[ad_1]

Knowledge reveals the Bitcoin open curiosity has continued to climb just lately, an indication that one other violent transfer could also be brewing for the asset.

Bitcoin Open Curiosity Is Steadily Going Up Proper Now

In a brand new put up on X, Maartunn, the group supervisor at CryptoQuant Netherlands, has appeared into how the spinoff metrics for Bitcoin proper now examine in opposition to these seen earlier than the latest crash.

There are primarily two indicators of curiosity right here: the open curiosity and the funding price. The previous measures the entire variety of BTC positions on the spinoff platforms.

When this metric’s worth goes up, buyers are opening up new market positions. Usually, such a pattern results in increased volatility for the cryptocurrency, as the entire leverage out there additionally will increase with the indicator’s rise.

Then again, decreases within the open curiosity counsel the buyers are both closing up their positions or are getting liquidated. Naturally, this might result in a extra secure worth for the asset.

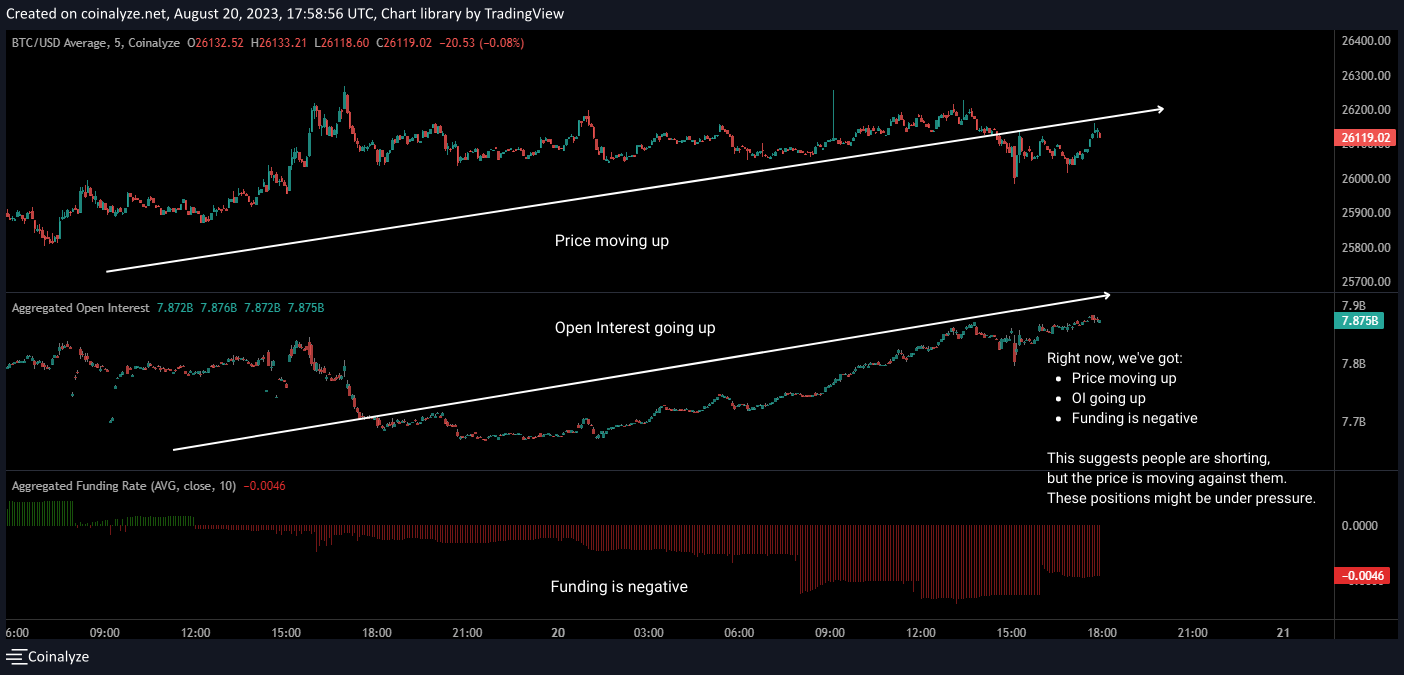

Now, here’s a chart that reveals how the Bitcoin open curiosity behaved within the leadup to and through the crash from a number of days in the past:

Appears to be like just like the metric had plunged through the crash | Supply: Maartunn on X

The chart reveals that as the value had declined within the lead-up to the crash, the open curiosity had elevated. When the crash struck, the open curiosity plunged, as many positions had been liquidated. This drawdown within the metric was the sharpest one noticed in round 1.5 years.

The heavy liquidations suggest that longs had piled up out there. And certainly, the funding price, the opposite metric of relevance right here, would verify this. This indicator tracks the periodic charge merchants on spinoff exchanges pay one another.

When this metric has a optimistic worth, it implies that the lengthy holders are paying the brief holders, and therefore, the vast majority of the positions are lengthy ones. Because the chart reveals, the indicator’s worth had been optimistic through the leadup to the crash.

The state of affairs has modified now, nonetheless, because the funding price has grow to be unfavourable.

The worth of the metric has been crimson just lately | Supply: Maartunn on X

The open curiosity has been going up previously couple of days as the value has recovered barely from its lows. It’s clear, nonetheless, that with this rise, the funding price has solely grow to be extra unfavourable, an indication that the brand new positions being opened up are the brief ones.

In the course of the crash a number of days again, the excessive open curiosity fueled the market’s volatility as a violent liquidation occasion occurred. For the reason that open curiosity has as soon as once more climbed to comparatively excessive values, it’s doable {that a} comparable occasion might occur once more.

The distinction is, after all, that the funding charges are unfavourable this time, implying that the shorts could be those that may get caught up within the volatility this time. “Is Bitcoin preparing for a reverse transfer from two days in the past?” ponders the analyst.

It must be famous, nonetheless, that the open curiosity is at present at notably lesser values than it was proper earlier than the crash, so if a transfer does come up out of the present overheated spinoff market circumstances, it’s doable that it wouldn’t be as explosive because the crash was.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $26,000, down 11% within the final week.

BTC strikes sideways across the $26,000 mark | Supply: BTCUSD on TradingView

Featured picture from Michael Förtsch on Unsplash.com, charts from TradingView.com

[ad_2]

Source link