[ad_1]

Be part of Our Telegram channel to remain updated on breaking information protection

Latest quarterly earnings stories from a number of publicly traded crypto-related firms confirmed increased gross sales and an increase in profitability in Q2 2023.

Because the market emerged past the crypto winter, the companies profited from elevated market costs and a gentle drop in bearish momentum.

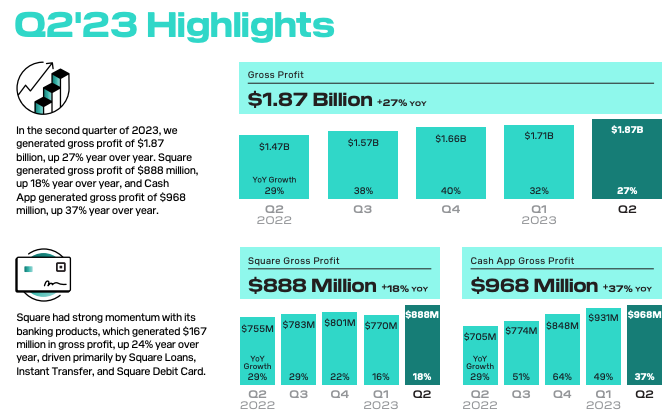

Block Information 27% Yr-on-Yr Enhance

Funds know-how supplier Block Inc. launched second quarter 2023 earnings with a gross revenue of $1.87 billion, a 27% year-over-year acquire.

The agency has shared that Bitcoin accounted for $2.4 billion of its total $5.5 billion Q2 internet gross sales. The income comes from Block’s Money App, a cellular software for crypto transactions.

“The year-over-year improve in Bitcoin income and gross revenue was pushed by a rise within the amount of Bitcoin offered to prospects, partially offset by a lower within the common market worth of Bitcoin in comparison with the prior-year interval,” the corporate talked about in a press release to traders.

The corporate, owned by former Twitter CEO Jack Dorsey, reported a 34% progress in Bitcoin revenue in comparison with the $1.8 billion reported in Q2 final yr.

Block additionally revealed that no Bitcoin impairment loss had been recorded within the length.

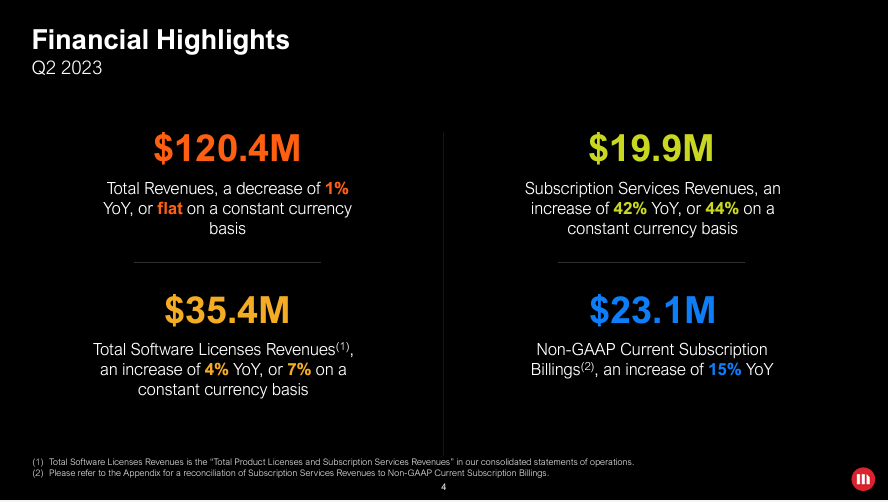

Coinbase Outperforms Analysts’ Forecasts

On August 3, the primary American cryptocurrency trade to go public, launched its quarterly earnings report, exceeding preliminary projections to declare $663 million in internet revenue.

Analysts had predicted a lack of $0.76 on $634 million in income, however Coinbase as an alternative revealed a lack of $0.42 per share on $708 million in income.

“One yr in the past, in Q2 2022, we began decreasing our expense base to function extra effectively. One yr later, we’re proud to say that our quarterly recurring working bills have dropped almost 50% Y/Y,” the corporate’s Q2 2023 letter to shareholders reads.

$COIN Coinbase transferring increased after Q2 earnings shock to the upside! 🪙

~EPS: $(0.42) vs $(0.78) est ~SALES: $707.91M vs $643.36M esthttps://t.co/1t8PcL8IY1

— TrendSpider (@TrendSpider) August 3, 2023

In Q2, the crypto trade’s non-trading income surpassed its buying and selling income for the primary time, totaling a internet of $335.4 million.

Regardless of the demise of FTX and falling cryptocurrency costs, the trade had maintained its upbeat tempo by the top of 2022, rising income by 22% sequentially.

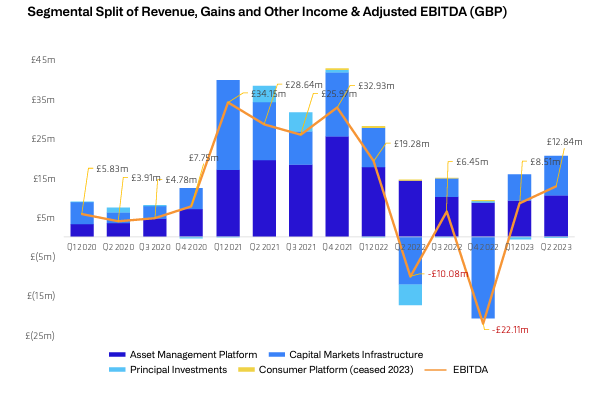

CoinShares Offsets Payment Decline with Elevated Operations

European crypto firm CoinShares reported a 33% improve in income over the earlier yr.

The respected digital asset supervisor introduced exceptional monetary outcomes for the yr’s second quarter on August 1, 2023.

Regardless of challenges, CoinShares was in a position to offset a 25% year-over-year decline in asset administration charges ($13.52 million) with a big improve in capital markets operations ($12.76 million).

Moreover, CoinShares made $6.76 million in earnings in the course of the quarter as an alternative of a internet lack of $0.77 million in Q2 2022.

Throughout this time, CoinShares unveiled “Ledger Lens,” a instrument permitting traders to immediately affirm the help of the group’s exchange-traded merchandise.

MicroStrategy Turns Worthwhile Once more

In distinction to a $1.1 billion internet loss in Q2 final yr, MicroStrategy reported a internet revenue of $22.2 million this yr.

A major motive behind the distinction was a smaller $24.1 million digital asset impairment loss within the quarter in comparison with final yr’s huge $917.8 million loss.

MicroStrategy founder and chairman Michael Saylor revealed by way of X that the enterprise had spent nearly $14.4 million to purchase a further 467 Bitcoins (BTC) in July. With this most up-to-date buy, it owns 152,800 BTC value near $4.43 billion on the time of writing.

The enterprise additionally disclosed that Bitcoin and the MSTR shares of MicroStrategy outperformed a number of different indexes and belongings.

In July, @MicroStrategy acquired a further 467 BTC for $14.4 million and now holds 152,800 BTC. Please be part of us at 5pm ET as we talk about our Q2 2023 monetary outcomes and reply questions in regards to the outlook for #BusinessIntelligence and #Bitcoin. $MSTR https://t.co/SCHeBJ80TH

— Michael Saylor⚡️ (@saylor) August 1, 2023

MSTR has hiked by over 254% because it adopted the Bitcoin technique in August 2020. As per Google Finance, the share worth of MSTR was $145.02 on January 3. It’s $376.97 as of the time of this writing.

Robinhood Turns First Revenue Since IPO

American monetary companies firm Robinhood [HOOD] reported a internet revenue of $25 million in Q2 2023 in comparison with a $511 million internet loss within the first quarter.

That is the primary time it has turned worthwhile since going public in 2021.

Robinhood stories its first revenue since going public. Here is what it is advisable to know and my evaluation 👇

Robinhood reported income of $486m and a internet revenue of $25m. Month-to-month actives are right down to 10.8m from 14m a yr in the past. Transaction revenues have been down at $194m, however internet curiosity… pic.twitter.com/fl7nhhyma5

— Simon Taylor (@sytaylor) August 4, 2023

“In Q2, we reached a big milestone by reaching GAAP profitability for the primary time as a public firm. Guided by our daring product highway map, we’re persevering with to innovate for our prospects, develop belongings, acquire market share, and alter the business for the higher,” Robinhood CEO Vladimir Tenev famous.

Nevertheless, the corporate confirmed a fall in income throughout crypto, equities, and transaction-based income. Crypto buying and selling income decreased 18% from $38 million in Q1 to $31 million in Q2.

Associated Articles

Wall Road Memes – Subsequent Large Crypto

Early Entry Presale Reside Now

Established Neighborhood of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Finest Crypto to Purchase Now In Meme Coin Sector

Workforce Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link