[ad_1]

On August 14, Kevin Kelly, Co-founder of outstanding crypto analysis agency Delphi Digital supplied some fascinating insights on Bitcoin and the crypto market usually. Based on Kelly, the crypto market strikes in constant cycles, and we’re presently within the preliminary phases of a brand new cycle based mostly on market proof.

Utilizing the premier cryptocurrency as a benchmark, Kelly states a crypto cycle often begins with Bitcoin attaining a brand new all-time excessive (ATH) worth, adopted by an 80% loss within the subsequent 12 months. Thereafter, BTC would expertise a market restoration over two years earlier than embarking on a bullish run to realize a brand new ATH.

The Interaction Between The Crypto Cycle And Macroeconomic Indicators

Primarily based on Kelly’s evaluation, a typical crypto cycle happens inside 4 years, and its occasions are triggered by some elements within the greater macro enterprise cycle.

Associated Studying: Bitcoin Value Comparatively Muted – What Might Set off A Sharp Decline?

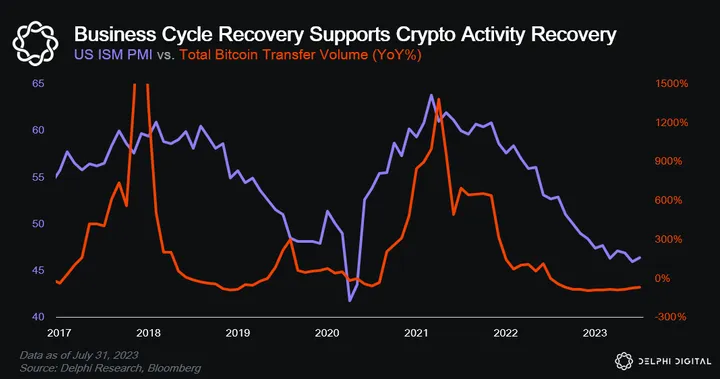

The analyst famous that, for instance, Bitcoin often attains new worth peaks on the identical interval because the Institute of Provide Administration (ISM) Index – an financial indicator that tracks the manufacturing sector’s well being in america.

He mentioned:

BTC worth peaks happen across the identical time the ISM exhibits indicators of topping out. Energetic addresses, complete transaction volumes, complete charges – all of them peaked alongside tops within the ISM too. Because the enterprise cycle exhibits indicators of restoration, so too does community exercise ranges…

Resulting from this similarity in market motion, Kevin notes that turning moments in a typical enterprise cycle have confirmed to be a positive interval to extend one’s publicity to danger property reminiscent of Bitcoin.

Supply: Delphi Digital

Supply: Delphi Digital

Bitcoin Poised To Attain New ATH By This fall 2024, Kelly Says

Curiously, Kevin Kelly acknowledged in his evaluation that the ISM is presently heading towards the top of a two-year downtrend, indicating that BTC’s costs might quickly begin surging within the coming months.

To again his long-term bullish worth prediction, Kelly highlights a number of different elements, together with the Bitcoin Halving occasion developing in April 2024.

The Delphi Digital Co-founder acknowledged that the final two Bitcoin halvings had occurred 18 months after BTC’s worth tanked and seven months earlier than rallying to a brand new ATH.

Associated Studying: Bernstein Predicts Spot ETFs Might Declare 10% Of Bitcoin’s Market If Greenlit

Primarily based on this historic information, BTC might effectively attain a brand new ATH by This fall 2024. Nonetheless, as with all predictions, Kelly acknowledged which might be sure danger elements concerned.

Firstly, he predicted that the BTC market is more likely to quickly witness a modest promoting stress or worth consolidation, particularly following the market’s sturdy restoration within the final 9 months.

As well as, he additionally highlighted the potential for the enterprise cycle presenting a false bearish finish – as seen in March 2020 – or not reaching its bearish finish as quickly as predicted.

Based on information from CoinMarketCap, Bitcoin is buying and selling round $29,333.89, with a 0.12% decline on the final day. Nonetheless, the token’s every day buying and selling quantity is up by 26.38% and is valued at $12.2 billion

BTC buying and selling at $29,322 on the every day chart | Supply: BTCUSD chart on Tradingview.com

Featured picture from LinkedIn, chart from Tradingview

[ad_2]

Source link