[ad_1]

The latest drop within the worth of Cardano (ADA) has raised issues amongst traders because it breached the mixed help of $0.3 and a vital help trendline. Nonetheless, a better evaluation of the day by day chart reveals a twist which may supply a glimmer of hope for the cryptocurrency’s restoration.

Technical evaluation of Cardano’s worth motion means that the obvious breakdown from the rising help trendline may be a faux one.

A faux breakdown, also referred to as a false breakdown or a bear entice, happens when a worth briefly drops beneath a help degree or trendline however shortly rebounds, trapping bearish merchants who offered in the course of the dip.

This misleading transfer usually results in a fast reversal and upward momentum.

Cardano: Pretend Breakdown Or True Bearish Sign?

On the flip aspect, a decisive breakout from the overhead trendline might set the stage for a considerable 26% upswing in Cardano’s worth, as per latest worth evaluation. This may not solely mark a big worth restoration but in addition instill renewed optimism amongst merchants and traders.

Offering insights into the present market dynamics, it’s vital to acknowledge the broader context surrounding Cardano’s efficiency.

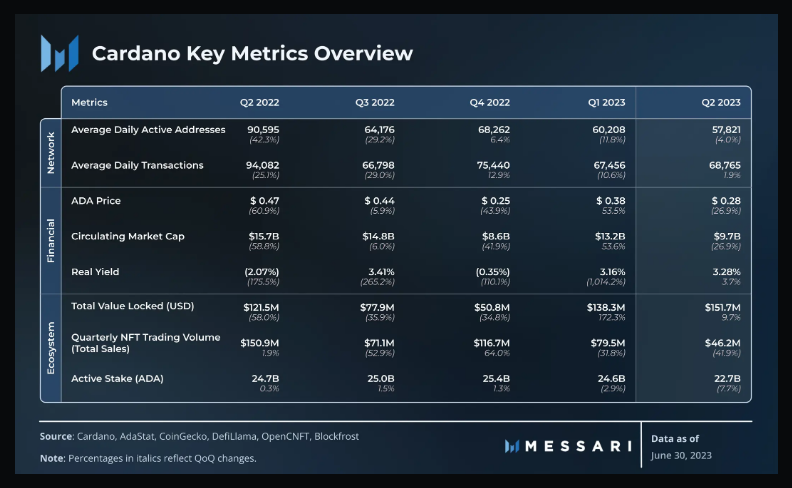

Regardless of the latest worth turmoil, Cardano has demonstrated exceptional development when it comes to its complete worth locked (TVL). Crypto analytics agency Messari’s newest report reveals that Cardano’s TVL has surged by practically 200% because the begin of the 12 months.

Quarter-over-quarter (QoQ), the TVL elevated by 9.7%, and year-to-date (YTD), it soared by a formidable 198.6%.

This surge in TVL propelled Cardano from the thirty fourth to the twenty first place when it comes to general TVL amongst all blockchain networks. This exceptional feat underscores the rising adoption and utility of Cardano’s ecosystem.

Setback Due To Regulatory Stress

Nonetheless, the journey to this achievement has not been with out its challenges. The report factors out that Cardano’s TVL skilled a dip in June, triggered by regulatory turbulence.

The US Securities and Trade Fee (SEC) charged cryptocurrency alternate Coinbase for allegedly providing unregistered securities, with ADA being particularly talked about within the lawsuit. This improvement led to a sell-off of ADA and resulted in liquidations on Cardano-based decentralized finance (DeFi) platforms.

ADA market cap presently at $10.4 billion in at this time’s chart: TradingView.com

As of the newest knowledge from CoinGecko, Cardano is presently buying and selling at $0.299138. Whereas the cryptocurrency has seen a 3.1% rally up to now 24 hours, it has additionally endured a 3.8% droop over the past seven days.

Cardano’s latest worth motion might seem bearish on account of a seemingly important breakdown from key helps. Nonetheless, a cautious evaluation suggests the potential for a faux breakdown, offering some ounce of optimism for a possible restoration. Amidst challenges, Cardano’s spectacular TVL development displays its resilience and adoption inside the crypto ecosystem.

(This website’s content material shouldn’t be construed as funding recommendation. Investing entails danger. If you make investments, your capital is topic to danger).

Featured picture from Flickr

[ad_2]

Source link