[ad_1]

Bitcoin (BTC) has been no stranger to dramatic value swings within the risky cryptocurrency world. As September approaches, market analysts carefully monitor BTC’s chance of plunging under the $25,000 mark.

Nonetheless, historical past has proven that September’s struggles typically pave the best way for a resurgence in October, with huge rallies that rekindle investor optimism.

Potential For BTC To Drop Under $25,000 Earlier than A Promising October

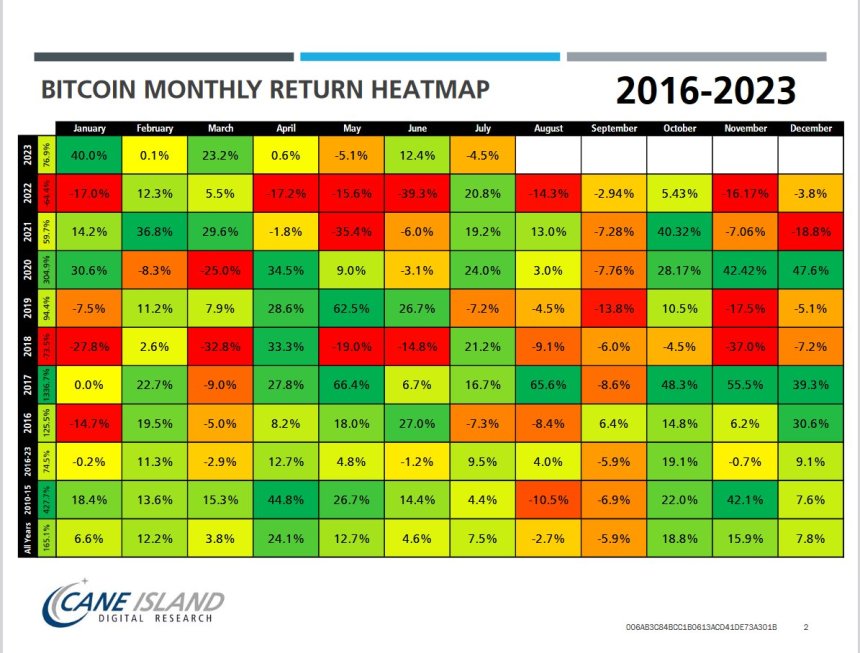

When inspecting Bitcoin’s historic efficiency throughout September, it turns into evident that the month has posed challenges for the world’s most famed cryptocurrency.

Earlier September has witnessed BTC experiencing declines of as much as 13%. This downward pattern has undoubtedly involved merchants and traders, elevating questions concerning the sustainability of Bitcoin’s bullish momentum.

In accordance to Timothy Peterson, market analyst and funding Supervisor, based mostly on present market evaluation, there’s a 50% chance that Bitcoin’s value will dip under the $25,000 threshold earlier than September concludes.

Whereas a possible drop under $25,000 may trigger short-term unease amongst Bitcoin lovers, historic patterns recommend that October may very well be the month to sit up for.

Previously, September’s value declines have typically catalyzed vital rallies within the subsequent month. Observing the heatmap above, Peterson recognized cases the place Bitcoin rebounded with positive factors as excessive as 48% following sharp declines in September.

If Bitcoin does certainly expertise a dip under $25,000 in September, it might mark the ultimate vital correction earlier than the graduation of a brand new bull run cycle.

On this word, Peterson believes that such a dip, coupled with the next restoration and October’s potential rally, may set the stage for substantial positive factors within the coming months.

Bitcoin Bullish Divergence

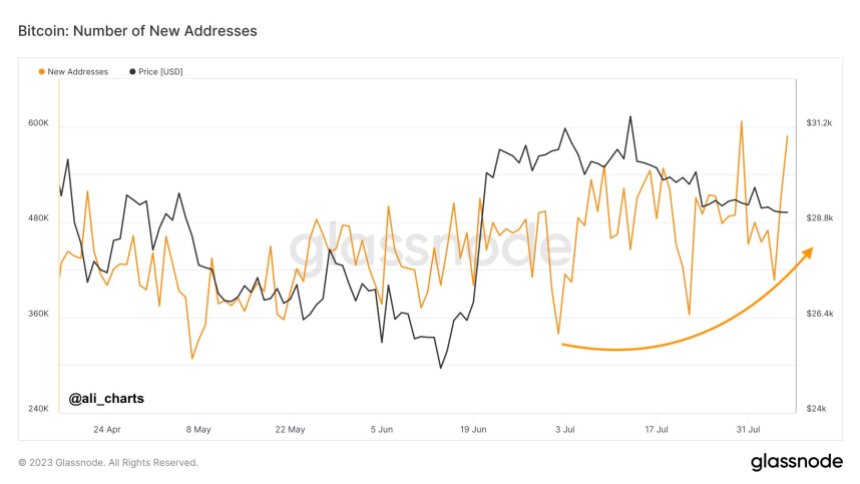

As BTC skilled a drop from $32,000 to $29,000, dealer Ali Martinez highlighted a big pattern; the variety of new Bitcoin addresses continued to rise steadily.

This intriguing divergence between value and community development supplies insights into BTC’s doubtlessly steady long-term uptrend.

Whereas Bitcoin’s value exhibited a downward trajectory, the variety of newly created Bitcoin addresses has persistently grown.

This divergence is noteworthy, suggesting that regardless of short-term value fluctuations, the community’s enlargement stays sturdy. It signifies a rising curiosity in Bitcoin adoption and utilization, which, in flip, helps the notion of a steady and sustainable long-term uptrend.

Conversely, Bitcoin stays trapped inside a value vary of $29,200 and $28,900, a sample that has continued because the begin of August. As of the time of writing, BTC is buying and selling at $28,960, reflecting a 0.5% lower within the final 24 hours.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link