[ad_1]

On-chain information reveals that stablecoin sharks and whales have been strongly accumulating lately, one thing that may very well be optimistic for Bitcoin.

Sharks & Whales Of Stablecoins Like DAI & USDP Are Accumulating

Based on information from the on-chain analytics agency Santiment, giant holders of some stablecoins have been increasing their holdings lately. The related indicator right here is the “Provide Distribution,” which measures what proportion of the full provide of an asset (on this case, a stablecoin) is being held by which pockets teams out there.

The addresses are divided into these pockets teams based mostly on the full variety of cash that they’re presently carrying of their balances. The 1-10 cash cohort, for example, contains all addresses holding between 1 and 10 tokens of the asset.

Within the context of the present dialogue, the investor teams of curiosity are sharks and whales. These are the massive buyers out there, who maintain some energy as a result of sheer scale of cash that they’ll doubtlessly transfer without delay.

Typically, their holdings lie within the $100,000-$10 million vary, so within the case of stablecoins, the related tackle group could be the 100,000-10 million cash cohort (because the stables being thought of listed below are these pegged to the USD, one token of theirs has a worth of $1).

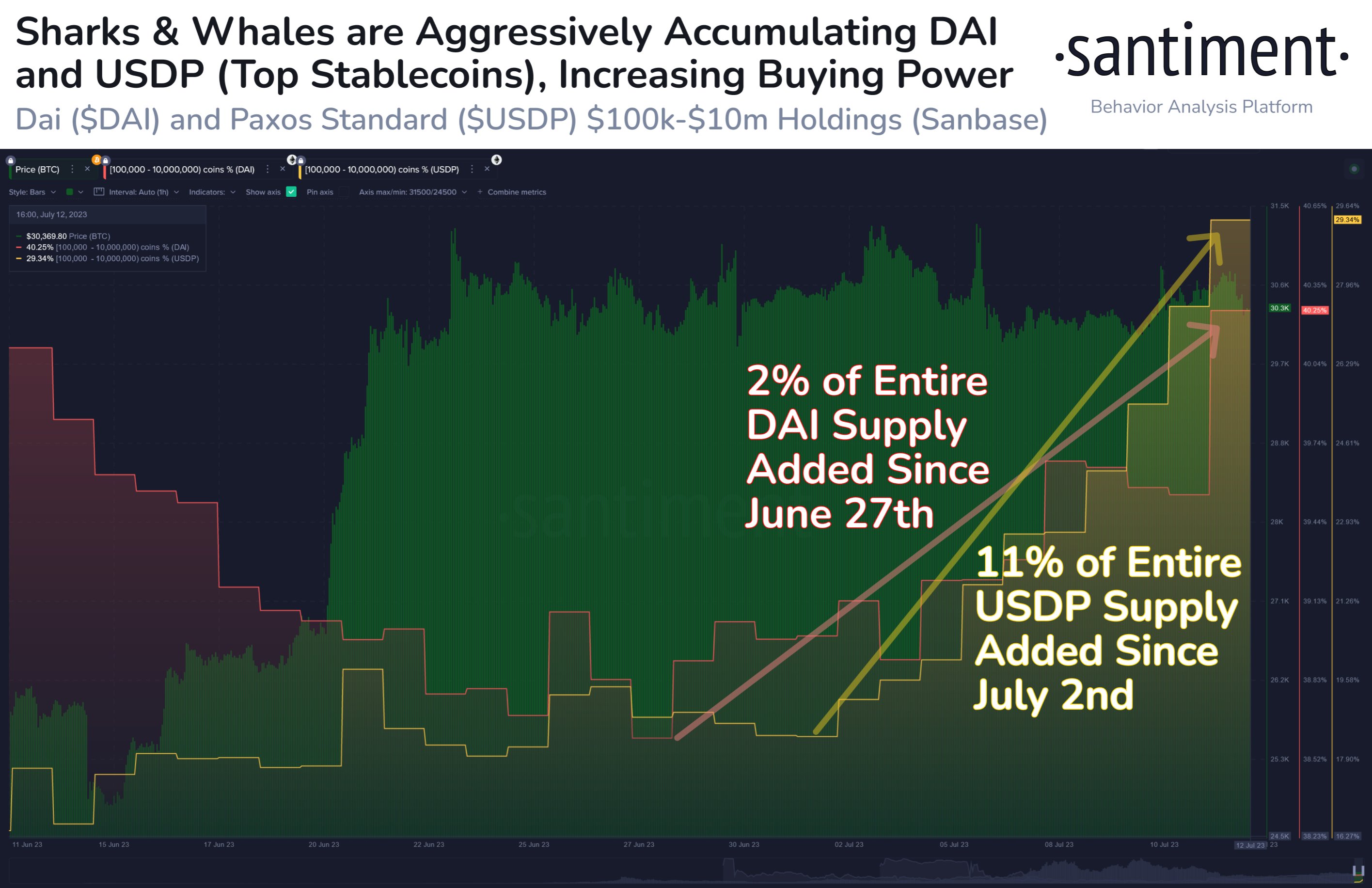

Now, here’s a chart that reveals the pattern within the Provide Distribution of the sharks and whales for 2 stables: USDP and DAI.

Appears to be like like each the metrics have noticed their values going up in latest days | Supply: Santiment on Twitter

As displayed within the above graph, the sharks and whales of each of those stablecoins have expanded their provides lately. Within the case of DAI, these humongous buyers have purchased 2% of the whole circulating provide of the secure over the last couple of weeks or so.

Following this shopping for spree, the mixed provide of the addresses holding between $100,000 and $10 million within the stablecoin has grown to about 40% of the circulating provide.

As for USDP, the stablecoin’s sharks and whales have added 11% of the full provide to their addresses previously eleven days. This has taken their mixed holdings to 29% of the availability.

Normally, buyers shift their cash into stables every time they wish to escape the volatility related to the opposite cryptocurrencies within the sector. When such holders finally really feel that the time is true to leap again into the opposite cash, they merely alternate their stablecoins for them.

This shift naturally offers a bullish enhance to the asset that they swap into. Thus, the availability of the stables could also be checked out because the accessible “shopping for provide” for risky cash like Bitcoin.

For the reason that sharks and whales of USDP and DAI have loaded up their provides, Bitcoin and others could profit from it after they use these reserves for purchasing (which will not be within the close to future, nonetheless).

BTC Worth

On the time of writing, Bitcoin is buying and selling round $30,500, down 1% within the final week.

BTC has solely been transferring sideways in the previous few weeks | Supply: BTCUSD on TradingView

Featured picture from Jake Gaviola on Unsplash.com, charts from TradingView.com, Santiment.internet

[ad_2]

Source link