[ad_1]

Understanding the dynamics of stablecoin provides is a vital facet of crypto market evaluation, as stablecoins play a pivotal position within the cryptocurrency ecosystem.

Fluctuations available in the market cap of those pegged belongings can sign shifts in investor sentiment, liquidity modifications, and total market well being.

In 2023, the stablecoin market witnessed a major shift, with Tether (USDT) and TrueUSD (TUSD) rising as market leaders.

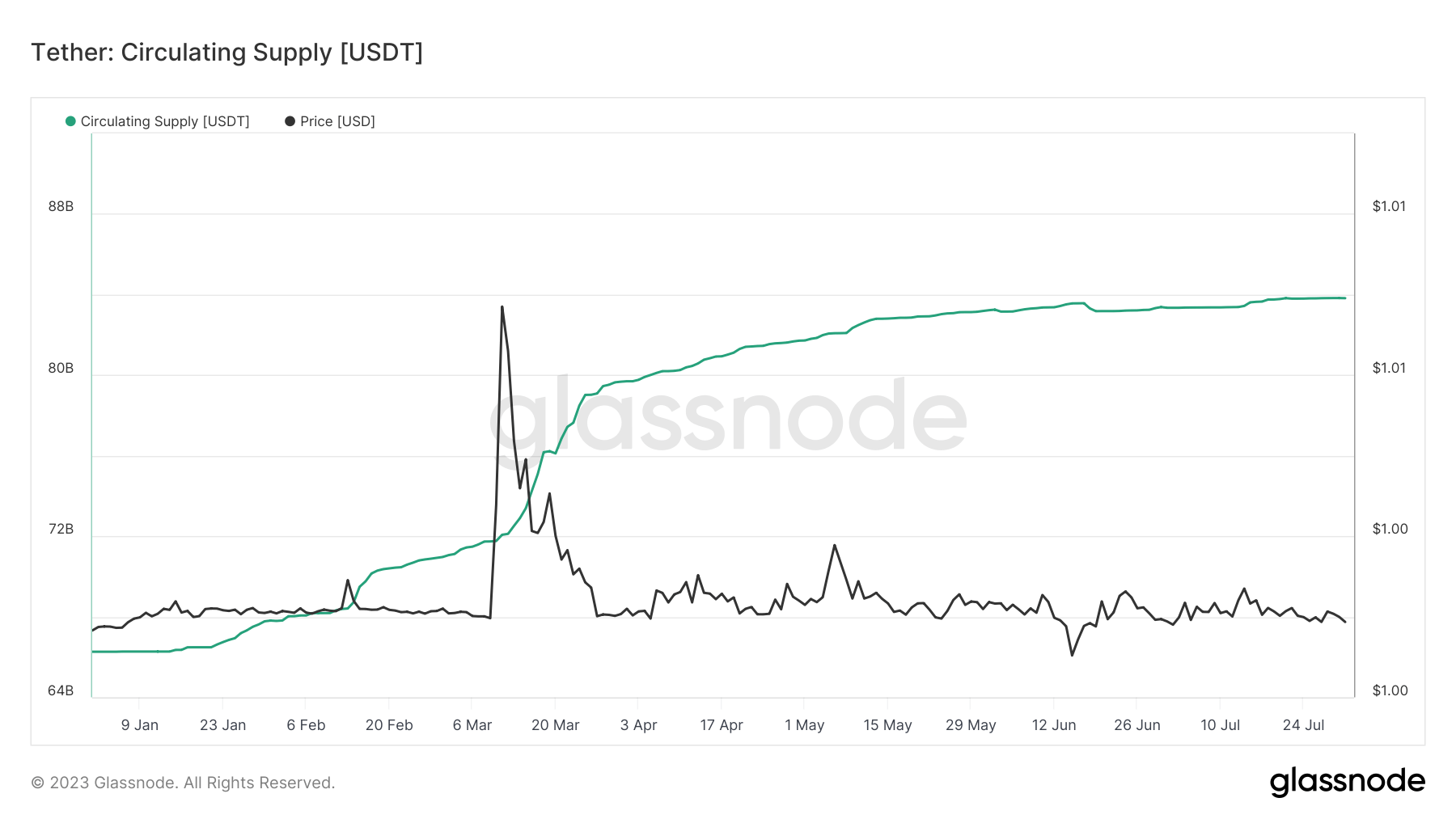

The provision of USDT reached an all-time excessive of $83.81 billion on July 31, surpassing its earlier peak of $83.16 billion in Might 2022. This represents a considerable development of 26.50% because the starting of the yr.

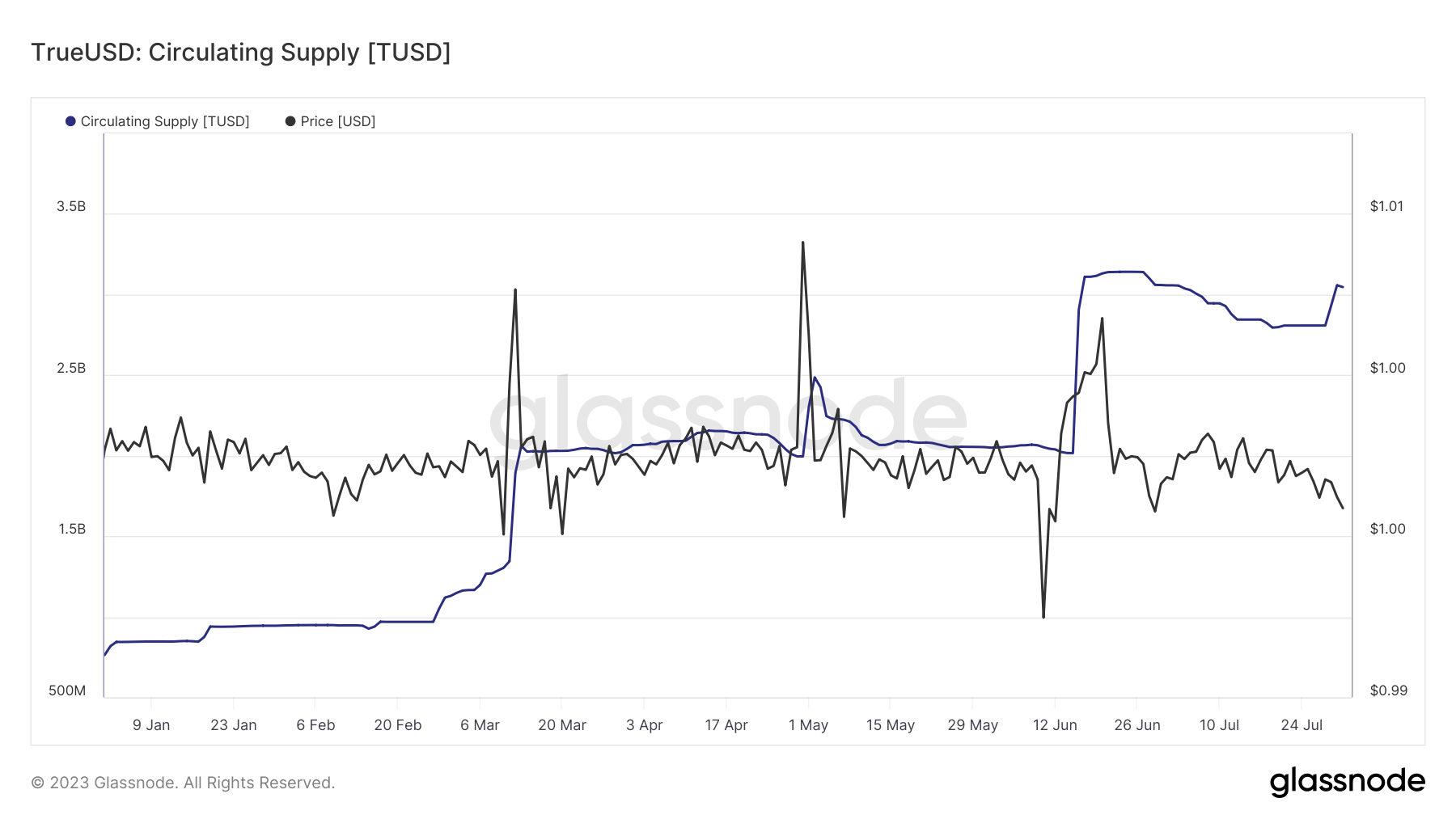

TUSD additionally reached its peak on June 26, with a provide of $3.14 billion. The latest surge, as beforehand analyzed by CryptoSlate, pushed TUSD’s provide again above $3 billion, at present standing at $3.05 billion. TUSD’s provide has grown by nearly 300% because the begin of the yr.

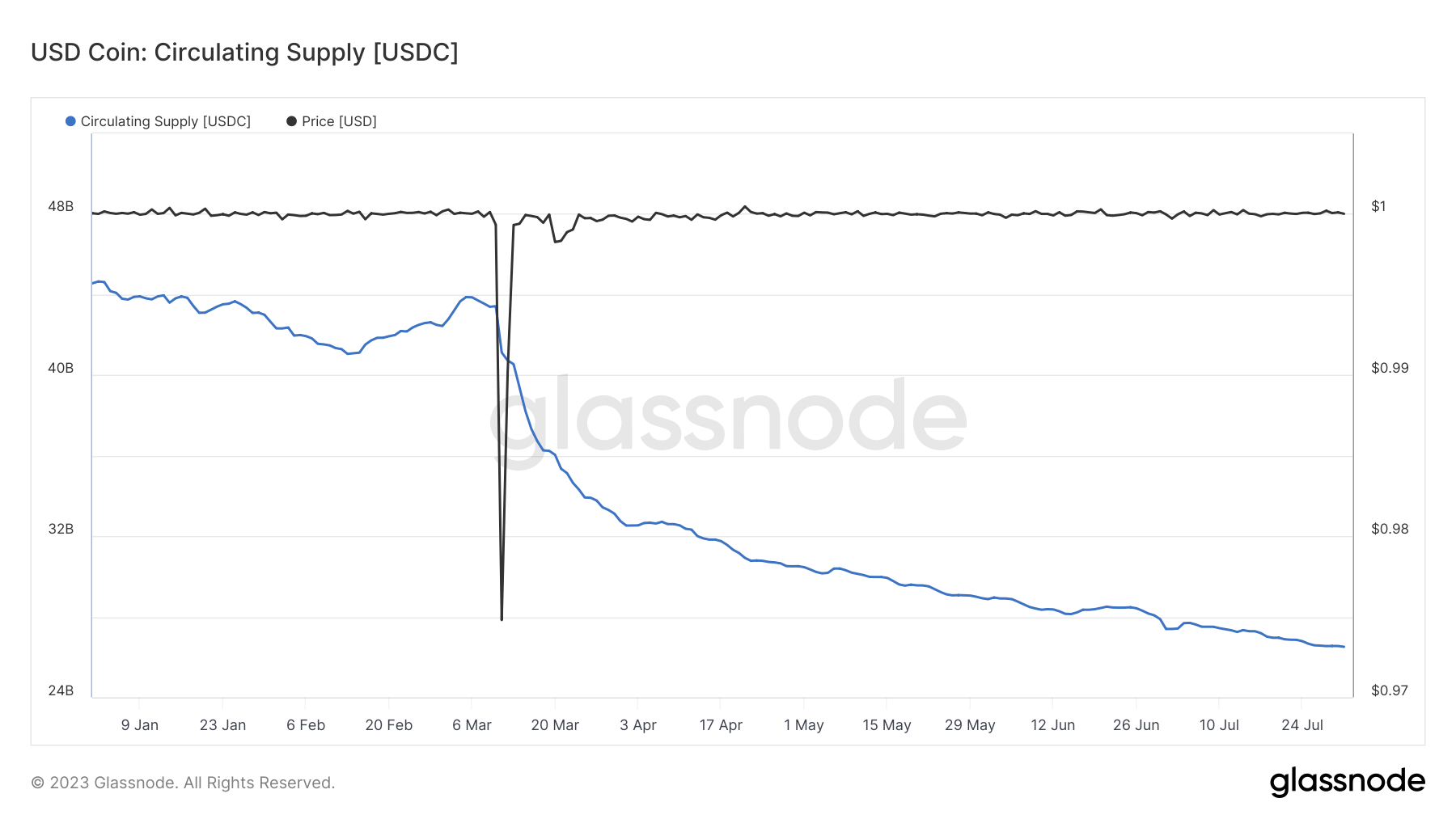

Nonetheless, different main stablecoins have skilled a pointy drop of their provides. Regardless of a considerably larger provide than TUSD, USDC has skilled a 40% lower because the starting of the yr, with its present provide standing at $26.51 billion.

The drop was exacerbated in March when USDC briefly de-pegged, buying and selling as little as $0.97. A de-pegging occasion, the place a stablecoin deviates from its pegged worth, can point out market instability and erode belief within the asset.

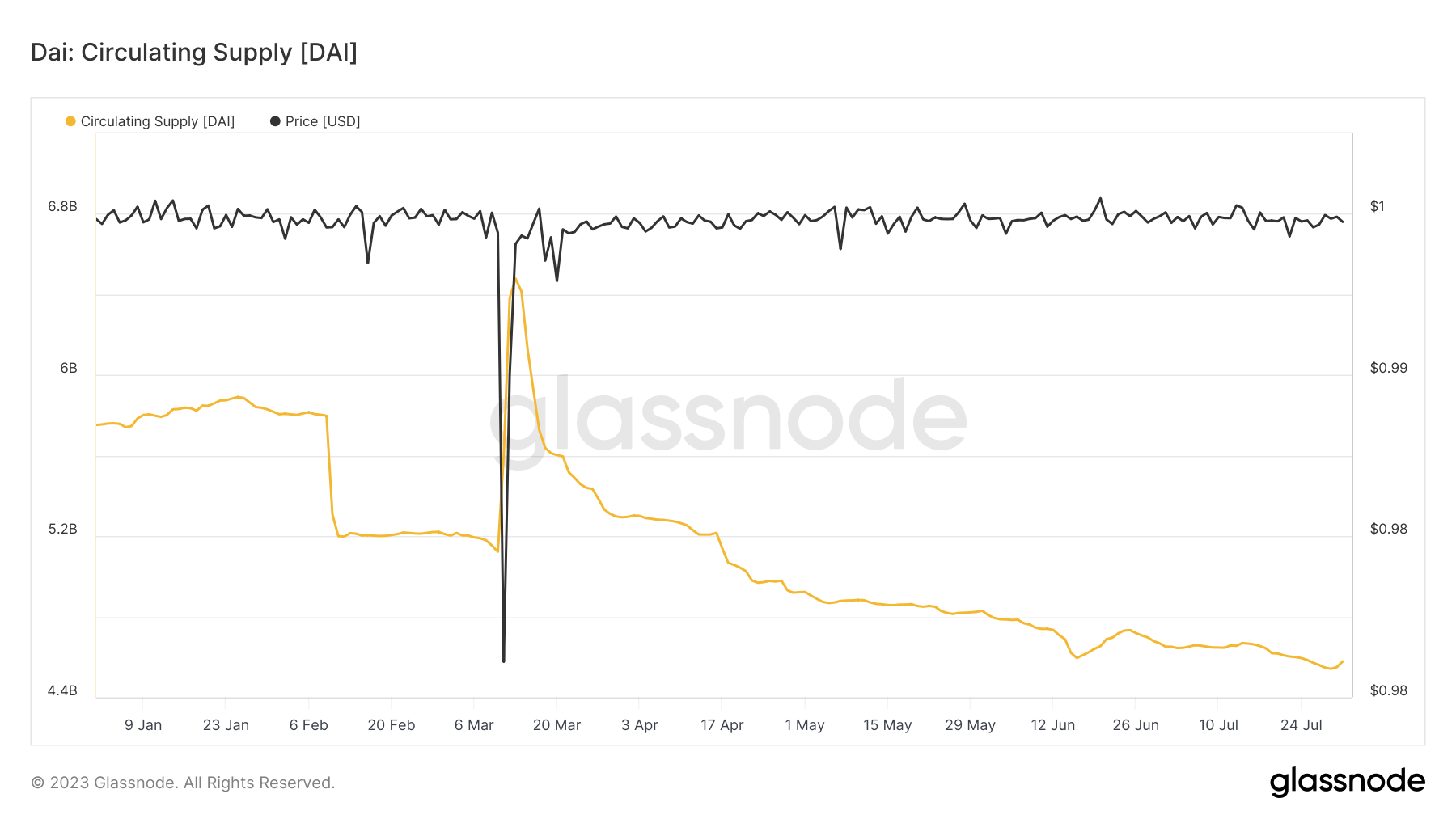

DAI, one other distinguished stablecoin, additionally skilled a de-peg on the identical time, however its provide initially elevated. Nonetheless, this enhance was short-lived, and the downward development rapidly re-established. The provision dropped from $5.75 billion at first of the yr to $4.57 billion on July 31, representing a 20% lower.

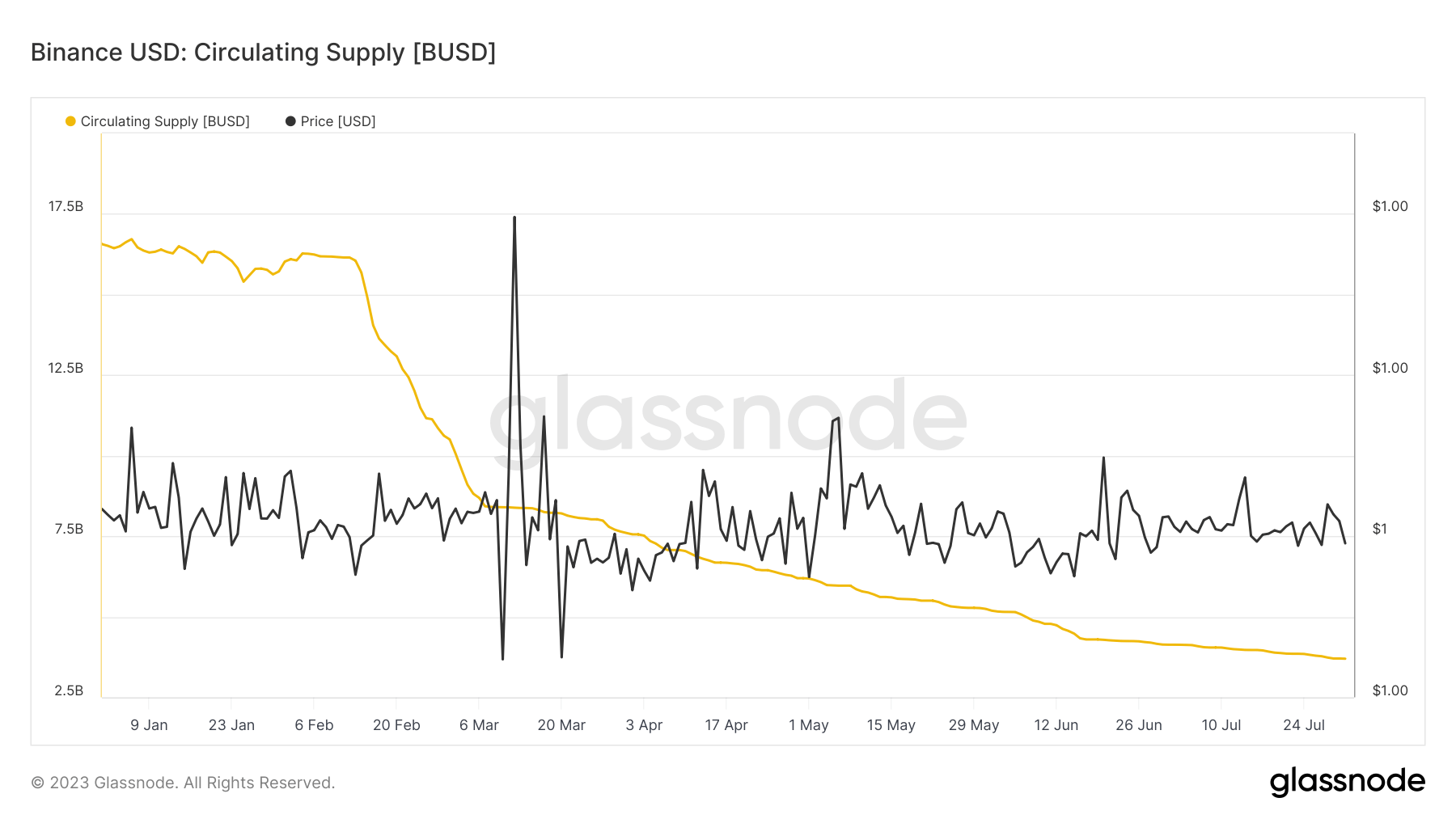

Essentially the most vital lower in provide was seen in Binance USD (BUSD), a stablecoin linked to the Binance alternate. The provision diminished by over 77%, dropping from $16.50 billion at first of the yr to $3.69 billion on July 31.

As a consequence of a pending lawsuit filed by the USA Securities and Alternate Fee (SEC), Paxos has stopped the issuance of the BUSD stablecoin, stating, ” Paxos not mints new BUSD, however permits clients to redeem BUSD for USD or convert their BUSD to USDP,”

These shifts in stablecoin provides underscore the dynamic nature of the crypto market. The rise of USDT and TUSD, coupled with the decline of different main stablecoins, could sign a change in investor desire and belief, with extra capital flowing to belongings buyers and merchants deem safer or extra liquid.

Rank

Title

Ticker

Market Cap

24H Vol

1

Tether

USDT

$83,801,671,209

$22,547,202,621

2

USD Coin

USDC

$26,446,685,467

$3,399,720,920

3

Dai

DAI

$4,558,160,395

$212,842,536

4

Binance USD

BUSD

$3,667,705,148

$1,662,534,530

5

TrueUSD

TUSD

$3,014,429,130

$2,937,994,931

The publish Inside stablecoin provide dynamics as TUSD shakes up the market appeared first on CryptoSlate.

[ad_2]

Source link