[ad_1]

DWF Labs has been making waves within the crypto neighborhood. Their worldwide presence, complete service choices, and aggressive buying and selling ways have set them aside. However is there extra beneath the floor?

As we probe deeper into their actions, a big focal point emerges: their public cryptocurrency pockets. Let’s delve into this digital treasury to uncover the nuances of their holdings and potential market influences.

Decoding DWF Labs’ Digital Pockets

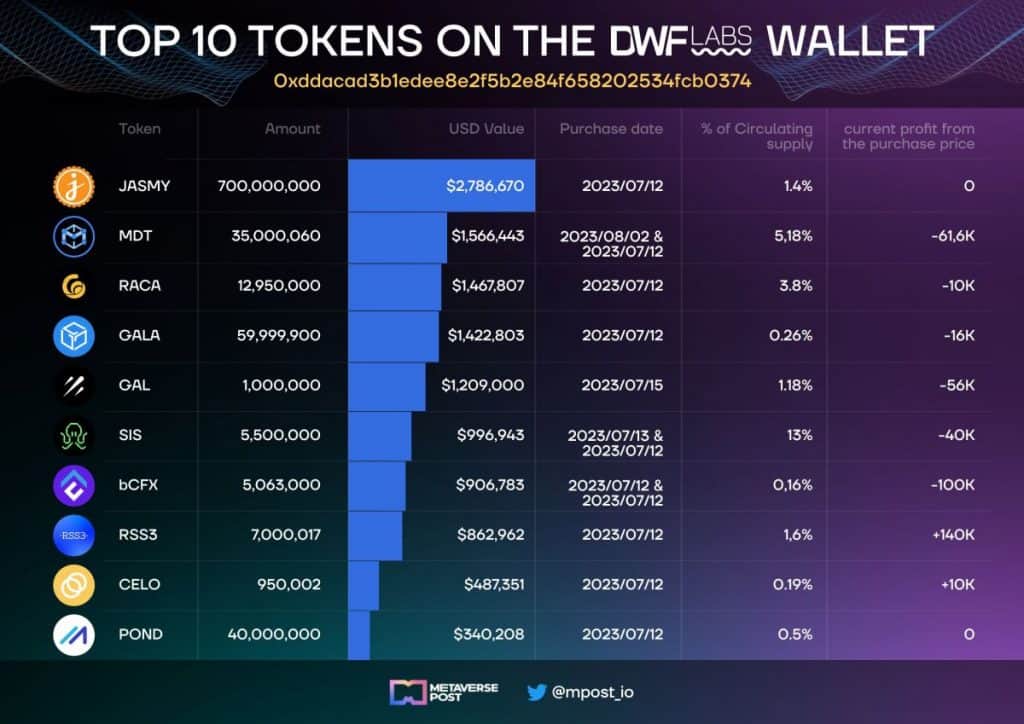

The general public pockets of DWF Labs offers a panoramic view of its diversified portfolio. Right here’s a breakdown:

JASMY: Holding 700 million tokens (1.4% of the circulating provide).MDT: A stake of 35 million tokens (5.18% of the circulating provide).RACA: Holding near 13 billion tokens (3.8% of the circulating provide).GALA: With practically 60 million tokens, they maintain 0.26% of the provision.GAL: Their 1 million tokens translate to 1.18% of the circulating provide.SIS: A major 13% of the circulating provide is held by DWF Labs.bCFX: With over 5 million tokens, they possess 0.16% of the circulating provide.RSS3: 7 million tokens of their pockets, or 1.6% of the circulating provide.CELO: Their 950k tokens make up 0.19% of the circulating provide.POND: Holding a large 40 million tokens, equating to 0.5% of the circulating provide.

Decoding DWF Labs’ Market Actions

There are substantial indications of potential market manipulation:

The large $65M open curiosity in opposition to a $107M capitalization on Binance mixed with a buying and selling quantity 13 instances its cap hints at orchestrated market actions.The clear distinction in YGG‘s spot and futures at its peak additional leads one to query if these disparities had been pure or induced.

Along with this, DWF Labs’ intensified funding into Conflux with a cumulative $28 million infusion raises considerations. Is that this a real increase to the Conflux ecosystem or a strategic positioning for market affect in Asia and Hong Kong?

@YieldGuild token $YGG listed on Binance Futures. Necessary step within the token’s improvement, which brings sustainability and energy to it. Good job, guys, I’m actually comfortable to see such good progress! Quick analysis > beneath👇 pic.twitter.com/sdk7tMEfRV

— Andrei Grachev (@ag_dwf) August 5, 2023

Previous Transactions: Patterns of Affect?

A deeper dive into their historic transactions uncovers probably regarding patterns:

The well timed motion of three.65M #YGG to Binance proper as the worth started to ascend.Their substantial acquisition of 29.2M YGG from the Yield Guild Treasury was complemented by their extra token purchases throughout varied exchanges in 2022.Binance’s figures reveal vital exercise: $1.475B in futures turnover, a leap of 36.5% at $C98, and a $45M open curiosity. The potential market manipulation is highlighted by the distinction between the $65M open curiosity and the $107M capitalization, with Binance’s buying and selling quantity being 13 instances its cap.

#C98 STRONG PUMP#Coin98 has obtained an funding of as much as “7 digits” from #DWFLabs to speed up the appliance of #Web3 globally.

DWF Labs is an funding firm that gives liquidity companies for #Web3 firms.#Crypto #CryptocurrencyNews #C98 #DWF pic.twitter.com/LwBg49T5WM

— NTT (@NTT3k) August 9, 2023

How Market Makers Affect Token Costs

At its core, a market maker facilitates liquidity in a market, making certain that there are all the time sufficient purchase and promote orders for merchants. They revenue from the unfold between the purchase and promote costs. However with vital holdings, additionally they wield appreciable affect.

Provide and Demand Manipulation:

If a market maker holds a good portion of a token, they’ll create synthetic shortages by withholding it from the market. Conversely, flooding the market with the token can drive costs down. Proudly owning 13% of all SIS provides DWF Labs the facility to tighten or loosen the token’s availability, influencing its worth.

Setting the Bid-Ask Unfold:

Market makers can set wider bid-ask spreads, making it costlier for merchants to enter or exit positions. This may deter buying and selling or make it extra worthwhile for the market maker on the expense of normal merchants.

Value Anchoring:

By inserting giant purchase or promote orders, market makers can create psychological “anchors” that may affect the perceived worth of a token. If different merchants see a large promote order at a specific worth, they might imagine that’s the token’s true worth and modify their buying and selling methods accordingly.

Creating Momentum:

By initiating a collection of purchase or promote orders, a market maker can create the looks of momentum in a token’s worth motion. Observing merchants may leap on the bandwagon, additional accelerating the meant worth path.

Data Asymmetry Exploitation:

Given their central place, market makers typically have entry to extra complete data than common merchants. By appearing on this data earlier than it turns into public, they’ll make strategic strikes that profit their positions.

Order E book Visualization:

Massive orders positioned by market makers could be seen on the order e-book, which might affect merchants’ choices. A major purchase order can create bullish sentiment, whereas a big promote order can do the other.

Oblique Affect by means of Partnerships and Bulletins:

By publicizing partnerships, investments, or different vital strikes associated to a token they maintain, market makers can create hype or concern round a token, influencing its demand and worth.

Within the case of DWF Labs, with their substantial 13% holding of SIS, they undeniably possess the aptitude to affect its market dynamics. The strategic actions they determine to take, or not take, can reverberate all through the token’s buying and selling ecosystem.

Interplanetary information! Symbiosis simply partnered with @DwfLabs, a number one international net 3.0 funding firm 💪

Collectively, we are going to tirelessly attempt to reinforce the awesomeness of Symbiosis! 👾

Try the article to study extra: https://t.co/36pZtMwoeK pic.twitter.com/zQyo5KUU3c

— Symbiosis (@symbiosis_fi) January 27, 2023

DWF Labs – Market Innovators or Manipulators?

The circumstantial proof and patterns appear to counsel DWF Labs’ potential involvement in market manipulation. The corporate’s capability to pump particular tokens, mixed with its strategic acquisitions, positively raises questions on their true intent out there.

Nevertheless, it’s important to strategy these findings with warning. Whereas there are patterns which may point out market play, there isn’t direct proof of malicious intent. It’s essential for regulatory our bodies and market watchdogs to delve deeper into such potential discrepancies to make sure a good taking part in area for all.

Because the crypto house continues to develop, the actions of great gamers like DWF Labs will inevitably come beneath the microscope. Transparency, honest play, and ethics are very important in making certain the longevity and credibility of the Web3 universe.

Learn extra:

[ad_2]

Source link