[ad_1]

The cryptocurrency market is presently experiencing a whirlwind of occasions which have the potential to form its future. Two outstanding gamers, Constancy and BlackRock, are looking for approval for Bitcoin Alternate-Traded Funds (ETFs), which might deliver newfound legitimacy and institutional funding to the crypto area. Nonetheless, amidst this improvement, the specter of rising rates of interest looms, posing challenges to cryptocurrencies with out robust fundamentals. On this article, we are going to delve into the potential affect of Constancy BTC ETF, and rising rates of interest, and spotlight some great benefits of the CONG token as a safe funding choice within the face of those market dynamics. The undertaking has managed to lift USD 8 million and not too long ago reached over 10,000 holders.

Constancy and BlackRock Bitcoin ETFs: Paving the Approach for Institutional Funding

The current efforts by Constancy and BlackRock to launch Bitcoin ETFs have despatched ripples of pleasure all through the crypto neighborhood. An ETF offers a regulated and accessible funding car for institutional and retail buyers, providing publicity to Bitcoin with out the necessity for direct possession or custodial considerations. If authorised, these ETFs might be a game-changer, opening the floodgates for institutional capital and bringing elevated liquidity and stability to the crypto market.

Constancy, a famend asset administration agency, has a observe document of embracing digital belongings, having established a devoted cryptocurrency division. Their proposed Bitcoin ETF goals to leverage Constancy’s experience and status to offer buyers with a safe and controlled technique of accessing the digital asset market. Equally, BlackRock, the world’s largest asset supervisor, has expressed curiosity in coming into the cryptocurrency area by means of a Bitcoin ETF. Such involvement from trade giants like Constancy and BlackRock holds the potential to draw vital institutional funding, additional solidifying cryptocurrencies’ place as a authentic asset class.

Rising Curiosity Charges: A Potential Problem for Cryptocurrencies

Whereas the prospects of Bitcoin ETFs and institutional funding are thrilling, it’s essential to think about the broader market setting. One such issue that calls for consideration is the prospect of rising rates of interest. Central banks worldwide have been signalling a shift in direction of tighter financial insurance policies to fight inflationary pressures. Larger rates of interest can have a profound affect on the crypto market, notably for cryptocurrencies with out robust fundamentals.

Cryptocurrencies and not using a strong underlying framework or a transparent use case could undergo as rising rates of interest drive buyers in direction of conventional belongings that supply extra secure returns. In periods of financial uncertainty, buyers typically search refuge in belongings backed by tangible worth and established markets. Because of this, cryptocurrencies that lack strong fundamentals could expertise vital worth volatility and decline in worth.

CONG Token: The Finest Protection Towards Rising Curiosity Charges

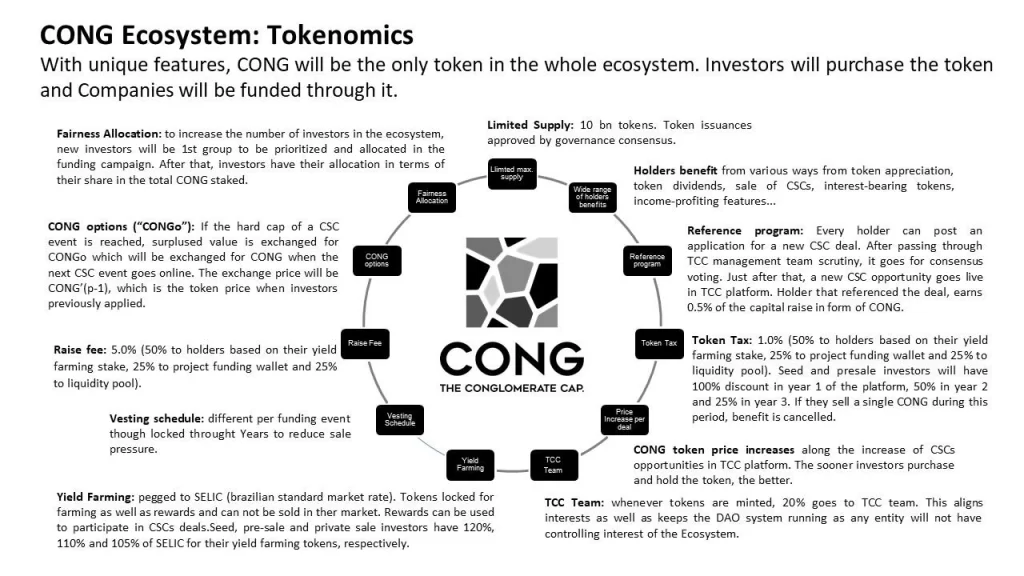

Within the face of rising rates of interest and the potential challenges they pose to the crypto market, the CONG token stands out as a perfect funding choice. CONG, an abbreviation for “Crypto Nexus for Development,” affords a novel mix of options that place it as a safe and dependable funding throughout instances of financial turbulence.

One of many key strengths of the CONG token lies in its strong underlying fundamentals. Not like many different cryptocurrencies, CONG operates on a decentralized blockchain platform that prioritizes safety, scalability, and sustainability. The token’s builders have taken a meticulous strategy to constructing a complete ecosystem that fosters development and innovation throughout the crypto neighborhood.

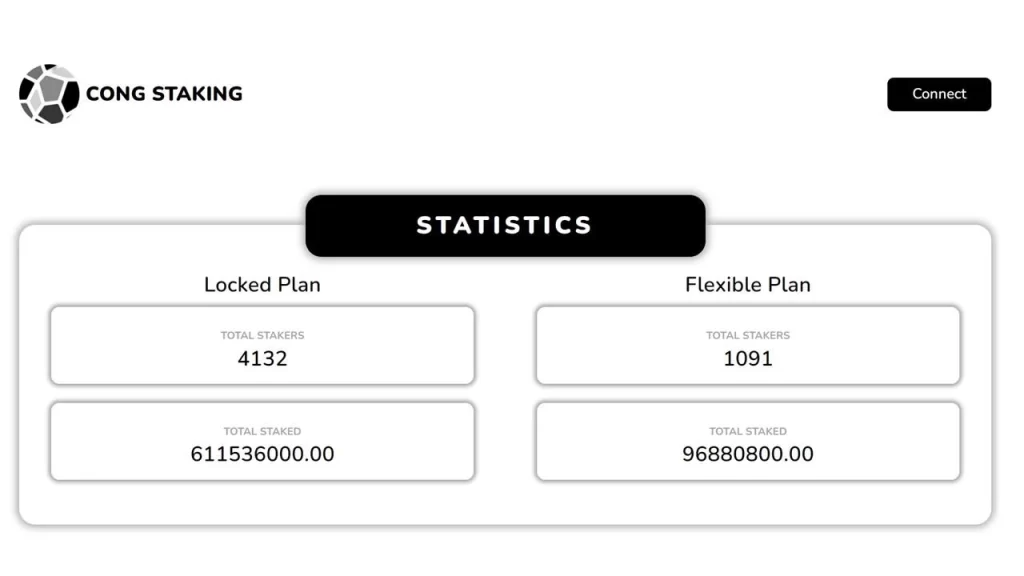

Furthermore, CONG affords buyers a tangible use case by means of its revolutionary staking and lending applications. Staking CONG permits token holders to earn passive revenue by taking part within the community’s consensus mechanism and securing the blockchain. Buyers can select amongst six staking sorts, with APYs as much as 59% plus compounding.

BUY CONG TOKEN NOW

Moreover, CONG’s lending program allows buyers to generate additional returns by offering liquidity to the platform. These options make CONG not solely an funding alternative but in addition a way of actively taking part within the token’s ecosystem.

The CONG token stands out from different tokens within the crypto market because of its distinctive funding technique and concentrate on real-world belongings throughout completely different sectors. Not like many cryptocurrencies which might be solely primarily based on speculative buying and selling or rely closely on the efficiency of the general crypto market, CONG takes a special strategy by investing in tangible belongings with intrinsic worth. This diversification throughout varied sectors, corresponding to actual property, infrastructure, and commodities, permits the CONG token to be much less correlated with the efficiency of different tokens, making it a sexy choice for buyers looking for to mitigate threat and set up a extra secure and balanced portfolio. By bridging the hole between the digital and bodily worlds, CONG offers a safe and uncorrelated funding alternative throughout the crypto area.

Moreover, CONG’s dedication to sustainability aligns with the rising environmental considerations related to conventional cryptocurrencies. By using an energy-efficient consensus mechanism and adopting eco-friendly practices, CONG units itself aside as a accountable and conscientious funding choice in a world more and more centered on sustainability.

CONG Token: A Complete Safety Framework

Along with its underlying fundamentals, the token prioritizes safety to guard buyers in opposition to the challenges posed by rising rates of interest. The token’s builders have applied superior safety measures to make sure the integrity and confidentiality of person transactions and knowledge. By using cutting-edge encryption protocols and multi-factor authentication, CONG offers a safe setting for buyers to transact and retailer their belongings.

Along with that, CONG leverages decentralized finance (DeFi) ideas to reinforce safety. By eliminating intermediaries and enabling direct peer-to-peer transactions, it reduces the danger of hacking or unauthorized entry typically related to centralized techniques. This decentralized nature not solely enhances safety but in addition offers transparency and immutability to the complete ecosystem.

Conclusion

Because the crypto world experiences seismic shifts with the potential introduction of Constancy and BlackRock Bitcoin ETFs, the looming specter of rising rates of interest poses challenges to cryptocurrencies with out robust fundamentals. On this panorama, the CONG token emerges as a safe and dependable funding choice. With its strong underlying framework, tangible use case, dedication to sustainability, and complete safety measures, CONG stands poised to climate the storm of rising rates of interest and supply buyers with a safe haven throughout the crypto market.

BUY CONG TOKEN NOW

[ad_2]

Source link