The Grand Previous Social gathering continues to struggle on the aspect of the crypto trade. On Tuesday, Home Monetary Providers Committee Republicans requested the U.S. Securities and Trade Fee to rescind its proposed rule to alter the definition of “trade.”

Within the letter, the group of lawmakers stated the SEC’s proposed rule will “stifle innovation and hurt digital asset market contributors and the U.S. financial system extra broadly.”

The rule change, first proposed by the SEC final 12 months, would redefine the time period “trade” inside the Securities Trade Act to “embody methods that provide using non-firm buying and selling curiosity and communications protocols to convey collectively patrons and sellers of securities.”

Republican lawmakers argue within the letter that this definition exceeds the SEC’s powers and would “shut down the event of the digital asset ecosystem and proceed to stagnate U.S. technological innovation.”

It’s not the primary time Republicans have blasted the SEC for its obvious aggression in opposition to the digital asset trade.

Republican SEC commissioner Hester Peirce has beforehand stated that the SEC’s demonstrated place “sends a message that we’re tired of facilitating innovation and competitors within the monetary markets and as an alternative search to guard incumbents.”

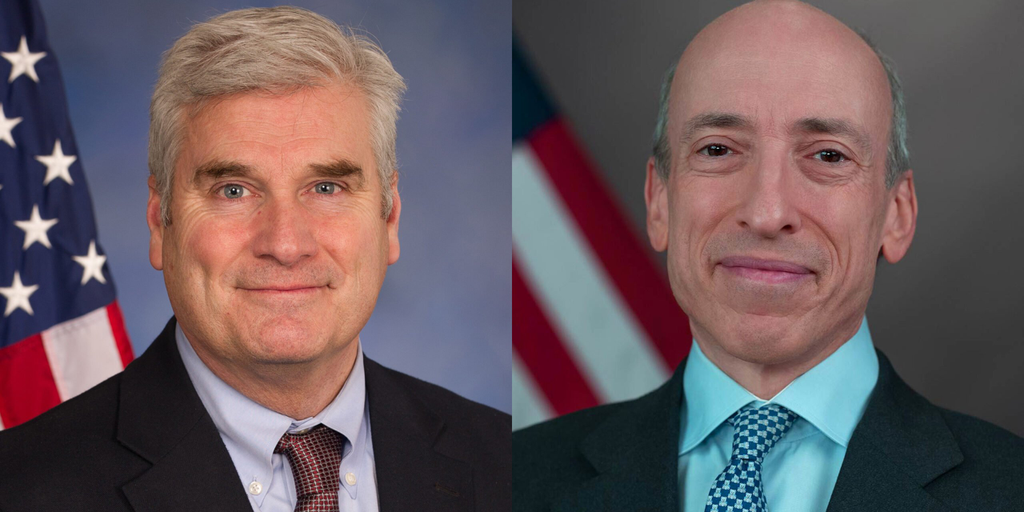

And simply final month, Republican lawmakers stated in a unique letter that SEC Chair Gary Gensler was forcing the digital belongings ecosystem into an improper regulatory framework.

The SEC has gone after quite a few main crypto manufacturers this 12 months. Kraken, Coinbase, Gemini, Binance and Binance US have all been hit with lawsuits.

SEC Chair Gary Gensler seems to be cracking down on all of the cash and tokens he believes are unregistered securities, and his company has charged quite a few digital asset firms consequently.

The highest regulator has even hinted that the digital asset trade will not be welcome on U.S. shores in any respect—saying final week, “We don’t want extra digital foreign money,” and including that the present trade was “constructed on non-compliance.”

This harsh stance has been criticized by lawmakers who argue that the regulator is overstepping its mark—and by crypto firms who at the moment are eyeing up different international locations to do enterprise.

Keep on prime of crypto information, get each day updates in your inbox.