[ad_1]

There’s a considerable amount of cash, billions in actual fact, flowing via the crypto house, which naturally attracts opportunistic people seeking to get their fingers on a chunk of the pie.

Crypto markets, very like any tradable markets, are vulnerable to manipulation. Nonetheless, these manipulative practices are available in numerous types and sizes, relying on components such because the market kind, regulatory measures in place, and the underlying applied sciences. Happily, armed with the precise info, most of those scams might be prevented.

This text spotlights the more and more prevalent sandwich assault, sometimes geared toward DEXs and DeFi customers. A sandwich assault entails malicious actors manipulating transactions on DEXs to generate income for themselves, usually on the expense of different merchants.

The roots of sandwich assaults might be traced again to conventional inventory markets, the place unethical staff at brokerage companies took benefit of insider info, utilizing this to execute private trades earlier than fulfilling buyer orders and making illicit income. Such actions are thought-about unlawful in typical finance and carry authorized penalties.

Nonetheless, the decentralized nature of DeFi creates a much less regulated setting, making it simpler for attackers to hold out sandwich assaults with out dealing with authorized repercussions.

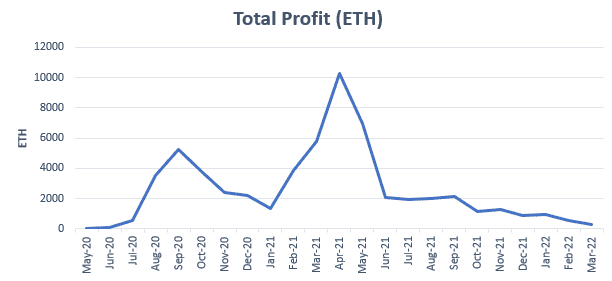

Between Might 2020 and April 2022, the Ethereum community skilled over 450,000 sandwich assaults, leading to a complete revenue of 60,000 ETH. These attackers divert the worth that rightfully belongs to particular person merchants who use DEXs for his or her transactions.

Whereas sandwich assaults don’t lead to a whole lack of funds like rug pulls and different forms of DeFi scams, they considerably restrict the revenue potential for merchants.

Surprisingly, sandwich assaults account for greater than 20% of all Maximal Extractable Worth (MEV), which is the utmost revenue that validators and different community contributors can extract through transaction manipulation on the Ethereum community.

Learn on to find out how sandwich assaults happen on DeFi platforms and methods to restrict your publicity to such assaults inside the DeFi ecosystem.

TL:DR

Sandwich assaults are front-running manipulations prevalent in decentralized finance (DeFi).

Attackers exploit blockchain transparency to prioritize their transactions, profiting whereas merchants endure losses.

On this three-stage assault, the malicious actor scans the mempool, executes transactions with increased fuel charges, and manipulates costs.

Between Might 2020 and April 2022, over 450,000 sandwich assaults on Ethereum resulted in a complete revenue of 60,000 ETH.

Though they don’t trigger full fund losses, sandwich assaults restrict merchants’ income. They represent greater than 20% of all Maximal Extractable Worth (MEV) on the Ethereum community.

Merchants can safeguard towards these assaults through the use of low slippage, flashbot transactions, restrict orders, and staying knowledgeable about potential threats and safety practices in DeFi.

What Is a Sandwich Assault?

A sandwich assault is a reasonably attention-grabbing type of front-running assault the place the attackers actors attempt to profit themselves by lowering the worth that merchants get after they make their trades. They do that by capturing the anticipated worth for themselves.

The factor about sandwich assaults is that they benefit from the transparency of blockchains and the vulnerabilities in DeFi programs and good contracts. What’s tough about them is that the merchants concerned may not even notice they’re being focused.

In a DeFi sandwich assault, the attacker largely takes benefit of value slippage, which happens when there’s a distinction between the anticipated value and the precise executed value as a consequence of market fluctuations and liquidity constraints. By exploiting excessive slippage, the attacker can manipulate the transaction to their profit.

Now, a single sandwich assault may not make the attackers filthy wealthy, however after they perform these assaults throughout a number of trades, the income begin to add up fairly shortly. It’s all concerning the cumulative impact.

How Do Sandwich Assaults Work?

Sandwich assaults exploit the vulnerabilities of decentralized exchanges (DEXs) and Automated Market Makers (AMMs), permitting attackers to revenue on the expense of different merchants. It derives its identify from its execution which happens in layers, resembling a sandwich. Understanding the mechanics of those assaults and taking precautions will help restrict publicity to such manipulative ways within the DeFi ecosystem.

A sandwich assault is executed in three phases described beneath:

When a commerce is initiated on a DEX, it enters the mempool, a short lived holding space the place miners or validators affirm transactions. Miners prioritize transactions with increased fuel charges for higher rewards. Attackers scan the mempool to determine worthwhile alternatives and exploit the details about a sufferer’s transaction.

2. Execution of the Assault:

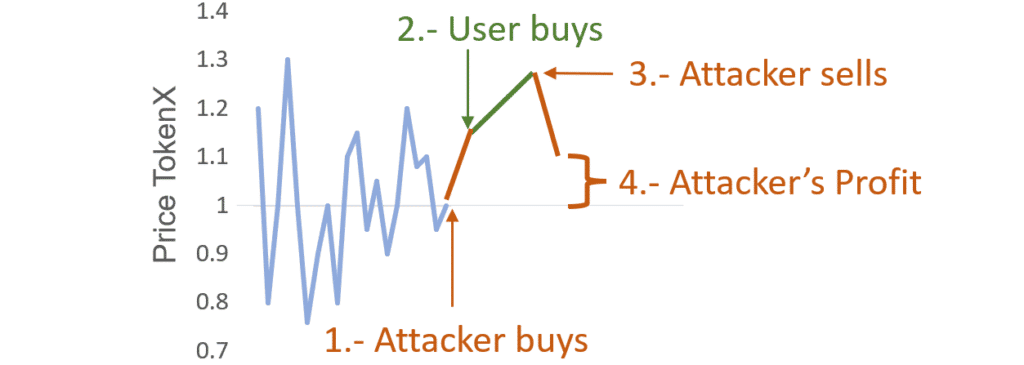

As soon as a possible transaction is discovered, the attacker performs the same transaction however pays a better fuel payment. Concurrently, they add a second transaction to the mempool that mirrors the sufferer’s transaction however with a decrease payment. This creates three transactions within the mempool, with the sufferer’s transaction sandwiched between the attacker’s transactions when it comes to fuel payment precedence.

The attacker’s transaction with the very best payment is prioritized, adopted by the sufferer’s transaction. Lastly, the final transaction, which can also be the attacker’s, is executed, ensuing within the attacker making a revenue. The sufferer experiences a loss as a result of value manipulation.

Alternate Method:

Alternatively, attackers can act as liquidity suppliers inside a liquidity pool to provoke sandwich assaults. They add liquidity to the pool and strategically take away it when the sufferer locations a commerce order. This creates a discrepancy between the anticipated and precise costs of the sufferer’s commerce. After the sufferer’s commerce is accomplished, the attacker reintroduces the liquidity again into the market, benefiting from the value variations.

Instance of a Sandwich Assault:

In a hypothetical situation, a dealer desires to change 1 USDT for LINK in an AMM liquidity pool and units a slippage tolerance of 5%, that means they’re prepared to just accept as much as a 5% distinction within the last worth they obtain, making an allowance for potential market fluctuations in the course of the transaction course of.

On the similar time, an attacker, who intends to hold out a sandwich assault, screens the mempool, discovers this dealer’s transaction, and shortly executes a transaction with a better fuel payment, manipulating the pool’s values. In consequence, the liquidity pool now comprises 51 USDT and 49 LINK (1 USDT was added, and 1 LINK was eliminated).

At this level, when the sufferer’s commerce is executed, they are going to obtain roughly 0.96 LINK for his or her 1 USDT. Since this worth falls inside the 5% slippage vary set by the sufferer, the commerce is executed with out elevating any suspicions, and the sufferer could not notice they’ve fallen sufferer to a sandwich assault.

After the sufferer’s commerce is accomplished, the liquidity pool can be left with 52 USDT and 48.04 LINK. The attacker then sells again the 1 LINK they obtained from the pool, which is now value 1.08 USDT. In consequence, the attacker makes an additional 0.08 USDT greater than their preliminary funding in shopping for LINK.

This commerce can be worthwhile provided that the attacker retains some USDT after deducting the fuel charges and protocol charges incurred in the course of the execution of their purchase and promote trades.

Sandwich assaults are sometimes orchestrated by particular bots designed for such assaults. In some situations, a single sandwich assault has generated income of as much as 39.17 ETH and 56 ETH. Nonetheless, profitability depends upon the sufferer’s commerce worth exceeding the fuel and protocol charges paid to liquidity suppliers.

Are Sandwich Assaults Unlawful?

DeFi sandwich assaults are broadly considered unethical as a consequence of their exploitative nature. Nonetheless, within the present state of the DeFi house, there may be an absence of complete authorized laws particularly addressing the legality of sandwich assaults.

It’s value noting that all these assaults are usually unlawful inside conventional programs and might also be prohibited within the DeFi house as soon as regulatory measures are applied.

Penalties Of Sandwich Assaults

Sandwich assaults in DeFi have a number of penalties that may influence customers and the ecosystem as an entire. Some these penalties embrace:

Monetary loss: DeFi customers who fall sufferer to sandwich assaults usually expertise monetary losses. They obtain much less worth than anticipated for his or her trades, leading to missed revenue alternatives and diminished returns.

Lack of confidence in DeFi: DeFi is a comparatively new idea and has not but gained the identical degree of adoption and recognition as conventional finance. Repeated sandwich assaults undermine DeFi ideas and potential. These assaults result in dangerous person experiences (corresponding to excessive fuel charges within the case of Ethereum) and will discourage potential customers from collaborating in DeFi, hindering its development and acceptance.

Stricter laws: Whereas the DeFi trade operates below restricted laws, unfavourable incidents like sandwich assaults can set off tighter regulatory measures from governing our bodies. This elevated regulation might impose tighter restrictions on DeFi actions, doubtlessly hindering participation within the ecosystem.

Defend Your self from Sandwich Assaults in DeFi

To safeguard your trades and decrease the chance of falling sufferer to sandwich assaults in DeFi, think about implementing the next methods:

Use Low Slippage

The vulnerability for a sandwich assault rises when a dealer intentionally units a excessive slippage. Merchants usually go for excessive slippage to make sure their trades are executed even in periods of excessive volatility or decrease liquidity, notably when coping with belongings like memecoins. This apply opens up a possibility for attackers to use and manipulate the dealer’s transactions, inflicting them to execute trades at considerably inflated costs.

Keep away from setting excessive slippage on your trades. By retaining slippage low, ideally round 2%, you scale back the potential rewards for attackers trying to govern your transactions. That is notably vital in public networks with excessive transaction charges like Ethereum.

Use Flashbot Transactions

Flashbot transactions are an progressive answer developed to counter sandwich assaults. In contrast to conventional transactions which might be broadcasted to public mempools and depend on miners or validators for verification, flashbots ship transactions on to miners/validators.

This methodology ensures that transaction information stays non-public, making it unattainable for attackers to govern trades. Merchants can leverage decentralized exchanges like 1inch to entry unique alternatives for initiating flashbot transactions which might be inaccessible to attackers.

Use Restrict Orders

Go for restrict orders every time doable. Restrict orders present higher management and predictability over your trades in comparison with market orders, lowering vulnerability to sandwich assaults.

Though restrict orders are generally used on centralized exchanges (CEXs), DEXs like Polkadex provide the choice to put restrict orders as properly. Utilizing restrict orders on DEXs means that you can higher perceive the anticipated commerce outcomes, thus minimizing the probability of being exploited by a sandwich assault.

Break Down Giant Trades

A single giant commerce simply attracts the eye of attackers looking for to govern it. As a substitute of executing a single giant commerce, think about breaking it down into smaller transactions. Doing so minimizes the probability of being focused by sandwich assaults and maintains a better degree of safety in your DeFi actions.

Commerce Liquid Pairs

Extremely liquid pairs have tight bid-ask spreads, minimal slippage, and are much less worthwhile for sandwich assaults. Attackers usually tend to goal much less liquid pairs for bigger income and important value actions, so follow the extra liquid choices.

Keep away from Buying and selling In Unstable Market Situations

Sandwich assaults thrive in extremely risky market situations. To mitigate the chance, chorus from buying and selling in periods of excessive volatility when value discrepancies are extra pronounced. Steady market situations provide much less alternative for attackers to govern trades.

Think about Paying Larger Fuel Charges

Whereas it’s an unconventional strategy, growing the fuel payment on your preliminary commerce can doubtlessly scale back the motivation for attackers to revenue out of your trades. In a public blockchain community like Ethereum, the place fuel charges might be fairly expensive, paying an quantity increased than the typical fuel payment would make it economically unfeasible for an attacker to execute a sandwich assault. Nonetheless, be sure to all the time strike a stability between value and transaction velocity.

Do Due Diligence

Keep vigilant and conduct thorough due diligence on the markets and tokens you have interaction with in DeFi. By paying cautious consideration to market traits, DeFi customers can determine the potential for a sandwich assault in that market and put together applicable options to counter such a menace.

If you conduct thorough due diligence in your DeFi actions, you possibly can restrict your publicity to varied scams, together with sandwich assaults. As an example, within the case of PEPE, a memecoin that not too long ago skilled important buying and selling volumes, DeFi lovers acknowledged that the PEPE market was vulnerable to front-running and sandwich assaults as attackers sought to use the coin’s momentum.

Keep Knowledgeable

Preserve educating your self about rising threats, safety finest practices, and developments within the DeFi house. Have interaction with the neighborhood, observe respected sources, and search recommendation from skilled customers to enhance your understanding and consciousness.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of economic loss. All the time conduct due diligence.

If you need to learn extra articles like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”

[ad_2]

Source link