[ad_1]

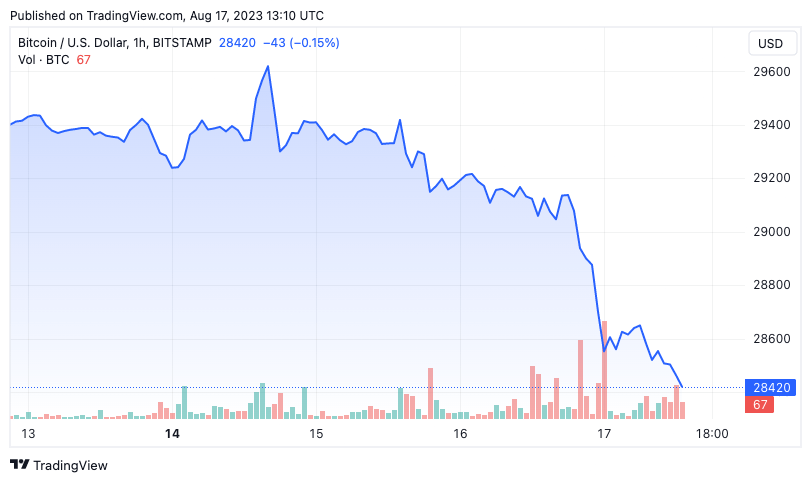

On Aug. 17, Bitcoin’s value dropped beneath the $29,000 mark, settling round $28,500. Whereas this decline may appear insignificant given Bitcoin’s traditionally unstable nature, the context of its current buying and selling vary magnifies the significance of this transfer.

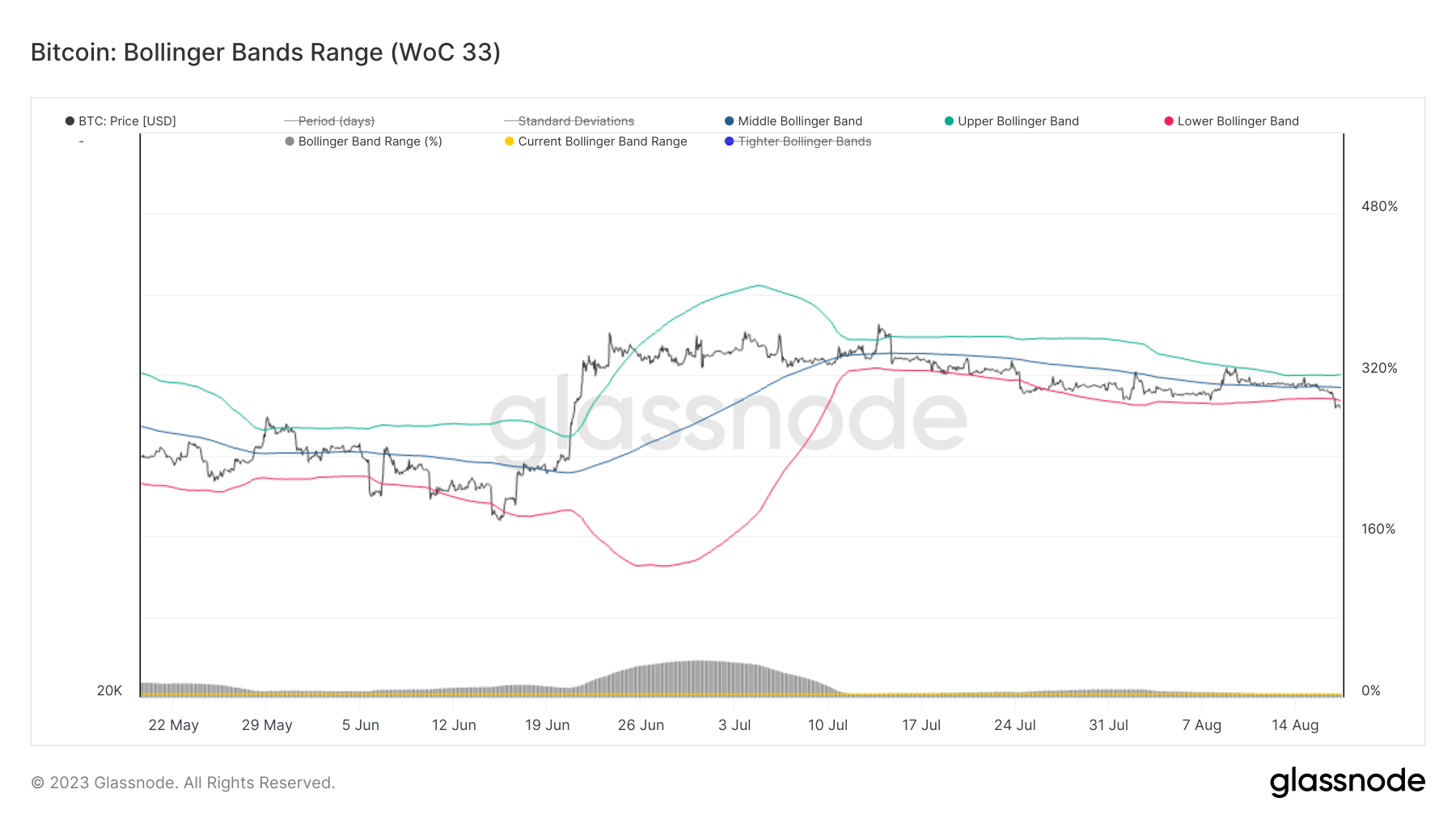

Bollinger Bands are a monetary software used to evaluate the worth volatility of varied property, together with Bitcoin. The bands include three traces — one central line and two outer ones. The central line on the chart represents the easy shifting common (SMA) of the asset’s value, whereas the outer bands are decided by the usual deviation, a measure indicating how unfold out the costs are from the common.

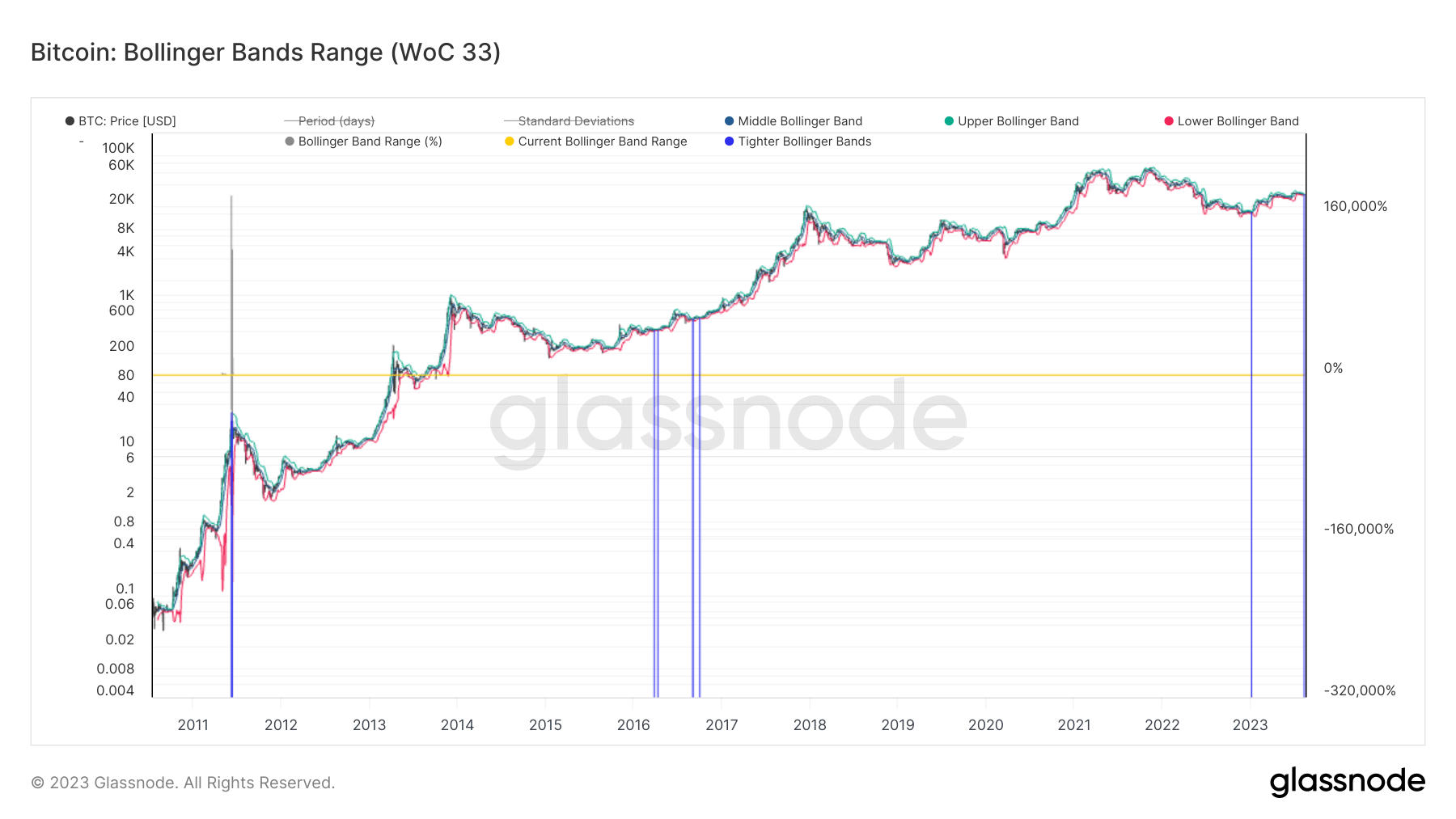

These bands widen in periods of excessive volatility and contract throughout low volatility. These bands are an important market indicator, serving to merchants establish potential purchase and promote indicators. When an asset’s value strikes outdoors these bands, it could actually point out a major value motion within the breakout path.

August has seen Bitcoin’s value volatility plummet to historic lows. Earlier than as we speak’s drop to $28,500, the higher and decrease Bollinger Bands had been separated by a mere 2.9%. Such a decent unfold has solely been witnessed twice in Bitcoin’s historical past. With the descent to $28,500, Bitcoin’s value breached the decrease Bollinger Band, which stood at $28,794. Consequently, the Bollinger Band vary expanded barely to three.2%.

Historic knowledge means that when Bitcoin’s value breaks beneath the decrease Bollinger Band, it’s usually adopted by a swift restoration and an upward trajectory. This sample has been noticed a number of instances, reinforcing the importance of the Bollinger Bands as a predictive software.

Moreover, each occasion of extraordinarily tight Bollinger Bands in Bitcoin’s historical past has preceded a notable value swing. For example, a number of occurrences of equally tight bands had been recorded in 2016. This era was the precursor to the rally that propelled Bitcoin to its all-time excessive in 2018. Extra not too long ago, in January 2023, Bitcoin’s value remained stagnant at round $16,800, with the bands indicating low volatility. Shortly after, Bitcoin surged, almost doubling its worth to $30,000.

So, what do these observations suggest for the market? The present tightness of the Bollinger Bands, mixed with Bitcoin’s value motion beneath the decrease band, suggests a possible for a major value upswing within the close to future.

The put up Bitcoin at $28.5K: Unpacking the importance of tight Bollinger Bands appeared first on CryptoSlate.

[ad_2]

Source link