[ad_1]

Introduction

In a blockchain community the place members stay nameless, a reliable coordination mechanism is crucial. The “proof” acts as affirmation {that a} participant has met the necessities to validate a block of transactions, signifying their good-faith participation. One such consensus algorithm employed to generate new blocks, distribute new cryptocurrency, and validate transactions is proof of stake (PoS).

This mechanism supplies an alternative choice to the unique consensus technique, proof of labor (PoW). Quite than the power expenditure necessitated by PoW, PoS requires validators or miners to contribute to the community from their very own holdings of the blockchain’s native cryptocurrency, i.e., their “stake.”

To keep away from dropping their stake, validators are incentivized to function actually and attain a consensus on the order and validity of transactions. PoS miners are chosen based mostly on the quantity of cryptocurrency they maintain or “stake” within the community; due to this fact, the extra cryptocurrency a validator stakes, the extra seemingly they are going to be chosen to create the subsequent block.

Learn Extra >> Technical Information To Proof Of Stake

Comparability With Proof Of Work

As an alternative of stakes, PoW requires appreciable computational assets and power consumption to validate transactions and create new blocks. Because of this, folks assume proof of stake is extra power environment friendly and fewer useful resource intensive than PoW. But, we are going to study later on this article that this can be a considerably false assumption.

Each consensus mechanisms intention at producing new blocks and validating transactions. They have to additionally keep the safety and integrity of the blockchain community, however they achieve this in several methods.

In PoW, miners compete to resolve the Byzantine Generals’ Drawback quicker and attain a consensus on the validity of transactions. The quickest miner to finish the goal hash creates a brand new block and receives the block reward, the community’s token of worth. By choosing the chain with probably the most work, the community overcomes any ambiguity, and double spending is prevented as a result of requiring not less than 51% of the worldwide hash energy for a double spend block to catch up.

In Ethereum’s PoS, by the use of comparability, the double-spending downside is solved utilizing “checkpoint blocks” at numerous cut-off dates, authorized by a two-thirds majority vote by means of a stake to “guarantee” everybody within the community in regards to the “reality” of the system.

One other important distinction between PoS and PoW is the incentives and the ethics behind them. In a PoS community, incentives disguise a damaging (penalty-based) connotation since validators could lose their stake in the event that they act maliciously. This contrasts with PoW, the place miners are solely incentivized to behave actually to be rewarded with cryptocurrency by means of a constructive (reward-based) incentive system.

Bitcoin miners who try to interrupt the foundations by producing poorly formatted blocks or invalid transactions will discover their blocks ignored by full nodes. Because of this, they are going to incur substantial electrical energy prices. Furthermore, they would want to command 51% of the hash energy to construct upon older blocks; in any other case, these chains will lag behind, resulting in much more pricey power waste.

Probably the most heated debates in consensus mechanisms is decentralization and the power to keep up this decentralization. PoW decentralization is secured by an energetic community of full nodes, along with miners, a significant function that isn’t mirrored in PoS consensus mechanisms. The significance of nodes in PoW was marked within the blocksize battle of 2017 when the small block supporters gained the battle towards huge blockers by beginning the user-activated gentle fork (UASF) motion and voting for the BTC chain as an alternative of Bitcoin Money (BCH). That historic Bitcoin occasion emphasised how nodes might win towards huge companies and that miners don’t management the community, in contrast to PoS validators.

How Proof Of Stake Works

In a proof-of-stake community, members will be miners or validators who confirm and authenticate transactions and create new blocks based mostly on the quantity of the blockchain’s native cryptocurrency they maintain or “stake” within the community.

Validators are randomly chosen so as to add the next block based mostly on their stake; the extra cryptocurrency a validator has staked, the extra seemingly they are going to be chosen to validate transactions and create new blocks.

When a validator is chosen to create a brand new block, they should validate all of the transactions within the block and add them to the blockchain. To validate the transactions, the validator should verify that they’re legitimate, usually are not “double spending,” and that the sender has sufficient cryptocurrency to make the transaction.

As soon as all transactions are validated within the block, a brand new block is created and added to the blockchain. At that time, the profitable validator is rewarded with native tokens for his or her work.

In a proof-of-stake community, consensus is achieved when most validators agree on the state of the blockchain. If a validator creates a block that’s not accepted by the vast majority of validators, the block is rejected, and the validator could lose their staked cryptocurrency.

Legitimate Criticisms Of Proof Of Stake

Though proof of stake is commonly perceived as extra power environment friendly and fewer useful resource demanding when in comparison with proof of labor, these assumptions will be simply refuted, exhibiting that decentralization and safety are compromised with proof of stake and that PoS is a mirror picture of the present financial system, which is understood to be significantly power inefficient, in addition to unfair to the vast majority of members.

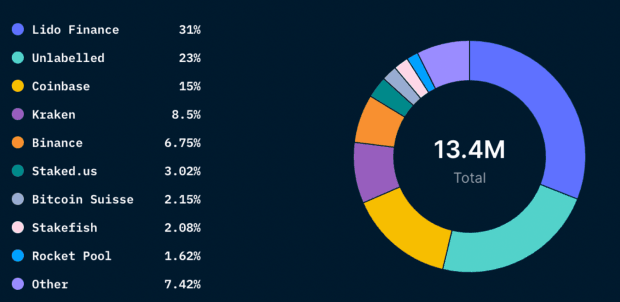

One key argument towards the perceived benefits of proof of stake is the focus of wealth and energy this may result in. In a PoS system, validators with extra stake (or wealth) have the next chance of being chosen to validate transactions and create new blocks. This leads to a rich-get-richer situation, the place the wealthiest validators acquire much more management and affect over the community. The desk beneath from Nansen Analysis supplies a transparent image of the staking panorama inside the Ethereum proof-of-stake system.

This focus of energy contradicts the rules of decentralization, as a small variety of validators can probably dominate decision-making processes. In contrast to proof of labor, the place miners need to spend money on computational energy, proof of stake permits validators to build up wealth and management the community based mostly on their preliminary stake, reasonably than their ongoing contributions to the system.

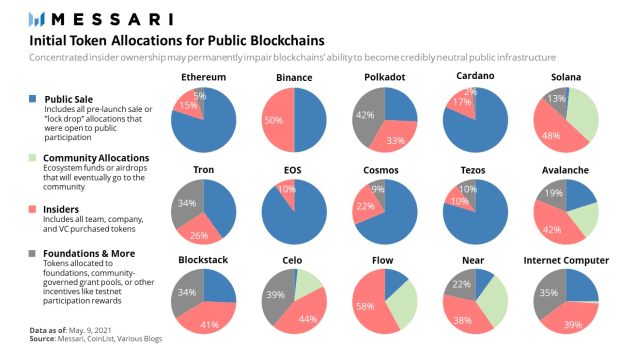

One other legitimate criticism of proof of stake is the pre-mine configurations many cryptocurrencies, together with ether (ETH), are based mostly on. Mining tokens earlier than their public launch implies that founders, stakeholders, and builders could entry a number of wealth and have a substantial benefit over every other buyers or validators who later be part of the community. Whereas such a design might additionally apply to proof-of-work blockchains, it’s extra usually used within the proof-of-stake ecosystems, as a result of in such techniques, it’s doable to have a better share of the validation course of, as a result of absence of nodes.

Widespread critiques of the PoS consensus mechanism:

Lack of decentralization: validators who maintain a considerable amount of cryptocurrency have the next probability of being chosen to create new blocks, obtain rewards, and so they have extra affect over the community, resulting in a focus of energy within the fingers of some validators. This might result in a scenario the place a small group of validators controls the community and its guidelines, probably compromising its safety and decentralization and reinforcing present wealth inequalities. The validation course of will be manipulated: for the reason that community might be manipulated by proudly owning 51% of the tokens in circulation, it’s simpler to affect the transaction validation than with a 51% assault on PoW, which requires controlling 51% of a community’s present computational energy.Safety: in PoS, the community’s security relies on the quantity of cryptocurrency held by validators, making it extra susceptible to assaults if a lot of validators had been to collude.Complexity: there are numerous varieties of proof of stake, similar to delegated PoS (DPOS), leased PoS (LPOS), pure PoS (PPOS), and different hybrid varieties. These are all variants of an overengineered system, which is tough for anybody to actually clarify and perceive. The extra complicated a system is, the extra seemingly it’s to fail.Environmental impression: proof of stake (PoS) is commonly criticized for its environmental impression, mirroring the considerations related to the present financial system. In contrast to proof of labor (PoW), which incentivizes the expenditure of power, PoS techniques are thought of much less power intensive. Nevertheless, the proliferation of blockchains counting on inefficient PoS mechanisms collectively exacerbates their environmental footprint.Nothing-at-stake downside: the nothing-at-stake downside is a theoretical weak point in PoS, the place validators have little to lose by creating a number of variations of the blockchain. In a PoS community, validators might create a number of variations of the blockchain, hoping that one model will grow to be the “appropriate” model. This might result in a scenario the place the community is unable to succeed in a consensus, compromising its safety.Issue in figuring out the correct quantity to stake: figuring out the optimum quantity of cryptocurrency to stake in a PoS community is difficult. Validators should steadiness the will for increased rewards with the chance of dropping their stake.

Would Bitcoin Ever Transfer To Proof Of Stake?

Ethereum’s latest shift from PoW to PoS in September 2022 sparked concepts throughout the corporatized environmental world that Bitcoin ought to do the identical and due to this fact abandon the “excessive power consumption” required by its consensus mechanism.

Altering Ethereum to a PoS system gained’t/didn’t cut back power consumption by 99.95%, because it fails to have in mind that costly enterprise farms and companies use monumental quantities of power to subsidize the work mandatory to finish PoS transactions globally.

The Greenpeace “Change the Code” marketing campaign funded by Ripple Labs to discredit the power utilization of Bitcoin’s proof-of-work system is a typical instance of how the company world doesn’t encourage change and, as an alternative, promotes the perpetration of an elitist system that’s now totally mirrored in Ethereum’s consensus mechanism.

In addition to proposing a brand new revolutionary and honest financial system, PoW fosters renewable power innovation and the usage of stranded and wasted power which can profit the atmosphere greater than a supposedly energy-efficient PoS system in the long run. Proof of stake is merely higher at concealing the power purchases made by the firms that allow its validating mechanism.

Fortunately, Bitcoin’s code is very immune to a lot of these assaults and was purposely developed this manner. It’s inconceivable {that a} proposal to vary the code would even cross any preliminary stage of consideration by the builders, not to mention the neighborhood.

Conclusion

In free markets, you will need to enable each proof-of-work (PoW) and proof-of-stake (PoS) mechanisms to coexist and evolve in methods which might be worthwhile and useful to their respective supporters. Bitcoin, as an revolutionary financial system, not solely brings about technological developments but in addition strives to have a constructive impression on the atmosphere. Educating people in regards to the significance of PoW on this transformative course of is a accountability that Bitcoin fans perceive and embrace.

In the event you’re involved about wealth safety, monetary inclusion, and fostering a greater atmosphere for all life on earth, the best selection is a foreign money that’s borderless, permissionless and embodies pristine exhausting cash and freedom know-how.

This kind of cash, which is impervious to censorship and protected from confiscation, highlights the prevalence of proof of labor over proof of stake. In years to return, Bitcoin could seemingly be the one token of worth, and the choice to assist proof of labor will probably be seen as apparent in hindsight.

[ad_2]

Source link