[ad_1]

Bitcoin is forming a sample that has traditionally led to the asset retesting a selected line. At current, this stage can be discovered at $20,500.

Bitcoin Has Dropped Beneath The 200-Day SMA With The Latest Crash

Just a few days again, Bitcoin noticed a pointy crash that took the cryptocurrency’s worth towards the $26,000 mark. As this plummet was already vital, many have questioned whether or not this was it or if the drawdown will proceed.

An analyst on X, Ali, shared a chart that will present hints about the place the asset might be heading subsequent.

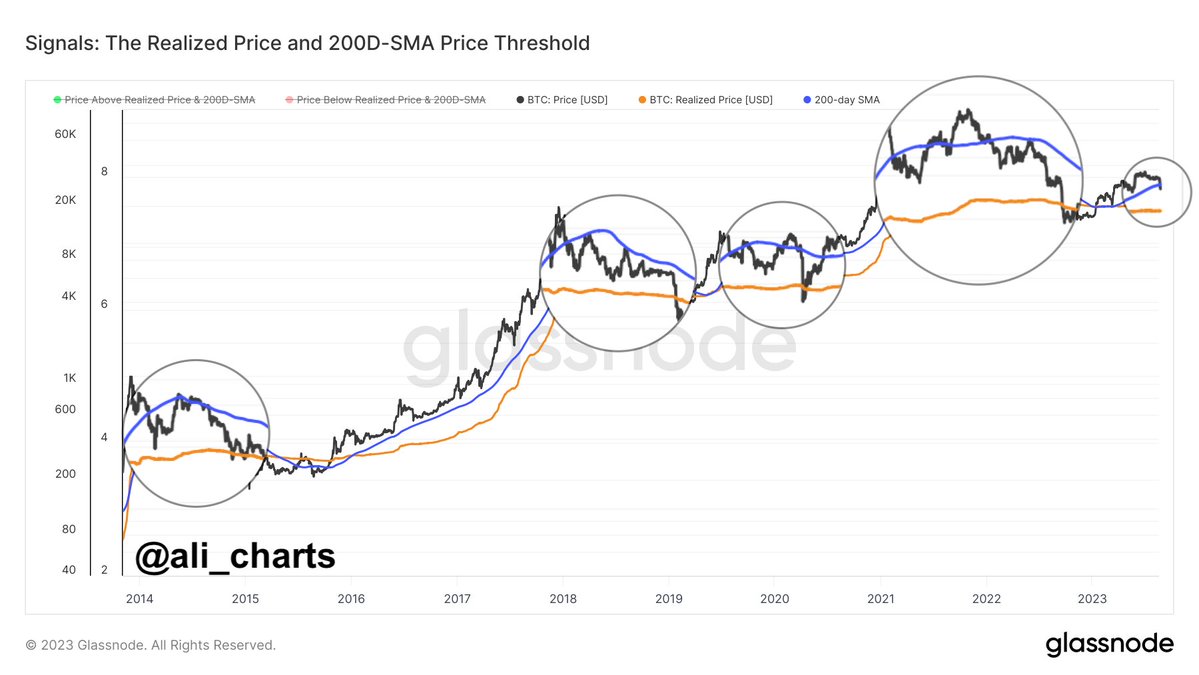

The pattern within the realized worth and the 200-day SMA for BTC | Supply: @ali_charts on X

The analyst has hooked up the information for 2 Bitcoin-related metrics within the graph: the 200-day easy shifting common (SMA) and the realized worth. The chart reveals that the BTC worth has dropped beneath the 200-day SMA (coloured in purple) with the most recent crash.

In accordance with the analyst, when the cryptocurrency’s worth has crossed beneath this stage in the course of the previous ten years, it has usually retested the realized worth (coloured in orange).

The “realized worth” right here refers back to the value foundation or the shopping for worth of the common investor within the BTC market. Because of this every time the cryptocurrency dips beneath this stage, the common holder enters a state of loss. Then again, breaks above the road indicate a return to earnings for a lot of the market.

Traditionally, this metric has had some attention-grabbing interactions with the spot worth of the coin. Throughout bullish durations, the road has typically supported the asset, whereas throughout bearish durations, it has acted as resistance.

The reason behind these curious interactions might lie in how the traders’ minds work in every interval. In bull markets, the common investor might imagine that the value will solely go up, so every time the asset drops to its shopping for worth, they accumulate extra of the asset.

Equally, in bearish developments, the holders might imagine the cryptocurrency will solely go down, so the value they purchased in (their break-even mark) can be the perfect exit alternative.

This shopping for and promoting might trigger the extent to behave as assist and resistance within the respective regimes. The newest instance of this conduct was seen earlier within the 12 months when Bitcoin rebounded off the road again in March.

Because the asset now seems to have damaged beneath the 200-day SMA, it might be heading in the direction of a retest, as has usually occurred many instances previously.

Proper now, the fee foundation of the common investor is $20,500, which signifies that if BTC goes to the touch this line once more, a big drawdown would wish to happen.

If this state of affairs certainly performs out, then it’s potential that Bitcoin may discover a rebound on the realized worth as soon as once more. A retest failure, nevertheless, can be a really regarding signal, as it would sign the return of the bear market.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $26,000, down 11% within the final week.

BTC has been shifting sideways because the crash | Supply: BTCUSD on TradingView

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link