[ad_1]

Polygon (MATIC) has not too long ago made a big announcement, unveiling the structure of its extremely anticipated Polygon 2.0. The group has been eagerly awaiting this replace, hoping it should deal with varied scalability points and convey additional enhancements to the community.

Regardless of the thrill surrounding Polygon’s future plans, the token, MATIC, appears to be experiencing a interval of battle.

Because the crypto area evolves quickly, traders and lovers marvel what may very well be inflicting MATIC’s present downturn and the way it might affect the platform’s trajectory.

Might Polygon 2.0 be the important thing to revitalizing MATIC’s worth and restoring confidence within the venture?

A Shift For Polygon’s Scalability And Liquidity?

Polygon (MATIC) not too long ago took to Twitter to supply a sneak peek into the extremely anticipated Polygon 2.0 replace, which goals to revolutionize the community by providing limitless scalability and unified liquidity.

In line with the tweet, Polygon aspires to remodel itself into the worth layer of the Web, emphasizing the numerous position it envisions for its upgraded infrastructure.

1/ Right this moment, we’re excited to suggest the Polygon 2.0 structure, designed to supply limitless scalability and unified liquidity, thus reworking Polygon into the Worth Layer of the Web!

Learn the weblog 👇🏽 or maintain scrolling 🧵https://t.co/sShy6R1E6R pic.twitter.com/BTdwkri4nI

— Polygon (Labs) (@0xPolygonLabs) June 29, 2023

The structure of Polygon 2.0 contains 4 distinct protocol layers, every serving a vital objective inside the community, contributing to the general performance and effectivity of the platform. Notably, Polygon’s staking area has witnessed development inside the span of simply seven days.

MATIC market cap at present at $10 billion on the weekend chart: TradingView.com

Staking Rewards knowledge reveals a noticeable enhance within the variety of MATIC stakers throughout this era, reflecting the rising curiosity and participation within the Polygon ecosystem.

Regardless of the optimistic developments in Polygon’s staking group, the MATIC token has encountered a minor setback in its market worth.

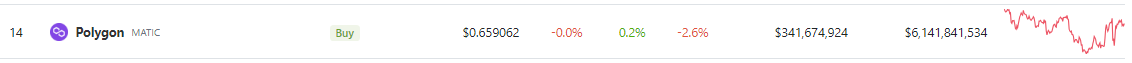

CoinGecko experiences the present worth of MATIC at $0.659, indicating a slight 0.2% decline prior to now 24 hours and a 2.6% loss in worth over the previous seven days.

Supply: Coingecko

Blended Alerts In MATIC Value Report

The most recent MATIC worth report presents a considerably intriguing situation, with sure metrics displaying bullish alerts whereas others counsel a contrasting outlook.

Among the many optimistic indicators, the Transferring Common Convergence Divergence (MACD) signaled a bullish edge available in the market, instilling optimism amongst traders.

Moreover, the Relative Power Index (RSI) confirmed an uptick, indicating elevated shopping for strain and potential energy in MATIC’s worth motion.

Nevertheless, the report additionally highlighted a regarding facet of MATIC’s worth development. The hole between the 20-day Exponential Transferring Common (EMA) and the 55-day EMA was widening, elevating crimson flags amongst merchants and market observers.

A big and growing hole between these two EMAs may counsel a possible lack of short-term momentum and would possibly point out a extra extended downtrend for the token’s worth.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing includes threat. If you make investments, your capital is topic to threat).

Featured picture from The Day by day Hodl

[ad_2]

Source link