[ad_1]

Bitcoin has come a good distance since its inception in 2009. From being value lower than a penny initially, it has seen large progress over time with some dramatic ups and downs. As we speak, Bitcoin is rising as a serious different asset class and its future valuation prospects stay optimistic.

This complete information takes a data-driven method to investigate elements affecting Bitcoin costs and makes educated projections about its potential highs and lows within the brief, medium and long-term timeframes. With cryptocurrencies gaining mainstream traction, the report goals to offer readability to traders on what lies forward for Bitcoin costs primarily based on historic patterns and developments.

What’s Bitcoin (BTC)?

Bitcoin is the primary and hottest cryptocurrency on this planet. It was created in 2009 by the pseudonymous Satoshi Nakamoto, who revealed the Bitcoin whitepaper and developed the Bitcoin protocol.

Bitcoin launched blockchain know-how to the world. The Bitcoin blockchain is a public ledger that information all Bitcoin transactions ever made. It’s decentralized, that means no single entity controls it. The blockchain is maintained by a world community of computer systems generally known as Bitcoin miners.

Key attributes of Bitcoin embody:

Decentralized

No central authority controls Bitcoin. It’s maintained by a distributed community of customers.

Restricted provide

Solely 21 million Bitcoins will ever exist. This shortage provides Bitcoin worth.

Pseudonymous

Bitcoin addresses are usually not linked to real-world identities by default, giving customers privateness.

Safe

Bitcoin makes use of cryptography and the blockchain to make sure the safety of funds and possession information.

Divisible

One Bitcoin will be divided into 100 million smaller models referred to as satoshis, permitting small transactions.

Permissionless

Anybody can use Bitcoin with out the necessity for permission from authorities.

These attributes make Bitcoin distinctive in comparison with conventional fiat currencies and a promising digital asset for funding.

Elements Influencing Bitcoin Value

Many elements can have an effect on the worth of Bitcoin, resulting in volatility. Some main elements embody:

Provide and Demand

Fundamental financial concept states that when demand will increase whereas provide stays fixed, value goes up. As extra traders and establishments undertake Bitcoin, demand rises. However since new Bitcoins are mined at a hard and fast price, provide stays regular, driving costs up.

Media Hype and Public Sentiment

Constructive or unfavourable media protection and public sentiment can affect demand and value. For instance, Elon Musk’s tweets on Bitcoin usually result in value swings primarily based on his views.

Main Protocol Modifications and Upgrades

Main Bitcoin developments just like the SegWit improve or Lightning Community adoption can enhance Bitcoin’s capabilities and have an effect on value.

Rules and Authorized Standing

Regulatory crackdowns or acceptance of Bitcoin in numerous nations impacts value because it impacts demand.

Whales and Institutional Traders

“Whales” – entities holding giant quantities of Bitcoin – can manipulate costs once they purchase or promote. Elevated institutional funding additionally drives up costs via elevated demand.

Safety Breaches and Scandals

Safety points with exchanges and wallets just like the Mt.Gox hack or malicious enterprise practices just like the FTX collapse can erode investor confidence and depress costs.

Macroeconomic Circumstances

Financial instability and forex devaluations inspire traders to purchase Bitcoin as a hedge, boosting its value. Nevertheless, it has struggled in a hawkish Fed atmosphere and amidst price hikes.

Bitcoin Value Efficiency within the Previous

Taking a look at previous value efficiency can present insights into long-term developments and assist predict future costs. Let’s take a stroll down BTC reminiscence lane.

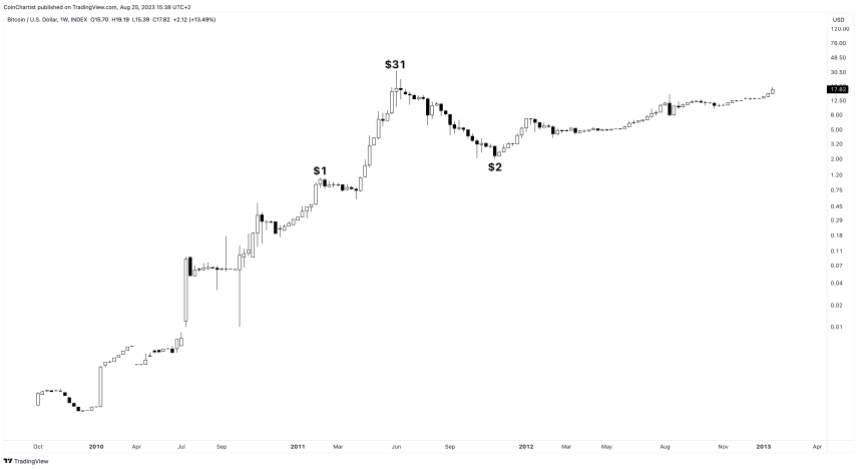

The Early Days – Volatility and Development (2009-2013)

When Bitcoin launched in 2009, it was virtually nugatory. In 2010, Bitcoin went from $0 to $0.39 and was extraordinarily unstable in its early days.

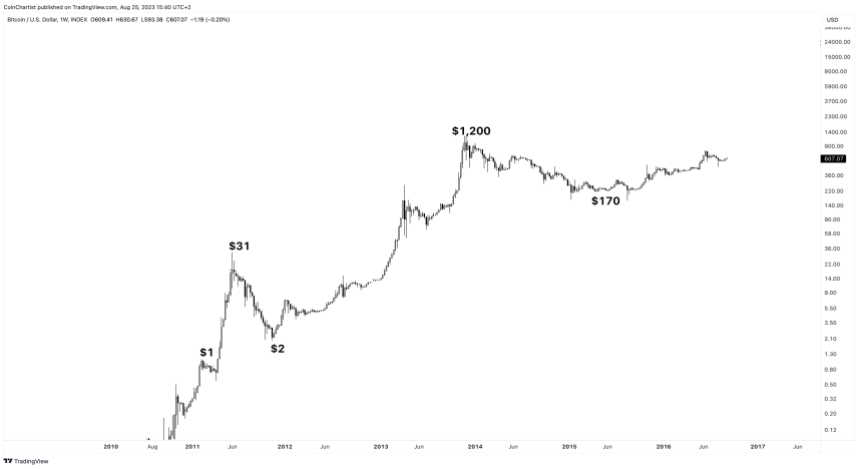

By early 2011, it achieved parity with the US greenback, hitting $1.00 in February 2011. In the identical 12 months, it reached $10 after which $30. This early volatility was attributed to inadequate liquidity, shortage as a result of low Bitcoin provide, and lack of alternate infrastructure.

In mid-2011, Bitcoin fell from round $30 to $2 after a collection of alternate hacks and thefts shook investor confidence. It took over a 12 months to achieve $10 once more.

2012 noticed gradual beneficial properties as much as $12 but additionally wild fluctuations between $7-$15. In 2013, Bitcoin entered a bull run from $12 to over $1,100 pushed by rising media protection and adoption at nighttime internet.

However it ended the 12 months round $700 following a China ban on monetary establishments and fee processors coping with Bitcoin. This cycle of speedy beneficial properties and dramatic crashes would come to outline Bitcoin value efficiency.

The 2014-2016 Bear Market

2014 kicked off with the collapse of Mt.Gox, then the biggest Bitcoin alternate, after a collection of hacks. This erased most beneficial properties from 2013 and brought on Bitcoin to fall from round $850 to under $350.

For the subsequent two years, Bitcoin hovered within the $200-$300 vary. Elevated regulation and lack of institutional curiosity saved mainstream adoption low throughout this era. Costs had been comparatively secure in comparison with previous volatility.

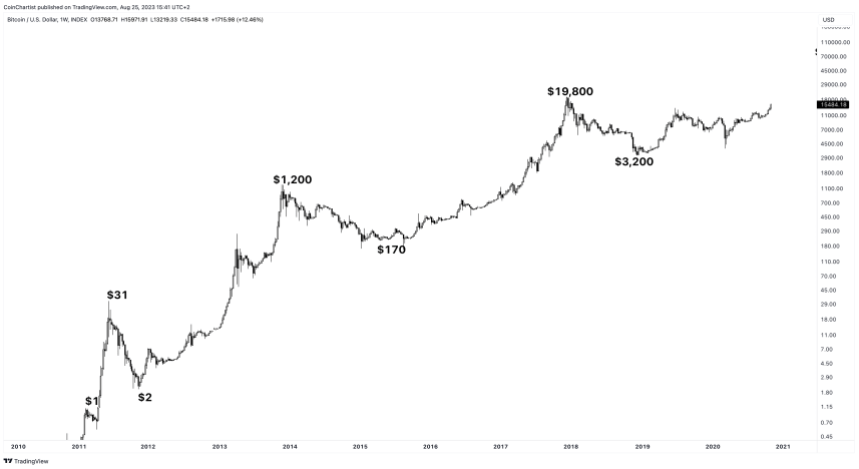

2017 – The Bull Run and Mainstream Mania

2017 marked Bitcoin’s entry into mainstream consciousness and a large progress in value to just about $20,000.

A number of elements drove this rally:

Rising media and funding financial institution protection calling Bitcoin “digital gold”

Elevated adoption in nations dealing with forex crises like Venezuela and Zimbabwe

Proposals for Bitcoin ETFs (exchange-traded funds) drew investor consideration

Launch of Bitcoin futures buying and selling on main exchanges like CME and CBOE lent legitimacy

Massive institutional investments – U.S billionaire Michael Novogratz invested $500M in Bitcoin in 2017

Demand rose as Bitcoin went from being an obscure digital asset to a family title. However by January 2018, Bitcoin had misplaced over 60% from its peak following regulatory measures and different elements resulting in a settle down from its beforehand overheated state.

2018-2020 – The Crypto Winter and Maturation

Bitcoin spent a lot of 2018 in a bear market following the 2017 rally, buying and selling within the $3,000-$6,000 vary.

Bitcoin spent a lot of 2018 in a bear market following the 2017 rally, buying and selling within the $3,000-$6,000 vary.

Elevated regulatory scrutiny, alternate hacks, and coin scams contributed to falling costs. However this era additionally noticed the maturation of Bitcoin with developments together with:

Lightning Community launch – enabled quick, low-cost Bitcoin micropayments

Elevated mainstream institutional funding from companies like Constancy and US Financial institution

Bitcoin futures added on Bakkt, Nasdaq exchanges

Nations like Japan acknowledged Bitcoin as authorized tender

These developments seemingly prevented additional drops. By mid-2019, Bitcoin recovered to the $10k-$11k vary.

The COVID-19 pandemic and ensuing financial disaster in 2020 proved Bitcoin’s worth as a hedge towards inflation and forex devaluation. Stimulus spending eroded fiat financial savings whereas Bitcoin held its worth.

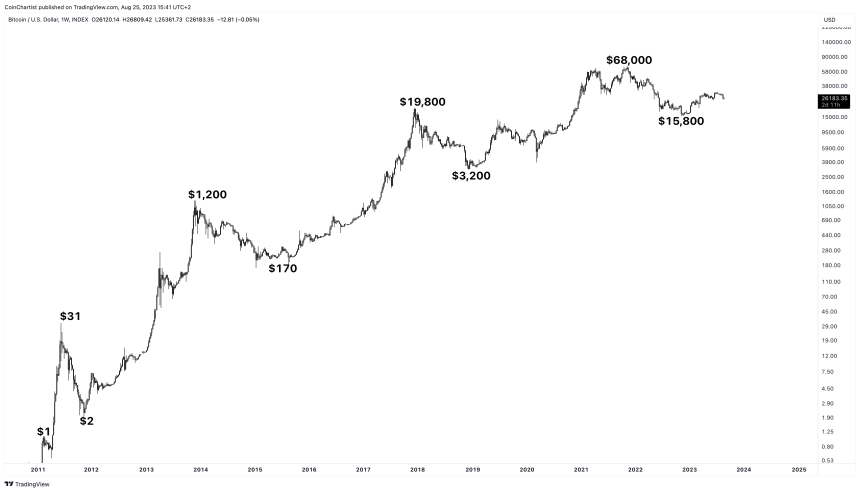

Rising institutional curiosity like Microstrategy’s $500M Bitcoin buy helped take costs previous 2017 highs, finally reaching an all-time excessive of round $68,000 in 2021.

2021-2022 – Twin Peaks and Recession Threat

Bitcoin value made not one, however two new highs in 2021. The second excessive failed to maneuver considerably previous the primary excessive, catching traders off-guard who had anticipated BTC reaching $100,000 or extra.

Bitcoin value made not one, however two new highs in 2021. The second excessive failed to maneuver considerably previous the primary excessive, catching traders off-guard who had anticipated BTC reaching $100,000 or extra.

As a substitute, Bitcoin crashed all through 2022 because the US Federal Reserve launched its QT program and started elevating rates of interest to struggle again towards inflation. The state of affairs was worsened by the implosion of a number of crypto companies, together with FTX. Finally, Bitcoin reached an area low of $15,800 in November 2022.

How is Bitcoin Doing Now in 2023?

Bitcoin value is doing its greatest to restoration from the crypto market carnage of 2022. The US Federal Reserve continues to lift charges to file ranges, and the US SEC is cracking down on the remainder of the crypto trade, making it tougher for Bitcoin to regain its footing.

Regardless of the challenges, many establishments are eying launching Bitcoin EFTs, which may create a bullish narrative that drives costs larger. Within the meantime, BTC is correcting after spending nearly all of 2023 in a short-term uptrend. The query stays: Is Bitcoin falling again right into a bear market, or will the short-term uptrend roll right into a extra significant mid-term uptrend?

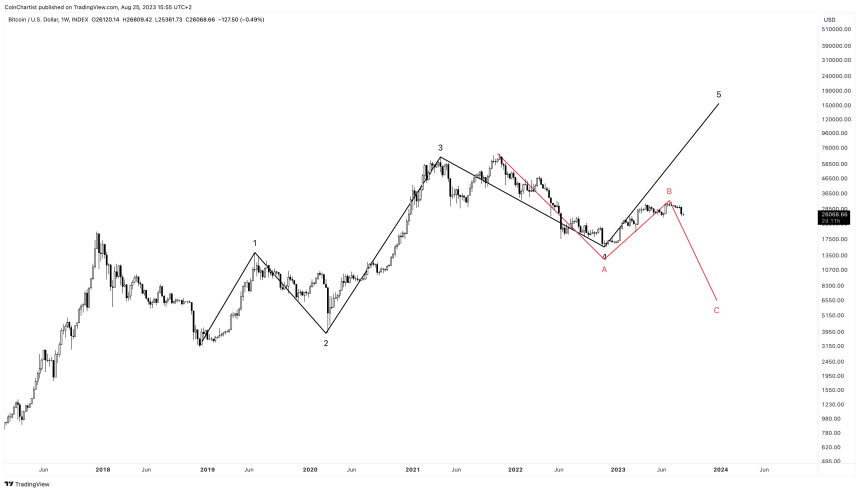

Quick-Time period Bitcoin Value Prediction for 2023

Within the short-term, as in earlier than the top of 2023, there are primarily three choices from a technical standpoint. The bullish state of affairs relies on Elliott Wave Precept, and factors to a wave 5 and a attainable new all-time excessive this 12 months. The bearish state of affairs would put Bitcoin in an additional corrective sample, concentrating on $6,000 per BTC.

After all, an alternate state of affairs is that Bitcoin easy stays in a sideways consolidation part for a number of months longer to complete out 2023. In any other case, a Bitcoin value prediction of $160,000 in 2023 isn’t unimaginable given previous value trajectories and share moved.

Medium-Time period Bitcoin Value Prediction for 2024 & 2025

Within the medium-term, Bitcoin value forecasts are primarily based on the four-year cycle concept that depends on the Bitcoin block reward halving to tip the tides of provide and demand in favor of value appreciation. Basically over the subsequent a number of years, Bitcoin ought to have restricted draw back.

Within the medium-term, Bitcoin value forecasts are primarily based on the four-year cycle concept that depends on the Bitcoin block reward halving to tip the tides of provide and demand in favor of value appreciation. Basically over the subsequent a number of years, Bitcoin ought to have restricted draw back.

As a substitute, Bitcoin value predictions for 2024 and 2025 level to anyplace between $100,000 to $250,000 per coin on the upside.

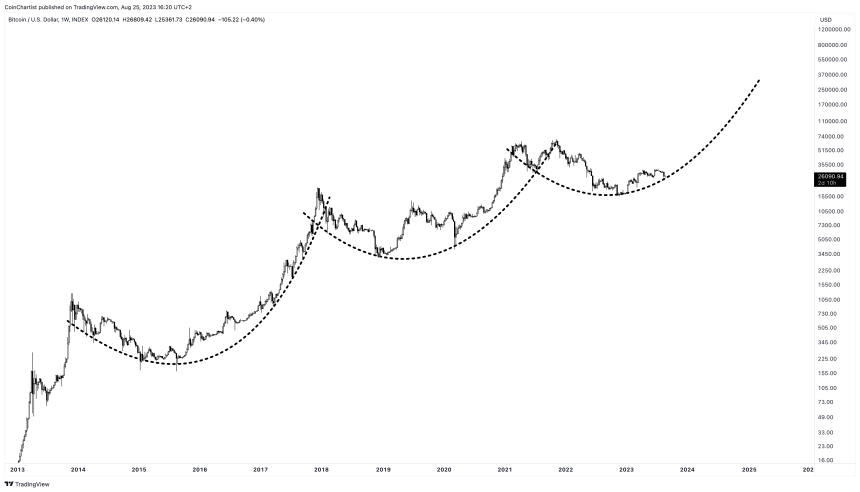

Lengthy-term Bitcoin Value Prediction for 2030 and Past

Predicting Bitcoin’s value within the long-term is difficult contemplating how new it nonetheless is. Nevertheless, utilizing a logarithmic progress curve, Bitcoin value predictions attain between $150,000 and $1 million per coin by 2030.

Additional out into the long run, if Bitcoin establishes itself because the main world digital forex, it could possibly be value between $1 million and $10 million per coin.

Complete 21 million BTC in provide would give Bitcoin a market cap of $21-$210 trillion, rivaling main property like actual property and world broad cash provide. However such valuations stay speculative. Bitcoin may face future competitors from each different cryptocurrencies and central financial institution digital currencies (CBDCs).

Bitcoin Value Predictions by Specialists

Listed here are some Bitcoin value forecasts by noteworthy consultants and analysts.

Ark Make investments CEO Cathie Wooden believes that Bitcoin may hit over $1,000,000 per coin in the long run, with a “base case” of $600,000.

Enterprise capitalist Tim Draper sees Bitcoin value in the end at greater than $250,000 per BTC by the top of 2025.

Customary Chartered has a Bitcoin value prediction of $120,000 by the top of 2024.

FAQ: Regularly Requested Questions

Listed here are solutions to some widespread questions on this Bitcoin value prediction article:

What was Bitcoin’s lowest value?

The primary recorded Bitcoin transaction in 2010 valued BTC at $0.0008. Bitcoin’s lowest current value was round $15,800 in late 2022.

What was Bitcoin’s highest value?

Bitcoin’s all-time excessive value was round $68,000 in November 2021.

How excessive may Bitcoin realistically go?

Contemplating rising mainstream adoption and funding curiosity, Bitcoin realistically may attain $100,000-$500,000 by 2030. A $1 million+ valuation can’t be dominated out within the very long-term.

Can Bitcoin value fall to zero?

It’s unlikely Bitcoin value will crash to zero given its rising adoption, finite provide, and rising regulation. There’ll seemingly all the time be some demand for Bitcoin which supplies it basic worth. Something is feasible, nevertheless.

Why is Bitcoin value so unstable?

As a brand new asset class, Bitcoin continues to be establishing itself, resulting in volatility. Manipulation by “whales”, media hype, and regulatory uncertainty add to giant value swings. Value ought to stabilize with broader adoption.

When will Bitcoin value cease fluctuating a lot?

Bitcoin value volatility ought to cut back considerably because it turns into a mainstream asset and beneficial properties broader public adoption in 5-10 years. However some short-term fluctuations will all the time stay.

Will Bitcoin value rise in 2023?

Contemplating adoption developments and investor curiosity, the general Bitcoin value trajectory seems to be upwards in 2023 regardless of some short-term fluctuations.

Funding Disclaimer: The content material supplied on this article is for informational and academic functions solely. It shouldn’t be thought-about funding recommendation. Please seek the advice of a monetary advisor earlier than making any funding choices. Buying and selling and investing entails substantial monetary danger. Previous efficiency will not be indicative of future outcomes. No content material on this website is a suggestion or solicitation to purchase or promote any securities or cryptocurrencies.

[ad_2]

Source link