[ad_1]

On-chain information exhibits the Bitcoin lively addresses metric has been lowering just lately, an indication that traders could also be dropping curiosity in BTC.

Bitcoin Lively Addresses Have Taken A Hit Lately

As an analyst on X identified, the lively addresses metric could sign that the community exercise has dropped just lately. The “each day lively addresses” is an indicator that measures the full variety of addresses collaborating in some transaction exercise on the blockchain each day.

This metric naturally counts each the senders and receivers. It solely accounts for distinctive addresses, that means that even when a pockets makes a number of transactions in a single day, its contribution in direction of the indicator’s worth will stay one unit.

The variety of lively addresses on the community could also be thought of analogous to the full variety of distinctive customers visiting the blockchain, so this indicator can inform us concerning the quantity of site visitors the Bitcoin community is receiving.

When this metric’s worth is excessive, many addresses are making transfers on the chain proper now. This development is usually a signal that the customers are presently discovering the community enticing.

However, low values of the indicator suggest low utilization of the chain, which can point out that the curiosity within the cryptocurrency is low among the many common investor.

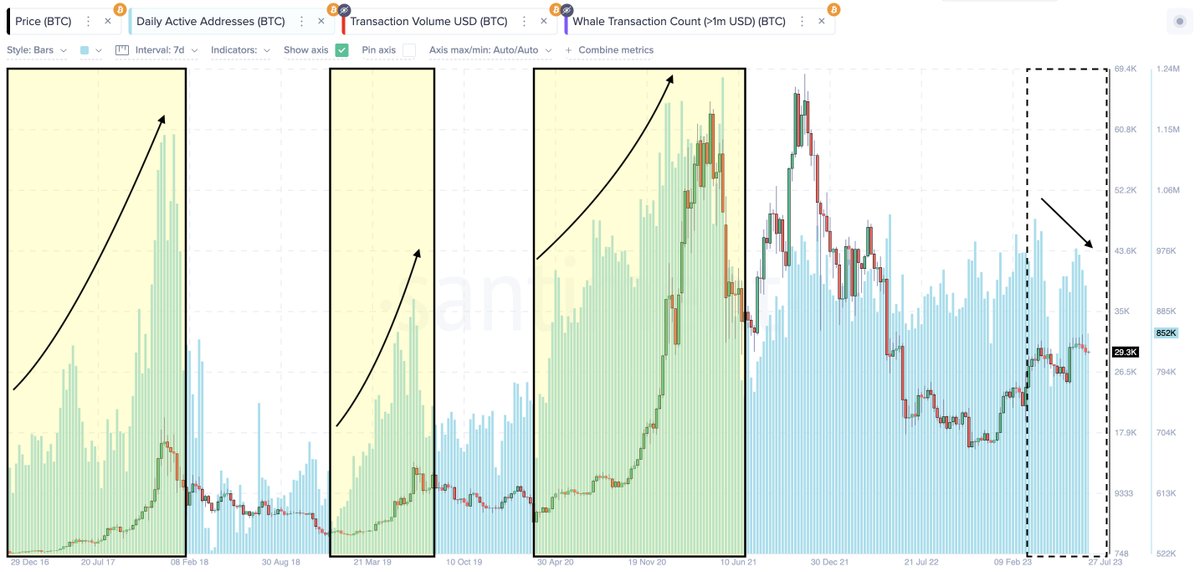

Now, here’s a chart that exhibits the development within the each day Bitcoin lively addresses over the previous couple of years:

Appears like the worth of the metric has been declining in current days | Supply: @ali_charts on Twitter

As displayed within the above graph, the Bitcoin each day lively addresses surged when the rally above the $30,000 mark occurred. Usually, traders get FOMO’d into the asset each time such sharp value motion occurs, so the blockchain exercise naturally shoots up.

The joy of the rally may solely final for thus lengthy, nonetheless, because the indicator had hit a high after some time when traders had began losing interest from the sideways motion that BTC had fallen to.

This infinite asset consolidation had slowly pushed traders away, because the metric had began to register a decline outright. Across the current peak within the each day lively addresses, the metric’s worth was greater than 970,000, however at the moment it has fallen to only 852,000. Which means that round 852,000 customers are presently taking an lively half on the blockchain.

Within the chart, the analyst has additionally marked the development that the indicator adopted throughout earlier main uptrends within the value. It might seem that the lively addresses have typically gone up previously because the asset has continued its rally.

This is smart, as such vital value strikes are solely possible when a continuing gas provide comes into the market within the type of merchants. And not using a stream of customers becoming a member of the community, any such transfer wouldn’t be sustainable, and therefore, it might fail earlier than lengthy.

Because the Bitcoin each day lively addresses are as a substitute happening just lately, it’s unlikely that the worth would be capable to amass collectively an upward transfer proper now.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $29,300, up 1% within the final week.

BTC has been trending sideways just lately | Supply: BTCUSD on TradingView

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, Santiment.web

[ad_2]

Source link