[ad_1]

newbie

Rates of interest play a pivotal position in our monetary lives, impacting all the things from our financial savings to the price of borrowing cash. This text goals to delve into two basic varieties of rates of interest: easy and compound. To make knowledgeable monetary choices, it’s important to know the excellence between them, how they’re calculated, and their potential influence in your funds.

Easy curiosity is an easy idea computed on the unique sum of money (principal) with out making an allowance for any beforehand gathered curiosity. However, compound curiosity takes into consideration not solely the principal quantity but additionally the curiosity that has accrued over time, resulting in sooner progress. This text will introduce you to their respective formulation, providing a transparent understanding of how one can calculate compound and easy curiosity. Moreover, I’ll define the important thing distinction between easy and compound curiosity.

My title is Daria Morgen, and I’ve been within the crypto trade since 2014. With the ability to calculate compound curiosity has been an awesome assist in my very own funding journey, and I hope this text might help you to reinforce your individual buying and selling methods, too.

What Is Easy Curiosity?

Easy curiosity is calculated on the preliminary sum of money deposited or borrowed. It doesn’t take into account any curiosity beforehand earned or charged. Many monetary establishments, like banks and credit score unions, use this mannequin for sure merchandise, reminiscent of pupil loans and a few varieties of financial savings accounts.

How Does Easy Curiosity Work?

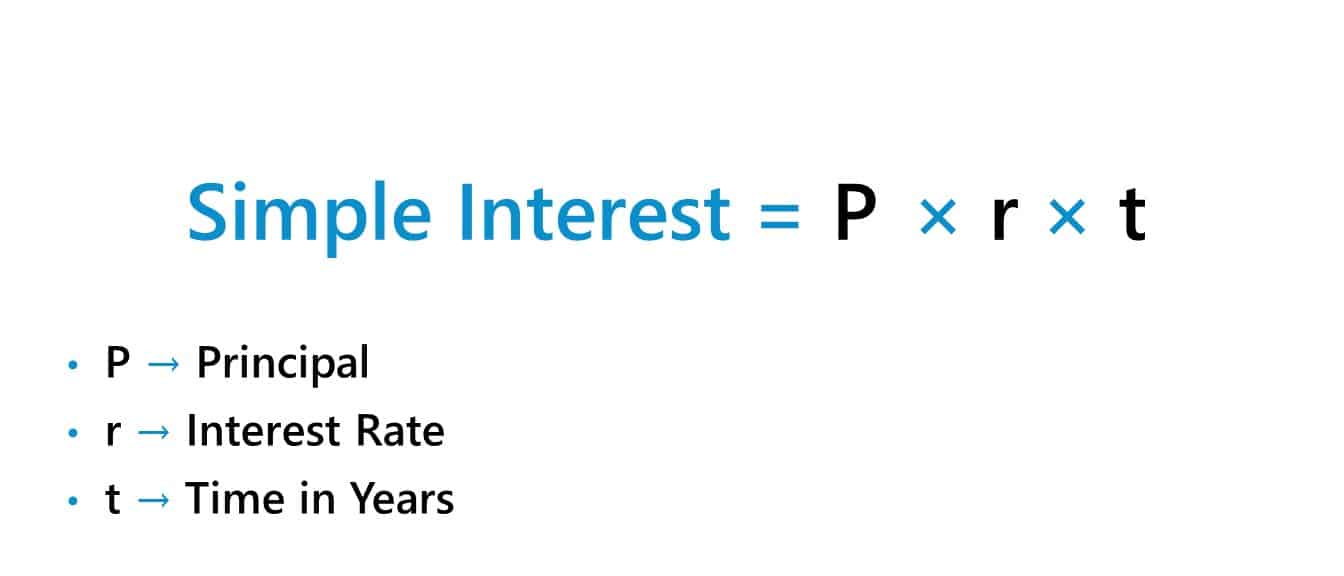

The easy curiosity components is fairly easy:

Easy Curiosity = Principal * Annual Curiosity Fee * Time

This components tells us that the curiosity is a product of the principal quantity, the annual rate of interest, and the time interval for which the cash is borrowed or invested. The time is usually expressed in years.

As an example, when you have a bank card that costs easy curiosity, you’re solely ever charged curiosity on the principal stability, no matter any gathered curiosity from earlier billing durations.

Easy Curiosity Instance

Let’s assume you deposit $1,000 in a financial savings account with an annual rate of interest of 5% and depart the cash there for one yr. The easy curiosity earned can be:

Curiosity = $1,000 * 5% * 1 = $50

On the finish of that yr, you’d have $1,050 in your financial savings account.

What Is Compound Curiosity?

Compound curiosity, then again, will be regarded as “curiosity on curiosity.” It takes into consideration each the principal stability and the curiosity that has beforehand been added.

Compound curiosity is widespread in lots of monetary merchandise like bank cards, financial savings accounts, certificates of deposit (CDs), and even some pupil loans.

How Does Compound Curiosity Work?

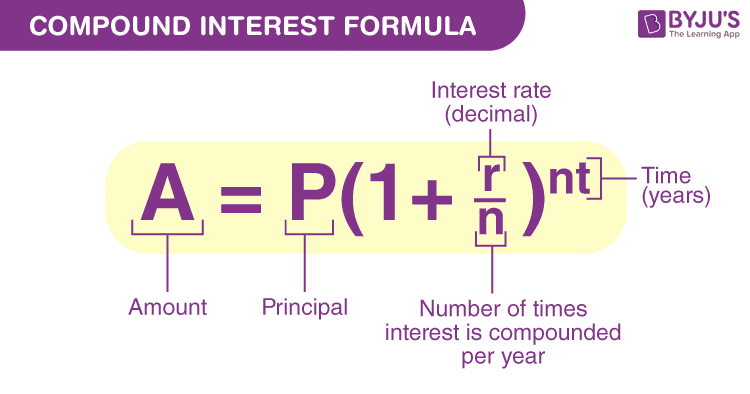

The components for compound curiosity is a little more advanced than the straightforward curiosity components:

Compound Curiosity = Principal * (1 + Annual Curiosity Fee / Variety of Compounding Intervals)^(Variety of Compounding Intervals * Time) – Principal

This components demonstrates that the curiosity is calculated on the preliminary quantity and the gathered curiosity from earlier time durations. The variety of compounding durations can differ. It could possibly be yearly, semi-annually, quarterly, and even day by day.

Compound Curiosity Instance

Let’s take the identical $1,000 deposit at an annual rate of interest of 5%, however this time, the curiosity is compounded yearly. On the finish of 1 yr, your financial savings account would have:

Curiosity = $1,000 * (1 + 5%/1)^(1*1) – $1,000 = $50

This seems the identical as the straightforward curiosity instance, proper? That’s as a result of the results of compound curiosity actually begin to present over longer durations of time. Let’s say you permit the cash for 5 years as a substitute:

Curiosity = $1,000 * (1 + 5%/1)^(1*5) – $1,000 = $276.28

On the finish of 5 years, you’d have $1,276.28 in your financial savings account. That’s considerably greater than you’d have with easy curiosity.

Easy Curiosity vs. Compound Curiosity. Which One to Select?

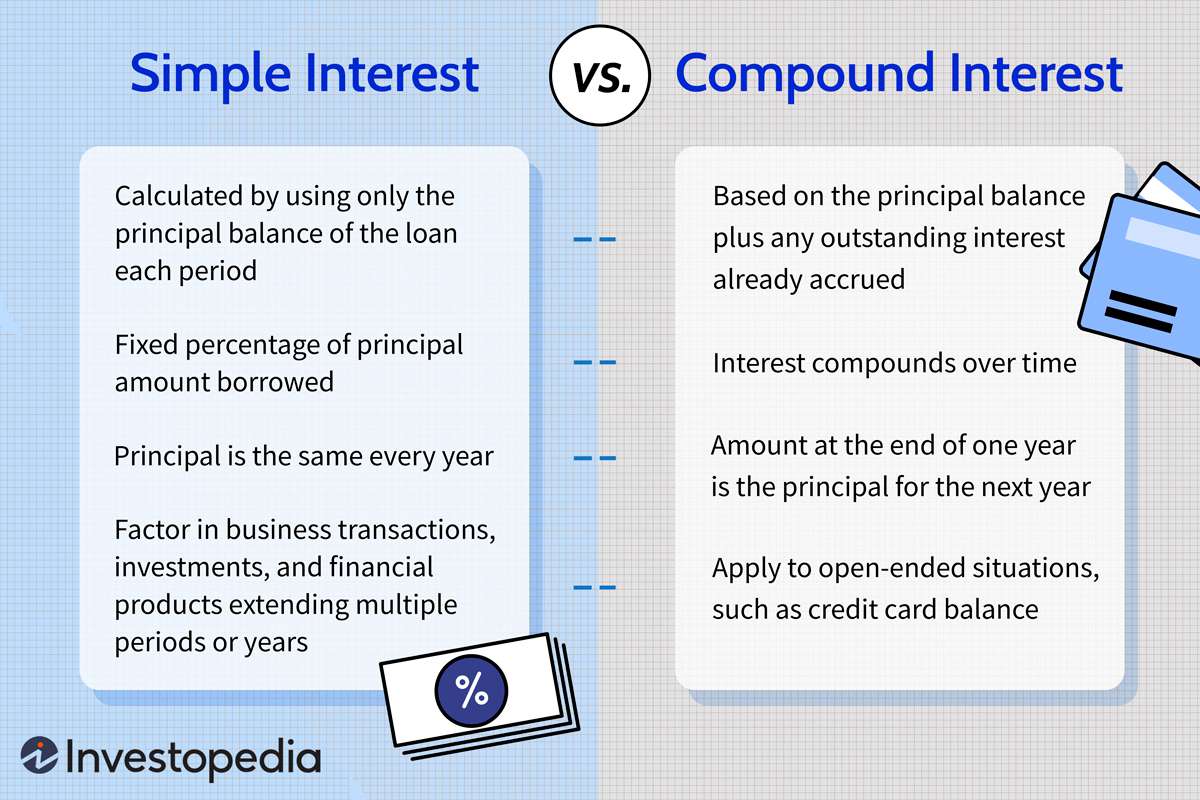

Whether or not easy or compound curiosity is healthier for you will depend on whether or not you’re borrowing or investing cash.

If you wish to borrow cash, you’d usually favor a mortgage with a easy curiosity components, as you’d find yourself paying much less over the mortgage time period in comparison with compound curiosity. It is because you’re solely being charged curiosity on the unique principal, not on any gathered curiosity.

Conversely, should you’re investing or saving, compound curiosity could possibly be extra helpful because it permits your cash to develop at a sooner charge over time as a result of impact of compounding. Which means that you earn curiosity not solely in your authentic funding but additionally on the curiosity that your funding has already earned.

Easy or Compound Curiosity for Crypto

Relating to investing in cryptocurrencies, the selection between easy and compound curiosity will depend on your monetary targets and threat tolerance. If a crypto platform gives curiosity on holdings, compound curiosity may result in extra substantial progress over time. Nevertheless, as with every funding, it’s essential to know the dangers and potential charge of return.

In conclusion, understanding the variations between easy and compound curiosity is important for making knowledgeable monetary choices. It could tremendously influence how a lot you find yourself paying on loans or incomes on investments over a time period.

FAQ

What’s the components for calculating curiosity?

The components for calculating easy curiosity is kind of easy: Easy Curiosity = Principal * Annual Curiosity Fee * Time. It’s calculated on the preliminary principal quantity with out contemplating the curiosity that accumulates over time.

In distinction, the compound curiosity components is extra advanced: Compound Curiosity = Principal * (1 + Annual Curiosity Fee / Variety of Compounding Intervals)^(Variety of Compounding Intervals * Time) – Principal. Compound curiosity is calculated on the preliminary principal and in addition on the gathered curiosity from earlier durations.

How are easy curiosity and compound curiosity completely different?

The important thing distinction between easy curiosity and compound curiosity lies in how the curiosity accumulates. Easy curiosity is calculated solely on the unique quantity (principal) that you just deposit or borrow, whereas compound curiosity is calculated on the principal quantity and any accrued curiosity. Which means that with compound curiosity, you earn or owe curiosity on the curiosity.

Which sort of curiosity can earn extra money over the long run?

Over the long run, compound curiosity can earn extra money. That is as a result of impact of compounding, the place you earn curiosity on each the cash you’ve initially invested and the curiosity you’ve already earned.

How do easy rates of interest have an effect on month-to-month funds on loans?

For private loans or every other mortgage that makes use of easy curiosity, the month-to-month cost principally stays the identical all through the mortgage time period. It is because the curiosity is calculated solely on the unique principal, and the general mortgage quantity doesn’t improve as a result of extra cash generated by gathered curiosity.

Does the frequency of compounding curiosity have an effect on how a lot curiosity you earn or owe?

Sure, the frequency of compounding can considerably influence the quantity of curiosity earned or owed. The extra steadily curiosity is compounded, the extra curiosity accumulates, supplied that the annual charge stays the identical. For instance, curiosity compounded day by day will accrue greater than curiosity compounded yearly.

How does the Annual Proportion Fee (APR) relate to easy and compound curiosity?

The Annual Proportion Fee (APR) is a standardized means of expressing the price of borrowing cash, which incorporates each the rate of interest and any charges related to the mortgage. For loans with easy curiosity, the APR and the rate of interest will sometimes be the identical. Nevertheless, for loans with compound curiosity, the APR can be greater than the acknowledged rate of interest as a result of impact of compounding.

[ad_2]

Source link