Crypto intelligence agency Coin Metrics launched a report on Tuesday outlining how Bitcoin’s power utilization will be measured by scanning the blockchain for clues—linking exercise on the community to particular, high-powered machines.

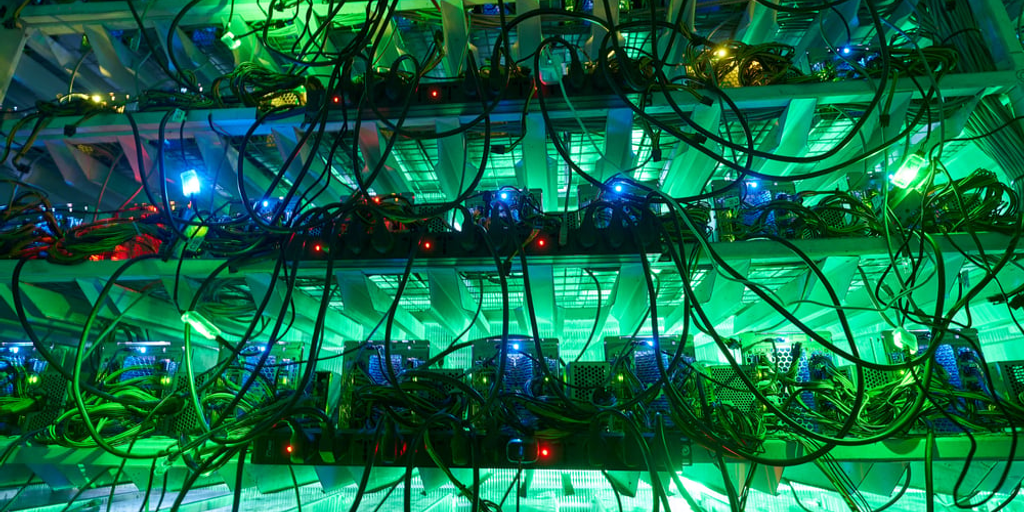

For years, Bitcoin’s electrical energy utilization has been a contentious subject, as critics level to the energy-intensive nature of validating transactions on proof-of-work networks. By constantly crunching advanced calculations in hopes of fixing Bitcoin’s subsequent block, 1000’s of machines make guesses on networks like Bitcoin in hopes of a reward.

As authorities organizations such because the White Home put strain on digital asset mining companies, primarily by its proposed 30% excise tax, the report goals to ascertain a extra correct strategy to figuring out Bitcoin miners’ total energy consumption and builds on the methodologies of research carried out by different establishments prior to now.

“Clearly, there’s this huge debate about power consumption,” the report’s lead creator Karim Helmy instructed Decrypt in an interview. However one of many research’s different foremost motivations is capturing network-wide statistics that function a “actually good reference worth” for a way aggressive miners’ machines are, he stated.

By taking a more in-depth have a look at information included in miners’ fixed stream of guesses, researchers at Coin Metrics say they’ll higher deduce Bitcoin’s total electrical energy consumption, matching up the “fingerprints” of every guess with the distinctive profile produced by sure machines.

Known as ASICs, these power-hungry machines are designed largely round making as many guesses to resolve Bitcoin’s subsequent block as rapidly as potential. The research checked out 11 completely different ASICs throughout 4 producers, together with fashions launched as early as 2016 to as not too long ago as final 12 months.

Attaching community exercise to particular machines results in much less room for overestimating Bitcoin’s power utilization as a result of fashions can have in mind the effectivity of every ASIC, the report states.

“Earlier makes an attempt at assessing Bitcoin’s energy draw missed a essential component that may solely be attained with this sort of ASIC-level information: {hardware} effectivity,” the report states. “Because the mining trade has advanced, ASICs have turn into considerably extra environment friendly, producing extra hashes per second and per unit of energy drawn.”

The Coin Metrics report discovered that Bitcoin’s energy draw has traditionally been lower than different research that didn’t embody ASIC-level information, particularly these carried out by the College of Cambridge and the Digiconomist.

For instance, Coin Metrics’ estimate for miners’ energy consumption this previous Could is 16% decrease than the College of Cambridge’s Bitcoin Power Consumption Index, which the report acknowledges is the trade’s present “gold normal.”

Whereas Coin Metrics argues its mannequin is extra correct than Cambridge’s illustration, which acquired pushback from throughout the digital property trade after its launch, Coin Metrics nonetheless recommended the college’s researchers for his or her work.

“The figures produced by Cambridge have been groundbreaking, and the methodology introduced on this report is at its core a refinement of this current work,” the report states.

Apart from producing correct power statistics, the report additionally seeks to seize information for miners to match how their rigs stack up in opposition to the competitors when it comes to effectivity, Helmy defined.

“Should you’re a miner, one of many key parts on all the fashions in your forecasted future profitability is a network-wide effectivity estimate,” he stated. “You need to know the place your fleet sits relative to different miners.”

Utilizing the information, the agency’s report additionally paints an image of which ASICs have grown in reputation over time, together with those who have fallen by the wayside. That is useful from a safety perspective, Helmy stated, as a result of monitoring the dominance of {hardware} producers may also help determine potential factors of centralization.

Along with network-wide effectivity metrics, Coin Metrics was additionally capable of produce estimates for e-waste, accounting for a way typically every ASIC must be changed.

Whether or not it’s miners’ power use or the related e-waste that companies produce, the environmental affect of crypto has come beneath heightened scrutiny throughout the previous 12 months. That is been true on the White Home and in artwork installations like Benjamin Von Wong’s “Cranium of Satoshi.”

However breakthroughs, reminiscent of Coin Metrics’ new technique, might result in larger nuance in debates surrounding Bitcoin’s power use and open the door to extra strong, data-based discussions with data gleaned from the community’s blockchain.

Keep on high of crypto information, get each day updates in your inbox.