[ad_1]

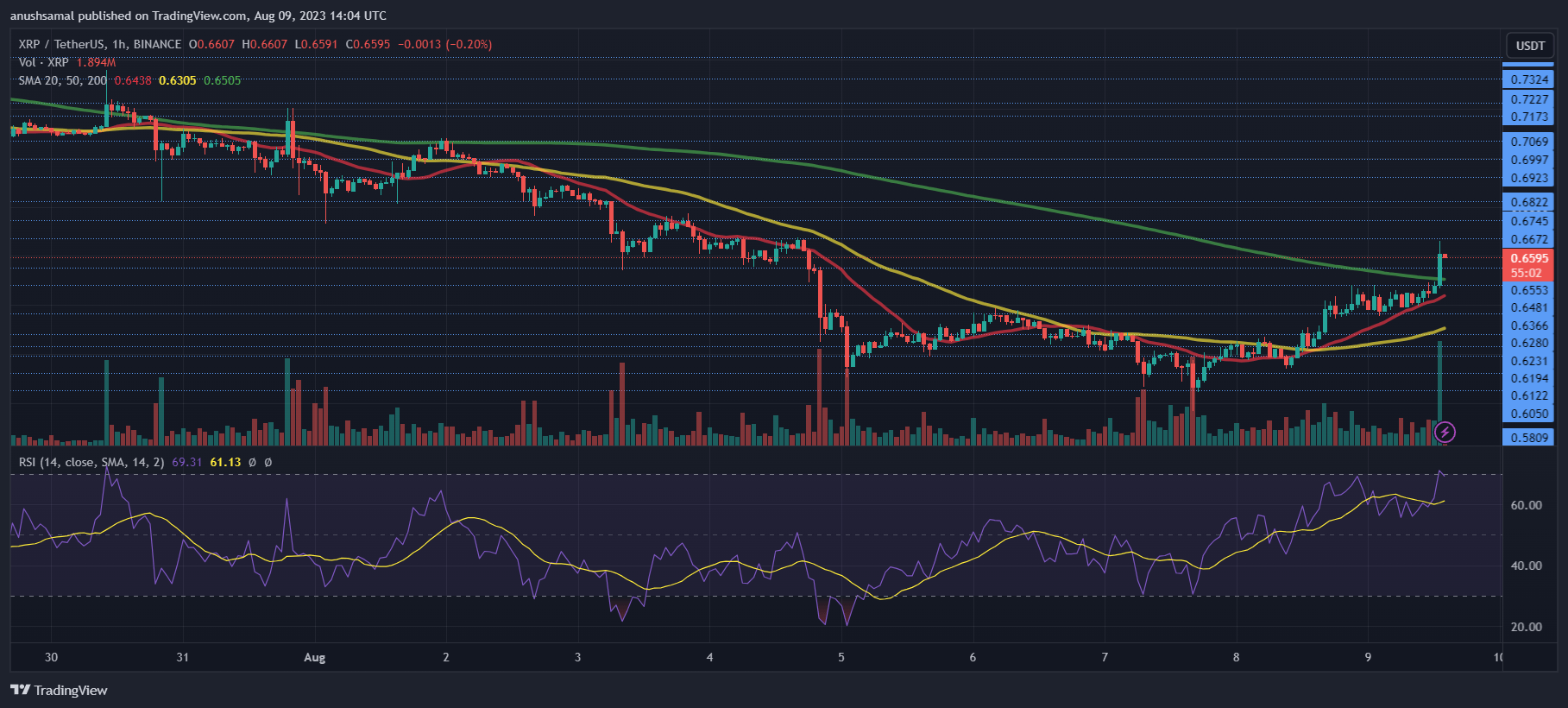

XRP has halted its decline by rising above the $0.60 worth stage. Prior to now 24 hours, its worth elevated by practically 6%. Nonetheless, XRP hasn’t but proven important positive aspects on the weekly chart.

The technical evaluation suggests a optimistic development for XRP, however there’s an opportunity that the coin might face extra downward motion within the upcoming buying and selling periods.

If patrons push the worth greater, XRP may preserve its place above the present worth stage. Furthermore, breaking via two essential resistance ranges might result in a possible surge of over 9%. For XRP to maintain rising, the broader market should present help, notably Bitcoin’s motion past the $30,000 zone.

If shopping for momentum doesn’t get better, XRP may expertise a decline and drop beneath its native help line. The growing market capitalization of XRP signifies energetic purchaser participation at this time second.

XRP Value Evaluation: One-Day Chart

On the time of writing, the altcoin was priced at $0.65. This worth has offered important resistance for the altcoin in latest weeks. The upcoming buying and selling periods maintain important significance as XRP should successfully surpass this stage.

Failing to realize this might set off a subsequent decline within the worth. Moreover, overhead resistance ranges are $0.67, adopted by $0.69. Ought to XRP efficiently breach the $0.69 mark, the altcoin may commerce across the $0.72 vary. Conversely, an area help stage is positioned at $0.63.

Ought to the worth dip beneath this threshold, it might probably descend to $0.60, finally pausing the general bullish sentiment.

Technical Evaluation

For demand, XRP’s chart signifies its present state as overbought. The Relative Energy Index has reached 70, indicating patrons at present affect the worth course. This might indicate the potential for a worth correction within the upcoming buying and selling periods.

Whereas such a correction may not be extended, any drop in XRP’s worth beneath $0.63 may cut back purchaser exercise.

The asset’s worth remained positioned above the 20-Easy Transferring Common line. This remark signifies an growing demand and emphasizes patrons’ position in steering the market’s worth dynamics.

Moreover, the altcoin has generated purchase indicators in response to the rising demand. These purchase indicators are represented by the emergence of inexperienced histograms within the Transferring Common Convergence Divergence indicator, signaling a bullish sentiment.

Moreover, the Directional Motion Index presents a optimistic outlook, with the +DI (blue) line positioned above the -DI (orange) line, indicating a positive worth trajectory.

Furthermore, the Common Directional Index (Crimson) has crossed the 40 mark, implying a rise within the power of the worth development. This growth suggests XRP might yield extra positive aspects within the near-term buying and selling periods.

Featured picture from Finbold, charts from TradingView.com

[ad_2]

Source link