH1.0 (Earlier than The Merge) and MEV-Enhance for ETH2.0 (After The Merge).

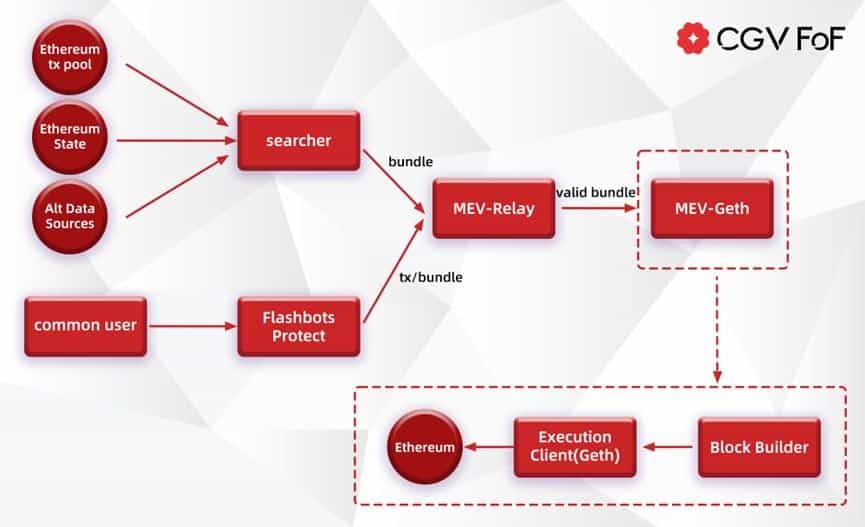

In early 2021, Flashbots launched MEV-Geth and MEV-Relay. MEV-Geth is a patch on the Go-Ethereum shopper, comprising simply over 100 traces of code. MEV-Relay is a bundle forwarder chargeable for relaying transaction bundles between searchers and miners. Collectively, MEV-Geth and MEV-Relay established a non-public transaction pool and a sealed-bid block house public sale, remodeling MEV from the darkish forest right into a market-driven financial system. Bundles, as a novel transaction sort, symbolize preferences for transaction orders. The Flashbots Public sale launched a brand new RPC known as “eth_sendBundle” to standardize bundle communication. Bundles embody a sequence of signed transactions and the situations below which these transactions are included.

Moreover, Flashbots supplied the Flashbots Shield RPC node, permitting customers to keep away from Entrance Operating assaults on their transactions within the public transaction pool by merely modifying their pockets’s RPC node. Moreover, since Flashbots Shield submits consumer transactions by an alternate block inclusion course of, reverts don’t happen, relieving customers of paying for failed transactions (although it launched an Unique Order Circulation).

MEV-Geth quickly gained adoption amongst over 90% of Ethereum miners and considerably boosted miners’ earnings. Nevertheless, the straightforward public sale design had a number of notable shortcomings, together with:

the necessity to belief miners,compatibility solely with Geth, missing range, andThe public sale service’s centralized server operation poses a danger of a single level of failure.

Moreover, as a result of prevalent aggressive relationships amongst searchers, the overwhelming majority of earnings flowed into the pockets of miners, introducing centralization dangers for Ethereum.

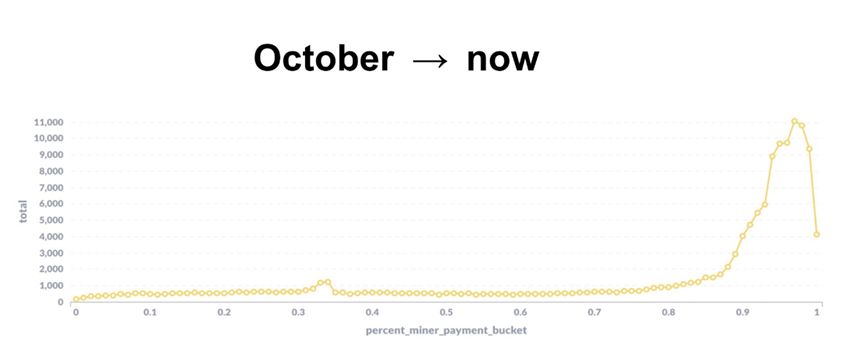

Supply: https://twitter.com/lvanseters/standing/1481988717367767042/picture/4

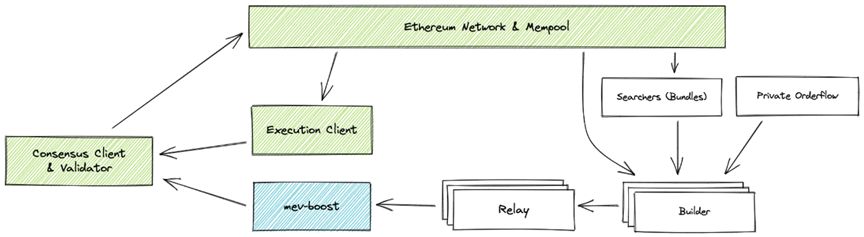

Following The Merge, Ethereum transitioned to a PoS consensus mechanism, making the centralization points led to by MEV extra pronounced. To handle this, Flashbots devised MEV-Enhance. MEV-Enhance may be seen as a variant of Single Slot PBS. In contrast to protocol-level PBS in Ethereum, this strategy serves as an non-obligatory middleware service relatively than implementing habits by the protocol, and it doesn’t modify the consensus course of. The relay now not acts as an middleman between customers/searchers and miners; as an alternative, it features as an middleman node between builders and validators. Primarily based on the transaction circulation submitted by customers/searchers, every position—builder, relay, and validator—selects blocks to be handed downstream in response to most features.

Supply: https://docs.flashbots.web/flashbots-auction/overview#

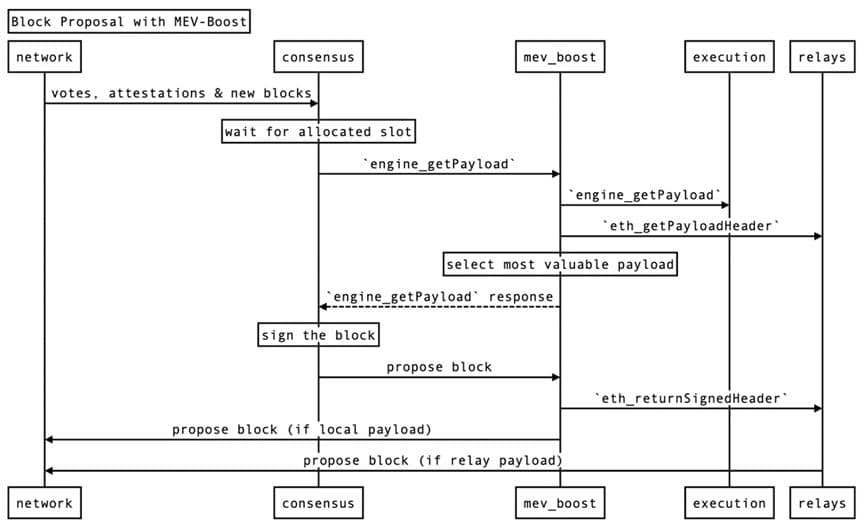

MEV-Enhance employs the commit-reveal mechanism proposed in Single Slot PBS. Solely when a validator commits to a block header does the builder reveal the complete content material of that block. The particular course of is illustrated within the diagram beneath:

Earlier than the proposal, validators should register with MEV-Enhance and relays, making certain that block builders can assemble blocks for a delegated validator’s proposal.

Customers/searchers submit transactions to dam builders by public/non-public mempools.Block builders assemble an execution payload based mostly on obtained transactions. Concerning incentive distribution, the builder units their tackle because the payload’s coinbase tackle and the final transaction transfers to the proposer’s tackle. The block is then despatched to the relay.The relay verifies the block’s validity and sends the ExecutionPayloadHeader to MEV-Enhance. MEV-Enhance selects the highest-profit forwarding from ExecutionPayloadHeaders submitted by completely different relays and sends it to the Validator.The validator indicators the header, calls submitBlindedBlock to ship it again to MEV-Enhance, after which forwards it to the relay. After verifying the signature, the relay sends the entire payload physique to MEV-Enhance and delivers it to the consensus. This permits the Validator to make use of it when proposing a SignedBeaconBlock to the community.

Supply: https://twitter.com/keccak254/standing/1656984680003153924

In comparison with MEV-Geth, MEV-Enhance provides larger versatility. It serves as a plugin for Consensus Shopper, supporting a number of shopper sorts whereas addressing the centralization points inherent in miners. Nevertheless, post-PBS, builders achieve increased authority. Dominant builders available in the market can attain the power to censor and monopolize transaction order flows. Presently, centralization dangers are mitigated primarily by encouraging competitors amongst builders. The belief stage in relays is additional diminished, although there’s nonetheless a possible danger posed by digital bidding submitted by builders and proposers. Monitoring relays’ honesty permits validators and builders to decide on relays to alleviate this concern.

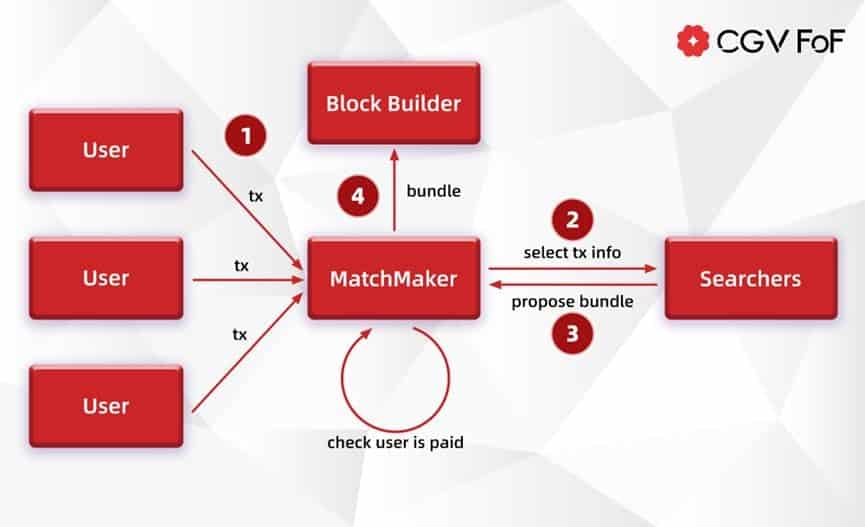

MEV-Geth enabled miners and searchers to share MEV earnings, whereas MEV-Enhance distributed MEV amongst proposers, builders, and searchers, safeguarding consumer transactions from entrance working. Nevertheless, neither of them accounted for consumer earnings. Throughout the ethos of Web3, the place customers generate worth from their knowledge, it’s essential to provide again to customers themselves. MEV-Share embodies this precept in observe. MEV-Share is devoted to permitting customers, wallets, and DApps to seize the MEV generated from their transactions.

MEV-Share introduces the position of Matchmaker, performing as an middleman between customers, searchers, and builders. It maintains consumer privateness by proscribing the consumer transaction info uncovered to searchers. Concurrently, it limits searchers to solely insert their transactions after consumer transactions, generally known as again working, to forestall consumer losses. Backrunning doesn’t lead to consumer loss; the earnings gained by back-running are primarily derived from market imbalances.

Customers can join their wallets to the Flashbots Shield RPC to ship transactions to the Matchmaker. Alternatively, they’ll use the Matchmaker API to ship non-public transactions, specifying the builders they wish to undergo.

For searchers, they should hearken to the selective portion of transaction info despatched by the Matchmaker by an SSE (Server-Despatched Occasions) Occasion Stream. SSE is a expertise that permits servers to push info to shoppers with out requiring the shoppers to provoke requests, permitting shoppers to obtain real-time updates on the blockchain state. Searchers choose transactions from this stream and insert their very own signed transaction afterward to create a bundle.

Searchers can share partial transaction info from the bundle with different Searchers to obtain MEV rewards and enhance the possibilities of their bundle being included in a block. Searchers may specify builders within the “privateness” area of the bundle. Finally, the bundle can be despatched to builders accepted by customers and searchers.

MEV-SGX: Eliminating Belief Assumptions with SGX Encryption

The exploration and dialogue available in the market relating to utilizing SGX to mitigate MEV points had been initially initiated by Flashbots. The MEV-SGX scheme was launched in June 2021 on the Ethereum discussion board. It aimed to deal with the belief situation throughout the MEV-Relay element of the Flashbots Alpha (the preliminary model of Flashbots MEV-Public sale) proposal from early 2021. The objective was to construct a totally non-public and permissionless MEV public sale utilizing MEV-SGX. Varied options had been mentioned, resembling sending solely block headers to cover the transaction trie, introducing collateralized block headers, using time-lock encryption, and creating safe enclaves. The choice was ultimately made to make use of safe enclaves, with Intel’s SGX being essentially the most extensively used, to supply full privateness and permission-lessness.

Within the MEV-SGX scheme, SGX serves as a Trusted Execution Atmosphere (TEE), changing the single-trusted middleman in MEV-Relay. Each searchers and miners use separate SGXs. The tamper-resistant options of SGX be certain that every get together runs particular code inside an setting that can’t be tampered with or breached. Searchers’ SGX offers block validity and profitability for miners (Proposers don’t must belief builders), whereas Miners’ SGX handles block decryption and broadcasting (Builders don’t must belief proposers, and proposers can not illegitimately seize earnings from submitted blocks).

It’s price noting that the time period “miner” is used within the context of this proposal since Ethereum was nonetheless in its PoW consensus on the time. Nevertheless, “miners” and “validators” serve the identical perform within the consensus: bundle transactions and suggest blocks.

With Ethereum’s transition to the PoS consensus by The Merge, MEV-SGX’s position step by step diminished in favor of MEV-Enhance and MEV-Share. Nevertheless, SGX hasn’t been completely deserted. Because of the complexity of implementing MEV-SGX, the group opted for the extra sensible MEV-Enhance and MEV-Share, with plans to make use of SGX to patch and enhance the present options.

On December 20, 2022, the Flashbots group introduced the profitable execution of Geth (Ethereum shopper’s Go implementation) inside SGX, validating the technical feasibility of making use of SGX to MEV. On March 3, 2023, the Flashbots group introduced the implementation of block builder execution inside SGX, taking one other step in the direction of transaction privateness and decentralized builders.

Executing block-building algorithms inside safe enclaves ensures that contributors, other than the customers, can not entry the content material of consumer transactions, thus preserving privateness. Moreover, working verifiable block execution algorithms permits for proving the financial effectivity of blocks with out compromising privateness. In the long term, working builders inside SGX might provide proposers verifiably legitimate blocks and real bidding, doubtlessly changing the trusted MEV-Relay position completely, attaining permission-lessness.

SUAVE – The Way forward for MEV

Whereas MEV-Share addresses the distribution of MEV-related advantages, it nonetheless fails to remove the centralization danger posed by block-building authority. In Flashbots’ present stage, as a consequence of 1) Unique order circulation and a pair of) Cross-chain MEV, the builder market experiences a constructive suggestions loop, making it vulnerable to centralization danger.

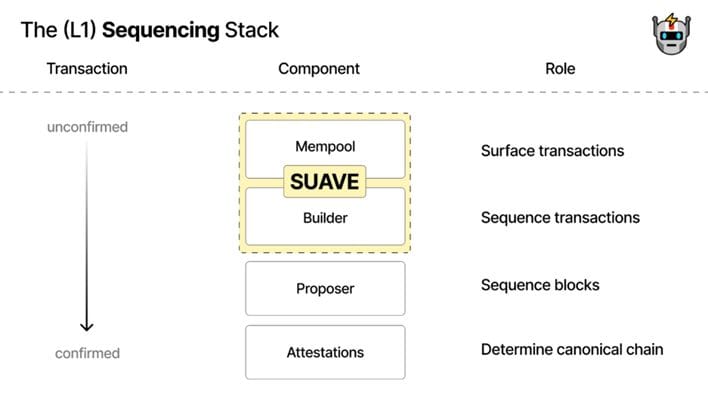

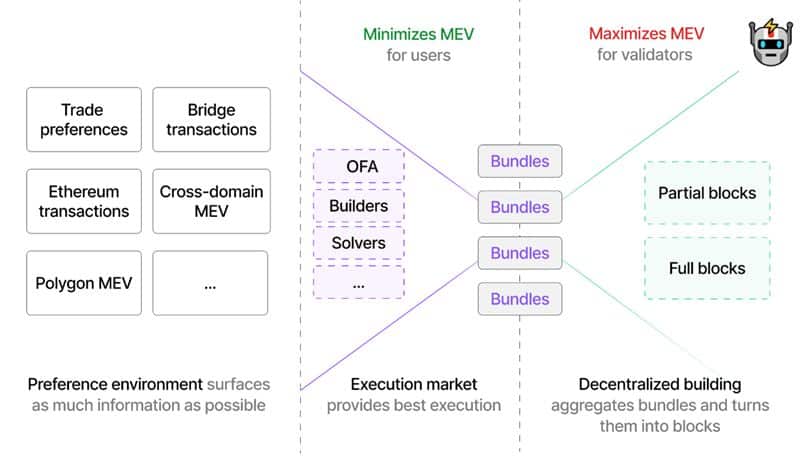

SUAVE (Single Unified Public sale for Worth Expression) goals to deal with the centralization danger posed by MEV. SUAVE is one other try at modular blockchains, striving to supply an off-the-shelf reminiscence pool and decentralized block builders for all blockchains. Working as a devoted blockchain, SUAVE goals to supply transaction sorting and block-building companies to all present chains.

Supply: https://writings.flashbots.web/the-future-of-mev-is-suave/

Supporting a number of chains successfully enhances the effectivity of cross-chain MEV extraction. As a blockchain itself, its decentralized nature will tackle the centralization danger related to block builders in earlier options.

SUAVE consists of the next three principal parts:

Common Desire Atmosphere: “Preferences” may be understood as an improved sort of transaction on the bundle, reflecting the consumer/searcher’s necessities for transaction execution (e.g., transaction parameters, timing, order). It maintains pre-confirmation privateness and irreversibility of the bundle. The “common” side embodies SUAVE’s multi-chain nature, aggregating transactions submitted by customers/searchers on all chains onto SUAVE. It offers a common sorting layer to collect consumer preferences and improve MEV extraction effectivity. Furthermore, it allows collaboration amongst block builders from completely different domains to spice up effectivity.Optimum Execution Market: Executors take part in bidding based mostly on user-submitted preferences, providing customers essentially the most optimum execution. This market facilitates cross-domain desire expression, aiming to return as a lot MEV income as attainable to customers.Decentralized Block Constructing: Throughout the decentralized blockchain community, block builders assemble blocks for numerous domains based mostly on consumer preferences and the optimum execution path. Whereas sustaining decentralization, this element offers a validator from every chain with maximized MEV blocks. The premise for this element’s implementation is sharing order flows and bundles amongst block builders with out revealing content material.

Supply: https://writings.flashbots.web/the-future-of-mev-is-suave/After all, it should be famous that SUAVE continues to be in its early phases, with an unclear technical roadmap and considerably ambiguous resolution design. The small print are nonetheless being developed. This can be difficult, as Flashbots refers to MEV because the Millennium Prize Drawback of the crypto world and requires collaboration to create a decentralized future.

New Variables within the MEV Market

Chainlink: Truthful Sequencing Providers (FSS) — Arbitrum’s Chosen MEV Mitigation Resolution

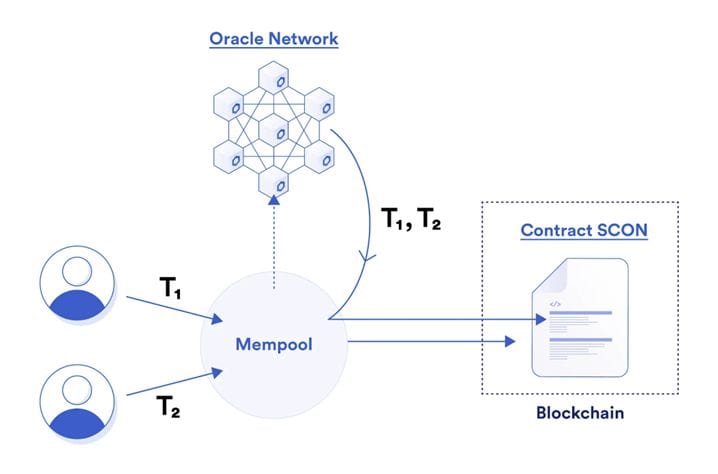

As the biggest Oracle platform available in the market, Chainlink seeks to alleviate the MEV drawback on the stage of the Oracle community by introducing transaction sequencing. Personally, I imagine its inspiration is to forestall the entrance working of Oracle studies, as manipulating the order of Oracle studies in a block may end up in important MEV as a result of substantial impression of those studies on costs.

Truthful Sequencing Providers (FSS) may be described as follows: Decentralized Oracle Nodes (DONs) present instruments to distribute transaction sequencing and implement methods specified by dependent contract creators. Ideally, these methods ought to be honest (sometimes First-Come-First-Served based mostly on arrival time) to forestall contributors searching for to control transaction sequencing from gaining a bonus. These instruments collectively kind FSS.

FSS includes three principal parts. The primary is transaction monitoring.

Transaction Monitoring: In FSS, oracle nodes in DONs monitor the reminiscence pool of the MAINCHAIN and permit off-chain transaction submissions by devoted channels.Transaction Sequencing: Nodes in DONs sequence transactions for dependent contract SCON based mostly on insurance policies outlined for the contract.Transaction Publication: After sequencing, nodes in DONs collectively ship transactions to the primary chain.FSS Diagram supply: Chainlinkv2 White Paper

The potential advantages of FSS embody:

Truthful Sequencing: FSS contains instruments that assist builders guarantee transactions coming into a selected contract are sequenced pretty, offering customers with ample sources or technical benefits on who can not achieve the higher hand. The same old technique for honest sequencing is FCFS (First-Come-First-Served).

Particular Contract’s Transaction Sequencing, Supply:https://weblog.chain.hyperlink/chainlink-fair-sequencing-services-enabling-a-provably-fair-defi-ecosystem/

Decreased or Eradicated Info Leakage: By stopping community contributors from exploiting data about upcoming transactions, FSS can mitigate or remove front-running assaults based mostly on out there info within the community earlier than transaction submission. Stopping assaults leveraging such leaks ensures adversarial transactions depending on the unique pending transactions can not enter the ledger earlier than the unique transactions are submitted.Decrease Transaction Prices: By eradicating the necessity for contributors to prioritize pace when submitting transactions to good contracts, FSS can considerably cut back transaction processing prices.Precedence Sequencing: FSS can routinely present particular precedence sequencing for essential transactions. For example, to forestall front-running assaults on Oracle studies, FSS can retroactively insert Oracle studies right into a sequence of transactions.

In comparison with different options that mitigate MEV inside good contracts, FSS carried out utilizing DONs achieves decrease latency as a consequence of its off-chain MEV protection mechanism. The latency could be within the millisecond vary as an alternative of the a number of of 12s corresponding to dam delay.

UniswapX: Addressing Sandwich Assaults however Introducing MEV Scrutiny

On July 17, main decentralized alternate (DEX) Uniswap introduced the launch of an open-source protocol known as UniswapX. This protocol aggregates liquidity from decentralized buying and selling swimming pools and introduces options to counter MEV assaults.

UniswapX introduces new options throughout its off-chain order matching course of. These options embody non-price-sequenced sorting, executing restrict orders, and utilizing an area ledger to deal with value variations.

As a consequence of these adjustments, transactions saved within the mempool turn into more and more unpredictable, lowering the arbitrage house for MEV. MEV largely arises from miners prioritizing transactions based mostly on fuel, however with changes made by the off-chain ledger, we will considerably enhance MEV.

Uniswap merchants are adversely affected by sandwich assaults, leading to dangerous MEV and potential losses of as much as $3 million each day. UniswapX goals to deal with this situation by changing unique transactions into “intents” submitted to Uniswap’s central server. Whereas this successfully resolves sandwich assaults, it introduces the brand new drawback of MEV scrutiny.

Throughout quoting and buying and selling, honest costs could lean in the direction of the quotes. In such circumstances, the only quoter usually prefers to submit transactions on-chain throughout an unique window. Nevertheless, this presents a possibility for validators who may collude to scrutinize transactions. Though any such assault is probably not widespread at this stage, if some validators turn into highly effective sufficient, constantly win a number of blocks, or the infrastructure for validator collusion turns into widespread, we would witness a malignant development of MEV scrutiny points.

In conclusion, whereas the Ethereum Basis may maintain a usually destructive view in the direction of MEV, the present state of the blockchain ecosystem, dominated by centralized miners/validators, makes it tough to deal with the issue with direct options like transaction encryption with out inflicting intense market volatility. Thus, progressive improvement-oriented options like these supplied by Flashbots and different groups purpose to contain a number of events in MEV extraction, step by step diminishing centralized management. This strategy minimizes MEV’s impression on customers and in the end transitions to privacy-focused transaction options (as emphasised by Vitalik in “The Three Transitions”).

From this angle, MEV has advanced from its preliminary state of a darkish forest zero-sum recreation to a stage of checks and balances. It could step by step transfer in the direction of complete privateness. However, MEV stays a market with sustainable growth potential, attracting extra contributors and novel developments.

References and knowledge supplies:

https://ethereum.org/en/builders/docs/mev/https://bitcoinops.org/en/subjects/replace-by-fee/https://bitcoinops.org/en/subjects/fee-sniping/https://medium.com/@Prestwich/mev-c417d9a5eb3dhttps://medium.com/@VitalikButerin/i-feel-like-this-post-is-addressing-an-argument-that-isnt-the-actual-argument-that-mev-auction-b3c5e8fc1021https://www.paradigm.xyz/2021/02/mev-and-me#mev-is-hard-to-fixhttps://ethresear.ch/t/proposer-block-builder-separation-friendly-fee-market-designs/9725https://thedailyape.notion.website/MEV-8713cb4c2df24f8483a02135d657a221The Way forward for MEV is SUAVE | Flashbotshttps://collective.flashbots.web/t/frp-18-cryptographic-approaches-to-complete-mempool-privacy/1210https://discover.flashbots.web/

About Cryptogram Enterprise (CGV): Cryptogram Enterprise (CGV) is a compliant and certified analysis and funding establishment within the crypto business, headquartered in Japan. With a enterprise concentrate on “research-driven funding,” they’ve participated in early-stage investments in a number of well-known initiatives. CGV performs an essential position in initiatives regulated by the Japanese authorities, such because the JPYW stablecoin, and collaborates with quite a few funds, together with Huobi Enterprise, Rocktree Capital, Cryptomeria Capital, and others.

Disclaimer: The knowledge and supplies offered on this article are sourced from public channels, and our firm makes no ensures relating to their accuracy and completeness. Descriptions or forecasts of future conditions are forward-looking statements, and any recommendations and opinions supplied are for reference solely and don’t represent funding recommendation or implications for any particular person. Our firm’s methods could possibly be the identical, reverse, or unrelated to the methods inferred by readers based mostly on this text.

[ad_2]

Source link