[ad_1]

On-chain information reveals the Bitcoin switch quantity has not too long ago reached ranges 75% increased than the FTX crash lows because it continues its uptrend.

Bitcoin Complete Switch Quantity Has Continued To Go Up Just lately

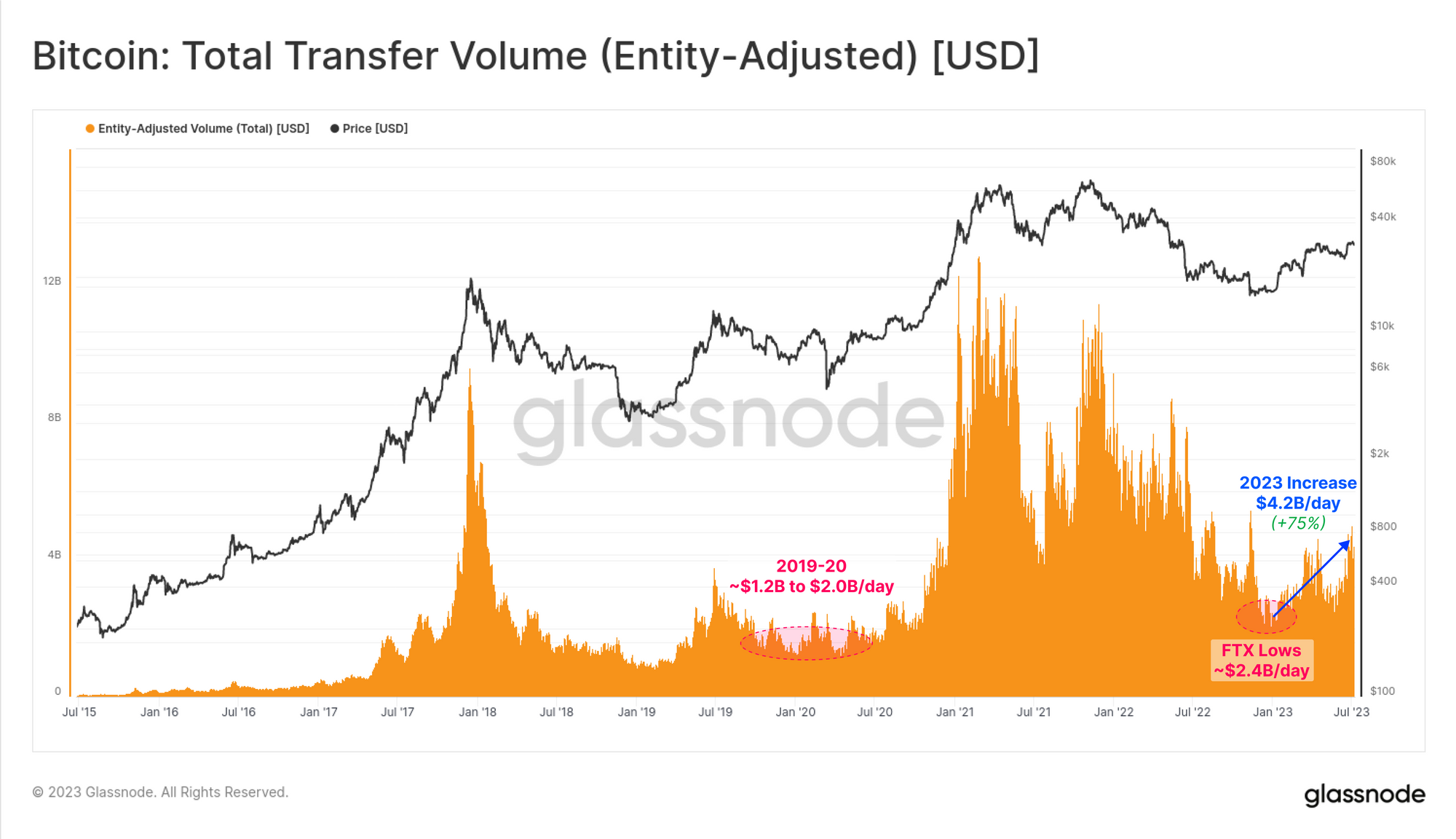

In line with the most recent weekly report from Glassnode, the BTC switch quantity has elevated to $4.2 billion per day now. The “switch quantity” right here refers back to the whole quantity of Bitcoin (in USD) that’s being concerned in transactions on the blockchain.

When the worth of this metric is excessive, it signifies that holders are transferring round a big variety of cash on the community. Such a pattern is usually an indication that the merchants are actively collaborating out there.

Alternatively, low values indicate the blockchain isn’t registering a lot exercise proper now. This type of pattern could recommend that the final curiosity within the cryptocurrency is low in the mean time.

Now, here’s a chart that reveals the pattern within the Bitcoin switch quantity over the previous few years:

Seems to be like the worth of the metric has been going up in latest days | Supply: Glassnode’s The Week Onchain – Week 28, 2023

Be aware that the Bitcoin switch quantity indicator getting used right here is the “entity-adjusted” one. Which means that the metric solely retains observe of the amount being exchanged between totally different entities on the community, somewhat than simply the totally different particular person addresses.

An “entity” is a set of addresses which can be managed by the identical investor. And since a holder transferring cash between their private wallets isn’t of any consequence to the broader community (no less than within the context of the present dialogue), it is sensible to exclude such transfers from the amount.

From the chart, it’s seen that the entity-adjusted Bitcoin switch quantity had declined to comparatively low values through the lows that adopted the FTX crash again in November 2022.

Normally, buyers discover sideways motion boring, so this consolidation interval after the crash naturally resulted in merchants changing into disinterested and the volumes declining.

With the beginning of the rally this yr, nonetheless, recent curiosity had returned to the cryptocurrency because the indicator’s worth had begun heading up. After the native prime in April, although, this uptrend had damaged because the asset had gone by way of a turbulent interval.

However with the most recent leg within the rally that has taken the cryptocurrency above the $30,000 mark, volumes have as soon as once more spiked. Following the most recent uplift within the metric, round $4.2 billion is being transacted on the Bitcoin blockchain per day, which is 75% greater than the aforementioned FTX lows.

Switch quantity selecting up is of course a constructive signal for BTC, because it reveals that there’s nonetheless elevated curiosity within the asset amongst buyers. Although, when in comparison with the 2021 bull run, the present values of the indicator are nonetheless considerably decrease.

BTC Value

On the time of writing, Bitcoin is buying and selling round $30,400, down 1% within the final week.

BTC has been transferring sideways in the previous few days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link