[ad_1]

The crypto market, led by Bitcoin (BTC), has proven a bearish pattern previously week, with the main digital asset slipping to a brand new 30-day low of $28,925. In the meantime, the US inventory indices continued to outperform Bitcoin, reflecting the divergence between conventional markets and the crypto house.

Because the market heads into a brand new week, a number of key elements may impression Bitcoin’s und the altcoins’ subsequent route. Right here’s what to observe:

Financial Knowledge And Company Earnings

The primary buying and selling week in August is fairly quiet from a macroeconomic perspective. It is going to kick off with the discharge of the US JOLTS jobs report on Tuesday, August 1, 10:00 am EST. This report, which supplies insights into labor market circumstances, may affect investor sentiment. A stronger than anticipated report could enhance confidence within the economic system. Conversely, a weaker report may set off a flight to security, strengthening the US-Greenback Index (DXY).

Thursday, August 3, 8:30 am EST brings the Unemployment Claims report. A rise in claims may sign financial misery. Alternatively, a lower in claims may point out financial restoration, presumably additional boosting the inventory market.

The week concludes with the Unemployment Price report on Friday, August 4, 8:30 am EST. A excessive unemployment price may result in a rising worry of a recession, placing shares and crypto below stress.. Conversely, a low unemployment price may result in a bullish pattern for Bitcoin and different cryptocurrencies as confidence within the conventional economic system grows.

Along with these macro occasions, the earnings week continues with some main corporations reporting, together with Amazon (AMZN), Apple (AAPL), Superior Micro Units (AMD), PayPal Shopify (SHOP) and Coinbase (COIN). These studies may have oblique results on the crypto market, significantly Coinbase (on Aug. 3), given its standing as a number one cryptocurrency trade.

Bitcoin And Crypto Market Sentiment

Whereas macroeconomic occasions, significantly Fed rate of interest selections, the efficiency of the DXY, and inflation information have traditionally had a serious impression on BTC and crypto costs, that correlation has all however disappeared in current weeks. Subsequently, Todd Butterfield, proprietor of the Wyckoff Inventory Market Institute, gave a preview of this week, stating:

Bitcoin traded under $29,000 final week, as we had known as for, on low quantity. We’re nonetheless searching for a greater purchase setup for Bitcoin. The technometer is impartial, so we’re nonetheless on the sidelines in the intervening time. We aren’t completely happy that bitcoin has not adopted the rise in equities in current weeks. This provides us pause. The technometer is impartial at 43.3.

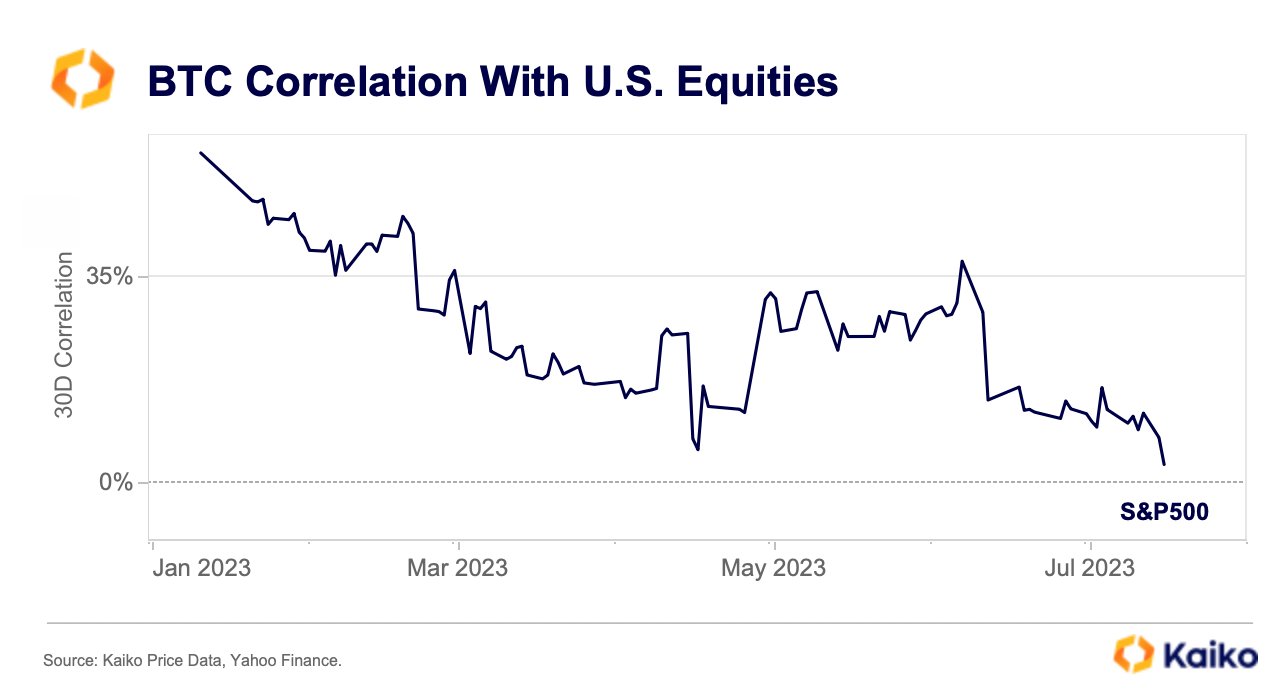

Knowledge from Kaiko additionally exhibits a pointy decline in 90-day realized volatility for each BTC and ETH, that are at two-year lows. Apparently, BTC’s correlation with the S&P 500 has additionally continued to fall to historic lows, reaching simply 3% in July. Kaiko tweeted:

Bitcoin’s correlation with the S&P 500 continued to fall in July, reaching simply 3%. The final time it was this low was in August 2021.

In current weeks, BTC has additionally misplaced its inverse correlation to the US greenback index (DXY) and thus to macro occasions. Nonetheless, not like earlier intervals, Bitcoin and crypto buyers could at the moment need correlation with the S&P 500, as it’s on a robust uptrend as a consequence of macroeconomic information and the current FOMC assembly.

Nonetheless, the crypto market has not reacted to macro information in current weeks. What’s essential to notice is that the non-correlation between BTC and macroeconomic occasions won’t final eternally, although. The second liquidity returns to the market, the correlation will possible return.

Earlier than that, it would possible take one other crypto-intrinsic occasion to wake Bitcoin and the broader market from their summer season slumber. A ruling within the Bitcoin Spot ETF case between Grayscale and the U.S. Securities and Alternate Fee, or perhaps a choice on the BlackRock utility, could possibly be attainable catalysts.

At press time, the Bitcoin value was at $29,417.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link