[ad_1]

On-chain knowledge reveals the Polygon buying and selling quantity has seen a major enhance in comparison with the opposite altcoins. Right here’s what this implies for MATIC.

Polygon Buying and selling Quantity Has Noticed A Sharp Bounce Just lately

In accordance with knowledge from the on-chain analytics agency Santiment, altcoins have noticed a rise in buying and selling quantity throughout the previous couple of days. The “buying and selling quantity” right here is an indicator that measures the every day complete quantity of a given cryptocurrency that’s getting concerned in transactions on the blockchain.

When the worth of this metric is excessive, it implies that a lot of tokens are being shifted round on the community. Such a pattern generally is a signal that merchants of the asset are actively taking part out there proper now.

Alternatively, low values indicate that the cryptocurrency is observing a low quantity of exercise presently. This type of pattern can recommend that there isn’t a lot curiosity within the coin amongst basic traders for the time being.

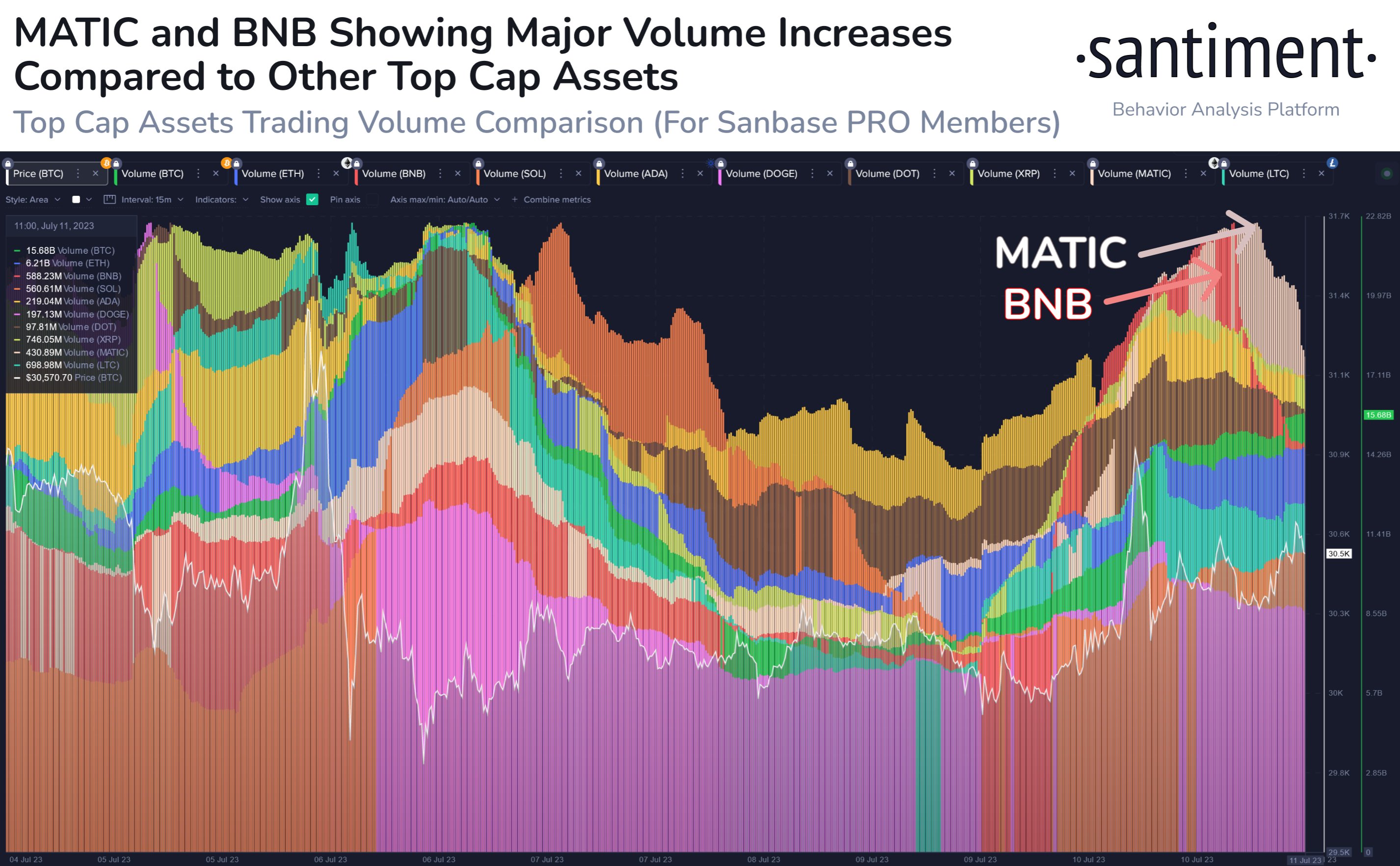

Now, here’s a chart that reveals the pattern within the buying and selling quantity of a number of the largest property within the sector over the previous week:

Appears to be like just like the alts throughout the board have seen an increase on this metric | Supply: Santiment on Twitter

As displayed within the above graph, the buying and selling quantity of many of the altcoins had declined to comparatively low values just a few days again, implying that curiosity in them had dropped.

Nonetheless, over the past couple of days or so, the indicator’s worth has bounced again for these property, suggesting that traders are as soon as once more taking part in buying and selling.

From the chart, it’s seen that two altcoins specifically have loved the sharpest enhance within the metric: Polygon and BNB. This could imply that these cryptocurrencies have a stronger curiosity backing them proper now.

Typically, excessive quantities of quantity are wanted to maintain any sharp strikes within the worth. It’s because a excessive quantity implies the presence of a lot of merchants, who can present gas for constructing any such transfer.

Thus, every time the buying and selling quantity rises for any asset, the value of the coin turns into extra more likely to present volatility. Which course such risky worth motion may take the cryptocurrency in is tough to say from the amount alone, nonetheless.

Within the case of Polygon and BNB, although, a surge of their costs occurred in the identical interval as when their buying and selling volumes jumped. This will indicate that this recent buying and selling curiosity is leaning towards the shopping for aspect, not less than for now.

With this newest uptrend, MATIC’s worth has gone up by virtually 9%. Naturally, if the buying and selling quantity continues to stay excessive within the coming days, it’s doable that this recent enhance may proceed into the close to future.

MATIC Value

On the time of writing, Polygon is buying and selling round $0.73, up 5% within the final week.

Polygon has loved some rise not too long ago | Supply: MATICUSD on TradingView

Featured picture from GuerrillaBuzz on Unsplash.com, charts from TradingView.com, Santiment.web

[ad_2]

Source link