[ad_1]

On-chain information reveals that Bitcoin long-term holders don’t care an excessive amount of in regards to the ongoing market FUD as their change inflows stay very low.

Bitcoin Lengthy-Time period Holder Inflows Have Remained Muted Lately

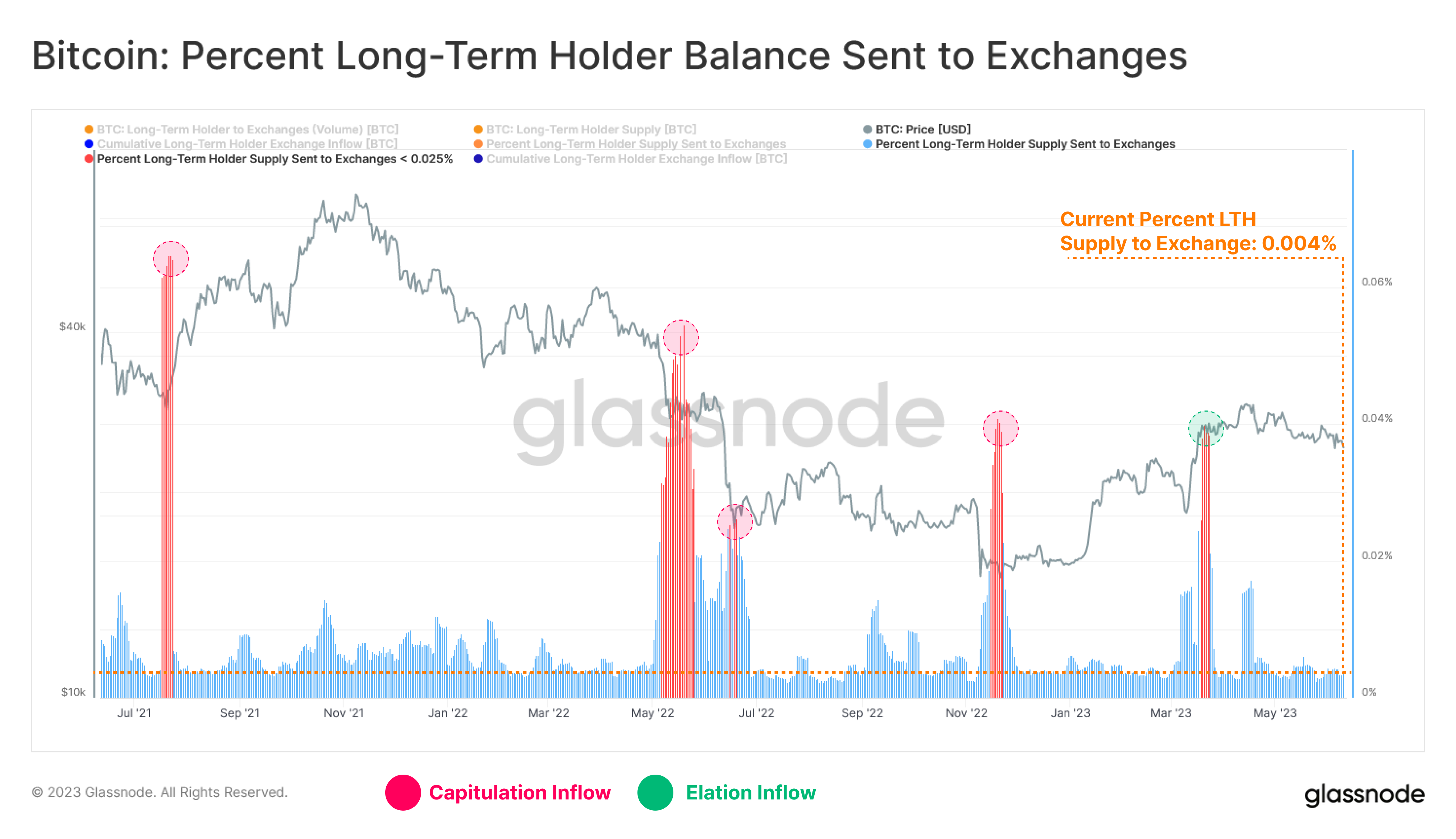

In response to information from the on-chain analytics agency Glassnode, the long-term holders have solely been depositing round 0.004% of their provide to exchanges not too long ago. The “long-term holders” (LTHs) right here confer with buyers who’ve been holding onto their cash since at the very least 155 days in the past.

The LTHs make up for one of many two most important segments the Bitcoin market is usually divided in, with the opposite cohort being the “short-term holders” (STHs). Naturally, the STHs are holders who acquired their BTC lower than 155 days in the past.

Statistically, the longer an investor holds onto their cash, the much less seemingly they turn out to be to much less at any level. Which means that the LTHs are often much less possible to take part in promoting, whereas the STHs are the weaker palms who would possibly simply promote. This resilience of the LTHs has earned them the nickname the “diamond palms.”

Lately, the Bitcoin market has been taken over by FUD as a result of regulatory stress that the US Securities and Alternate Fee (SEC) has placed on the cryptocurrency exchanges Binance and Coinbase.

Amid such market uncertainty, it’s not unthinkable that the STHs could be doing a little dumping. The LTHs, after all, could be anticipated to point out a stronger conviction.

To see how the LTHs could be dealing with the present scenario within the sector, Glassnode has appeared into the change influx information for the group, as exchanges are what buyers usually switch their cash to once they wish to promote.

The under chart depicts the current habits of those holders.

Appears like the worth of the metric hasn’t been that prime in current days | Supply: Glassnode on Twitter

Right here, the change influx of the Bitcoin LTHs is represented by way of the share of the mixed provide held by these diamond palms. From the graph, it’s seen that this indicator’s worth has been at very low ranges not too long ago. This may suggest that these buyers have been collaborating in little quantities of promoting through the previous few days.

At present, the LTHs are making deposits equal to simply 0.004% of their provide. The analytics agency has additionally highlighted the earlier main selloffs that these buyers had participated in, to see how these values evaluate with those being noticed proper now.

Clearly, the present spike within the indicator is nowhere close to the size of the spikes noticed over the past couple of years. Each the selloffs following the FTX collapse and the March 2023 restoration rally, for instance, noticed the LTHs depositing at the very least 10 instances the share of their provide as proper now.

It will seem that not like earlier FUD occasions just like the LUNA collapse or the 3AC chapter, the Bitcoin LTHs aren’t notably bothered by the present misery within the sector.

BTC Value

On the time of writing, Bitcoin is buying and selling round $25,900, down 3% within the final week.

The worth of the asset appears to have taken a success not too long ago | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link