[ad_1]

The M1 cash provide, a key financial indicator, represents the full quantity of bodily foreign money in circulation, together with cash, notes, traveler’s checks, and demand deposits.

Basically, it measures an economic system’s liquidity and the general public’s spending energy.

Within the context of the cryptocurrency market, evaluating Bitcoin’s spot value to the M1 cash provide gives an attention-grabbing perception into the digital asset’s relative value and potential for future development.

This comparability can function a device for traders and economists to evaluate the size of Bitcoin in relation to conventional cash provide and its potential implications on international financial buildings.

Furthermore, monitoring adjustments in Bitcoin’s worth in opposition to the M1 cash provide can doubtlessly spotlight shifts in public sentiment in direction of conventional fiat currencies and digital property, providing a singular perspective on the evolving monetary panorama.

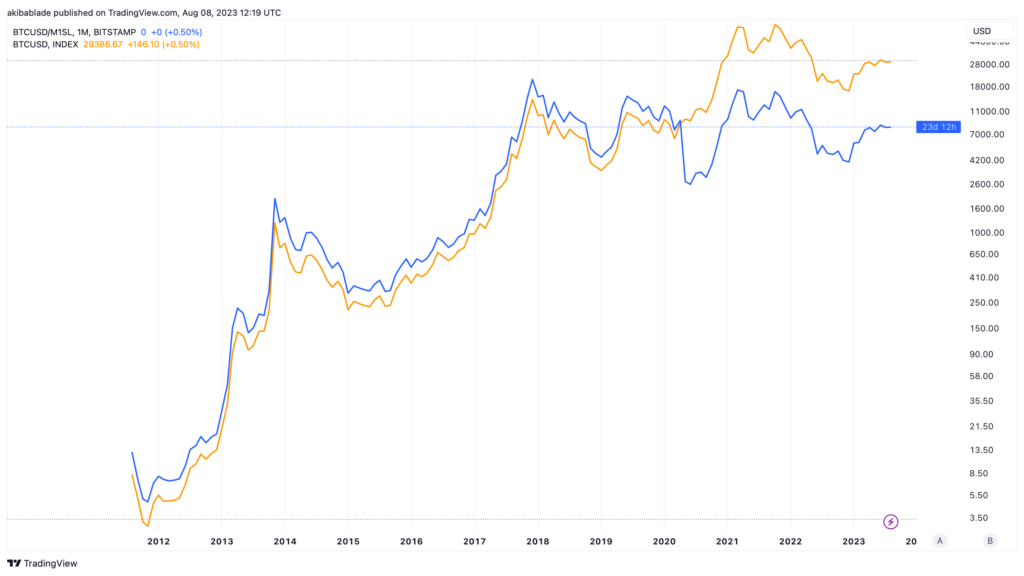

Within the chart beneath, the ratio of Bitcoin’s spot value to the M1 cash provide (BTCUSD/M1SL) is all the time greater than Bitcoin’s spot value till Q1 2020.

This development has been noticed on a logarithmic scale, emphasizing the relative development charges and proportional adjustments between these metrics. Notably, Bitcoin’s value, when adjusted for the M1SL hasn’t reached an all-time excessive since 2017.

Presenting Bitcoin’s spot value as persistently decrease than BTCUSD/M1SL signifies that the expansion charge of Bitcoin’s value was lagging behind the expansion charge of the M1 cash provide or that the M1 cash provide was rising at a better charge than Bitcoin’s value.

This aligns with the macroeconomic evaluation of the time, on condition that conventional fiat currencies and liquidity within the economic system had been increasing extra quickly than the demand or valuation of Bitcoin. Bitcoin was additionally much less correlated with typical monetary markets and financial indicators throughout this era.

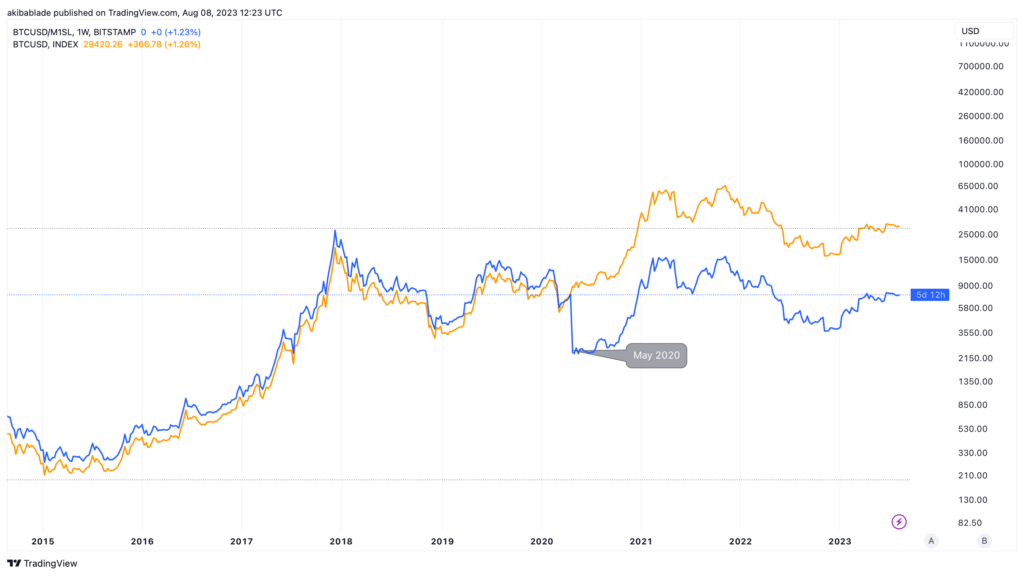

Then, the shift from Could 2020, when Bitcoin’s value started to rise after the halving, seems to point that Bitcoin’s development charge began to outpace the expansion charge of different property.

Nevertheless, the BTCUSD/M1SL chart exhibits that the worth of Bitcoin relative to the full quantity of fiat cash in circulation decreased. This could possibly be attributed to a few elements.

One could possibly be the results of the financial insurance policies enacted by the Federal Reserve. Because the COVID-19 pandemic hit, central banks injected giant quantities of liquidity into their economies to curb the anticipated financial downturn. This led to a rise within the M1 cash provide, subsequently inflicting a lower within the BTCUSD/M1SL ratio.

Nevertheless, it’s necessary to notice that this lower within the BTCUSD/M1SL ratio doesn’t essentially point out a discount within the intrinsic worth or potential of Bitcoin. As an alternative, it displays the adjustments in financial circumstances and market sentiment on the time.

Whereas the worth of Bitcoin elevated in greenback phrases, the relative liquid value of the greenback additionally declined as provide skyrocketed. The M1SL rose 426% over 700 days, rising the M1 provide to $20.8 trillion from $3.95 trillion. The equal change in Bitcoin provide can be to go from 21 million cash to 88 million.

Sooner or later, ought to the BTCUSD/M1SL chart flip the BTCUSD value once more, it might sign an acceleration in Bitcoin’s precise greenback worth. The present hole between the orange and blue strains on the chart basically represents the surplus liquidity within the US markets post2020. On this scenario, both the Bitcoin value rises relative to the M1SL or the M1SL declines whereas Bitcoin holds regular.

Nevertheless, if the M1SL declines in tandem with a lower in Bitcoin’s value, it might signify a decreased perceived greenback valuation for the highest cryptocurrency by market cap.

The noticed traits between BTCUSD and BTCUSD/M1SL present useful insights, highlighting elements past easy value comparisons wanted to realize a real sense of the worth of digital property resembling Bitcoin.

It serves as a reminder that even within the quickly evolving world of cryptocurrencies, conventional financial indicators just like the M1 cash provide nonetheless maintain relevance and may present useful context for understanding crypto market dynamics.

The submit Adjusting Bitcoin’s value for US liquidity reveals key indicator for bull run appeared first on CryptoSlate.

[ad_2]

Source link