[ad_1]

Fast Take

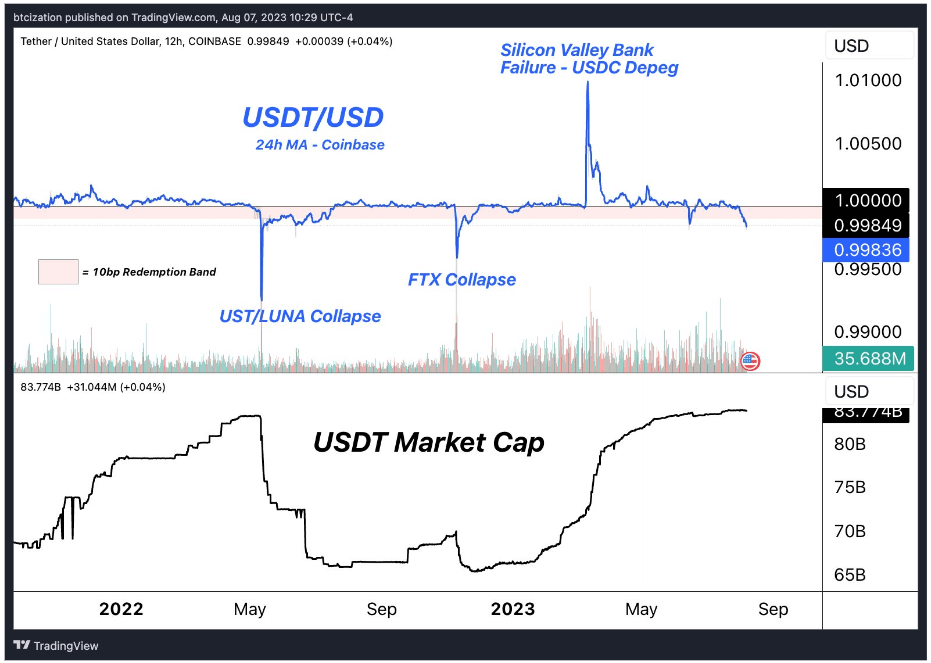

Tether, the issuer of USDT, has not too long ago skilled one among its largest redemptions because the FTX collapse in Nov. 2022, in accordance with Paolo Ardoino, Tether’s CTO.

A complete of roughly 325 million USDT was redeemed, marking a big occasion within the stablecoin’s historical past.

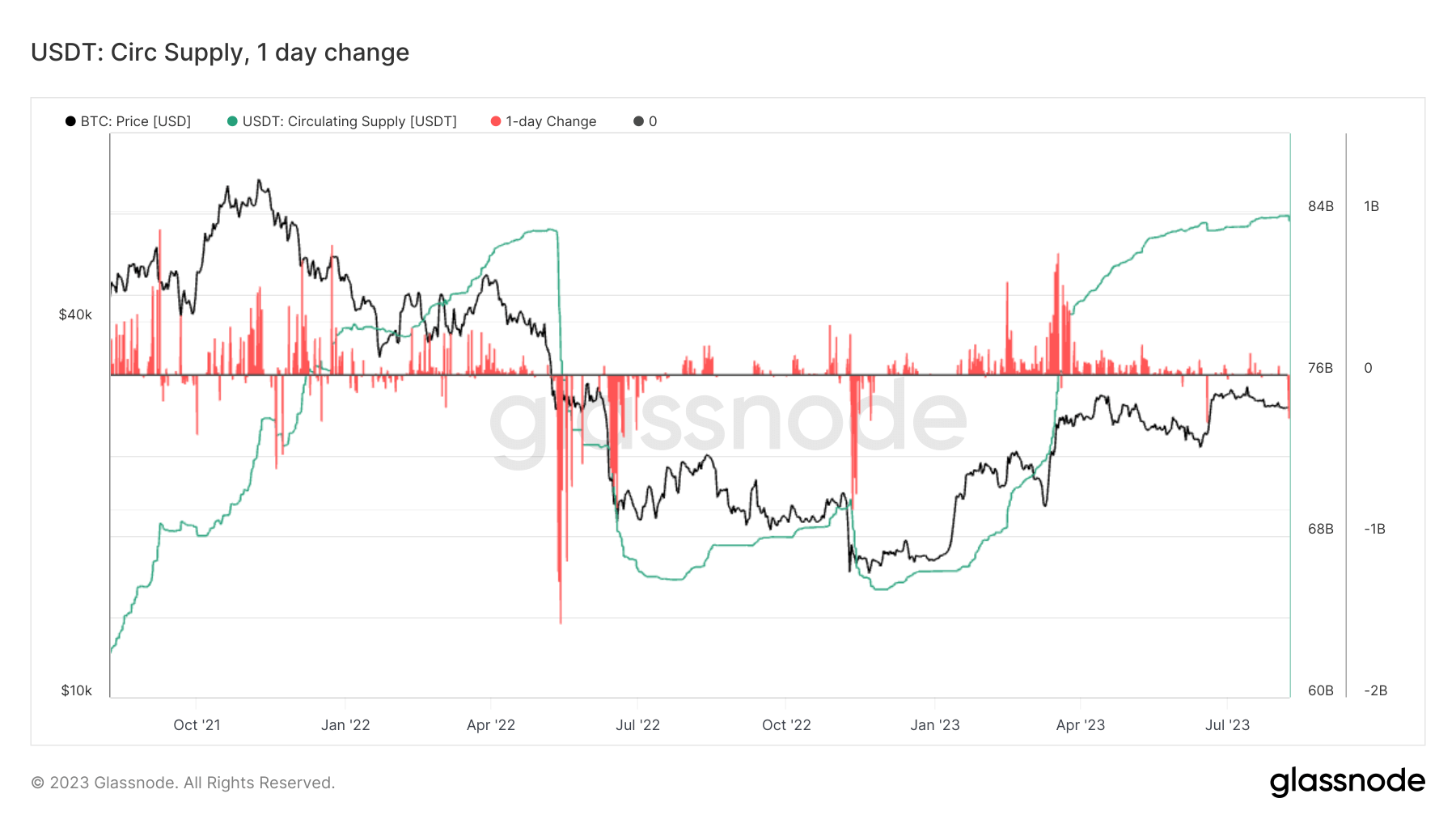

This comes because the circulating provide of USDT is close to document highs of round 83 billion, indicating the resilience and demand for this explicit stablecoin.

An intriguing notice is the USDT/USD redemption charge, which, in accordance with Dylan LeClair, has fallen beneath the 10bp mark over the previous 24 hours. That is the bottom charge seen because the FTX collapse and will recommend a change in market habits or sentiment in the direction of the stablecoin.

This information offers a snapshot of Tether’s exercise and the continuing affect of previous market occasions, just like the FTX collapse, on current occurrences. Additional monitoring of those redemption charges and circulating provide traits may provide invaluable perception into the broader market dynamics and the stablecoin’s position inside it.

PayPal launched its personal stablecoin PYUSD on Aug. 7, which presently has a market cap of simply $26 million, suggesting USDT redemptions are usually not immediately linked to the elevated competitors.

The submit Market sentiment sways as Tether sees largest redemption since FTX collapse amid PYUSD launch appeared first on CryptoSlate.

[ad_2]

Source link