[ad_1]

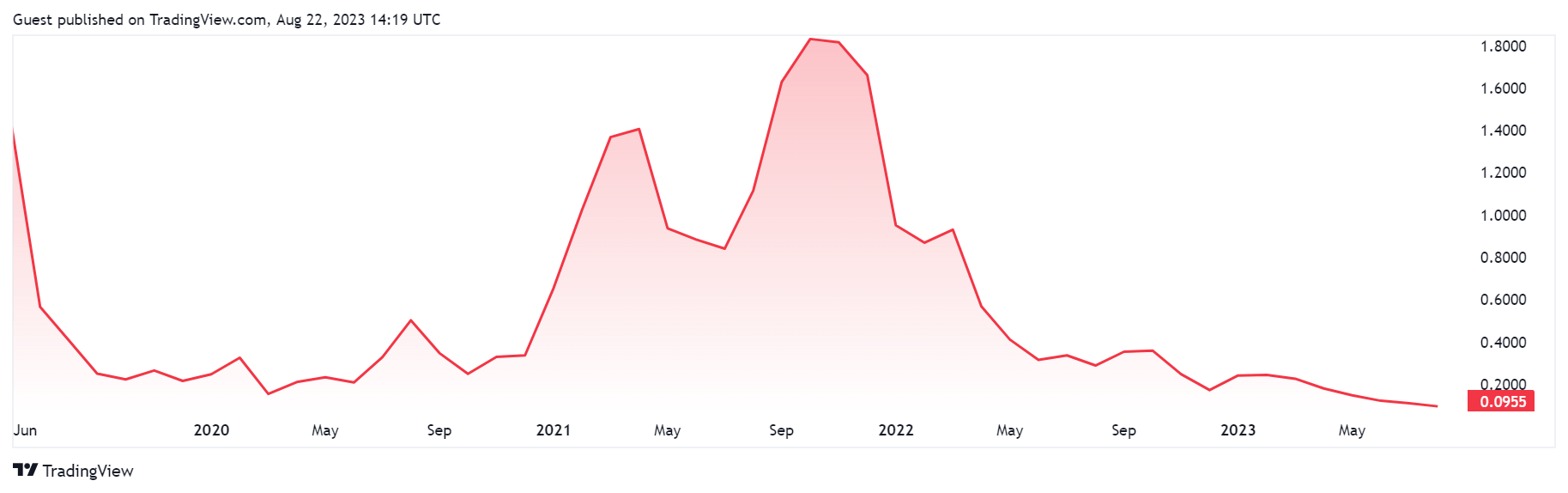

Algorand’s ALGO token value has plunged to new lows following the crypto market’s epic crash on Aug. 17.

In accordance with CryptoSlate’s information, the digital asset fell to an all-time low of $0.08846 final Thursday. Whereas its worth has since rebounded to $0.09673 as of press time, market sentiments surrounding the asset stay unfavorable.

Why is ALGO worth dropping

Earlier within the yr, the SEC labeled the ALGO token as a safety as a part of its expenses towards the U.S.-based crypto change Bittrex. This classification has vital implications for the monetary laws that the token and its holders face.

Regardless of robust opposition from its Basis, ALGO has seen a decline in demand because of investor hesitation round property with out clear regulatory standing. This has resulted within the token’s worth dropping by greater than 87% for the reason that classification.

Earlier than the SEC classification, Algorand’s ecosystem confronted challenges when MyAlgo, a distinguished pockets within the ecosystem, was hacked in March. The incident resulted in losses of over $10 million, shaking confidence within the community’s safety measures.

Nonetheless, Algorand’s Basis CEO Staci Warden has watered down the impact of the falling worth of the asset. In accordance with Warden, the community is on the trail to success because it was nonetheless attracting builders to its ecosystem.

Regardless of the falling worth of ALGO, Algorand Basis CEO Staci Warden stays optimistic, believing that the community’s means to proceed attracting builders is a constructive signal for its future.

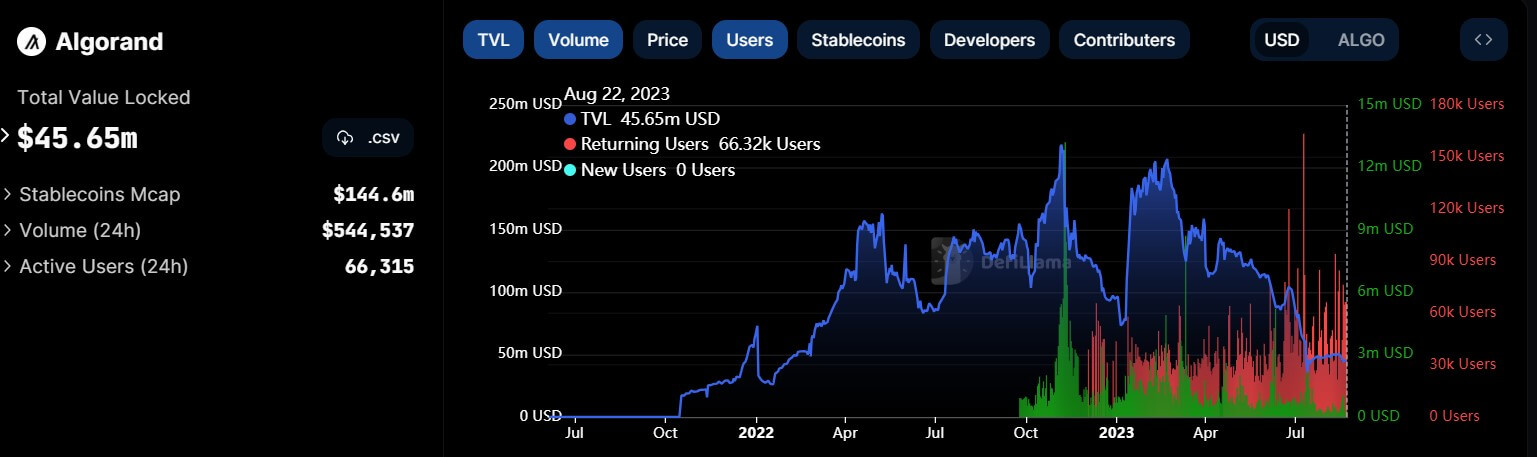

DeFi exercise stalls

In the meantime, the worth decline is amid a falling DeFi exercise on the community. Information from DeFillama exhibits that the whole worth of property locked on the blockchain has fallen to lower than $50 million after peaking at greater than $200 million in February.

Apparently, the drop in TVL will not be merely a results of ALGO’s falling costs. In July, Algorand’s largest decentralized finance protocol, Algofi, stated it could wound down its operations because of its incapacity to take care of the platform. At its peak, the DeFi platform contributed over 50% of Algorand’s DeFi exercise.

Algofi’s sudden closure severely impacted confidence in different protocols, which had been nonetheless striving to draw new customers to their platforms.

The publish Algorand’s ALGO token nosedives amid SEC classification and deflating DeFi exercise appeared first on CryptoSlate.

[ad_2]

Source link