[ad_1]

Be a part of Our Telegram channel to remain updated on breaking information protection

Michael Saylor maintains his optimistic stance on Bitcoin regardless of the latest developments relating to Bitcoin ETF approvals.

Through the earnings name on August 1, the CEO of Microstrategy highlighted that the corporate would retain its distinct standing as a consequence of its “Bitcoin-centric operational technique,” even when spot ETFs turn out to be accessible.

He commented to Bloomberg, “As an operational firm, we now have the power to make the most of leverage, one thing an ETF can’t do, thus, we see this as advantageous to the whole ecosystem.”

Nonetheless, he didn’t downplay the potential influence of spot Bitcoin ETFs on the ecosystem. Drawing an analogy, he mentioned, “We’re akin to a sportscar, whereas the upcoming spot ETF will resemble a supertanker.”

He identified that if the Securities Alternate Fee approves even one of many 9 pending Bitcoin ETF functions, it’s seemingly that vital entities similar to hedge funds and sovereign wealth funds will make investments billions into the Bitcoin market.

In the identical earnings name, Saylor emphasised that Spot ETFs will cater to a unique buyer base, contributing to the expansion of the entire class in a complementary method.

Microstrategy Showcases its Outperformance Since Adopting Bitcoin

On August third, Michael Saylor tweeted a graph to showcase the rise of Microstrategy since adopting the Bitcoin technique.

Contemplate a #Bitcoin Technique. pic.twitter.com/MJcGxiVHop

— Michael Saylor⚡️ (@saylor) August 2, 2023

A analysis report from TD Cowen reveals that the corporate has generated 254% returns since 2020 after adopting the Bitcoin technique, outperforming the token itself, which has grown by 145% throughout the identical interval.

Shares like Microstrategy comply with the value of digital property of their steadiness sheet, so traders usually use them to realize publicity to crypto property with out involving a cryptocurrency change.

Microstrategy Poised to Purchase Extra Bitcoins

As one of many distinguished Bitcoin whales, Microstrategy now owns round $4.5 billion value of Bitcoin after shopping for one other $341 million value of BTC in Q2 2023.

The newest buy got here in July when Michael Saylor revealed by his tweet that Microstrategy had purchased 467 BTC value $14.4 million, rising the corporate’s holdings to 152,800 BTC.

In July, @MicroStrategy acquired a further 467 BTC for $14.4 million and now holds 152,800 BTC. Please be part of us at 5pm ET as we focus on our Q2 2023 monetary outcomes and reply questions in regards to the outlook for #BusinessIntelligence and #Bitcoin. $MSTR https://t.co/SCHeBJ80TH

— Michael Saylor⚡️ (@saylor) August 1, 2023

One doc filed to SEC revealed that Microstrategy now plans to promote $750 million value of sophistication A standard inventory so as to add extra Bitcoin to its current holdings.

Bitcoin Efficiency Stays Unstable

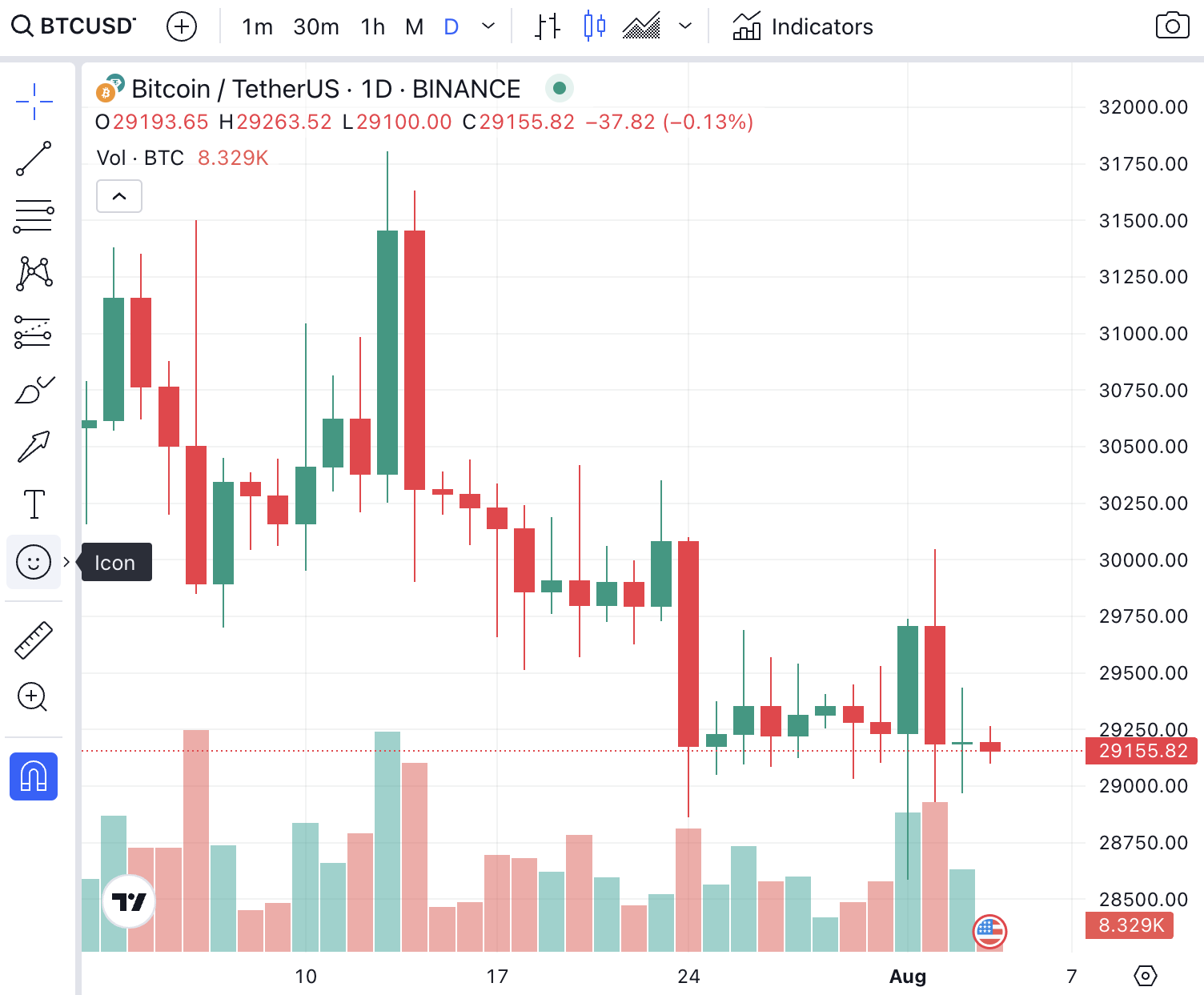

Bitcoin’s efficiency has remained risky because it pared again from $30k. The newest lengthy pink got here after it was reported that US prosecutors are contemplating fraud prices in opposition to Binance.

Candle charts present a bearish dominance, which is protecting Bitcoin simply above the $29k mark.

The Bitcoin worth has skilled a marginal decline of 0.04% within the final 24 hours, accompanied by a minor 0.04% improve in its market capitalization and a steep drop of 17% in its 24-hour buying and selling quantity.

Associated

Microstrategy Plans $750 Million Share Providing and Says it Will Add Extra Bitcoin to $4.5 Billion Holding

Ether Futures ETFs Had Costs Inflated by Tweeting Bots on X, Research Says

Wall Road Memes – Subsequent Large Crypto

Early Entry Presale Stay Now

Established Neighborhood of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Greatest Crypto to Purchase Now In Meme Coin Sector

Group Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be a part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link