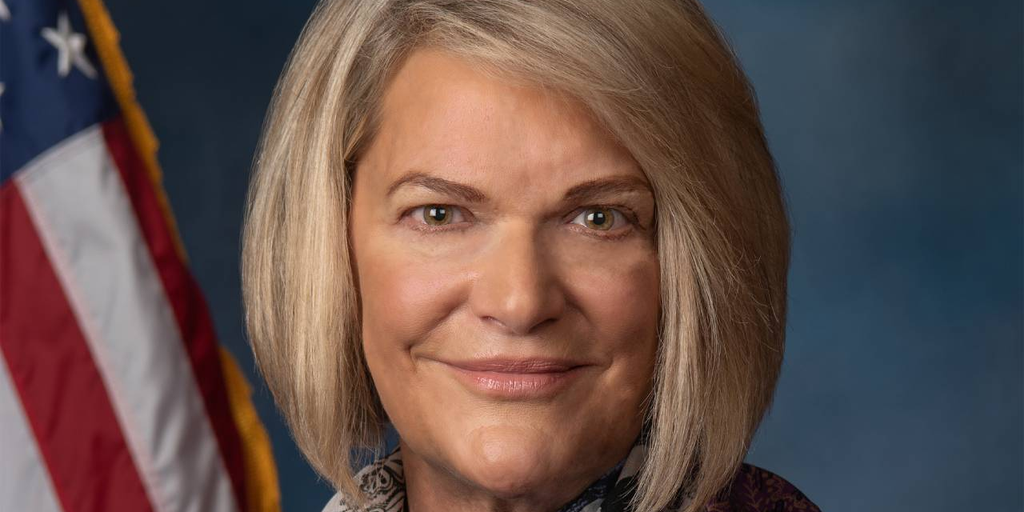

United States senator Cynthia Lummis mentioned that the “combat is way from over” as she re-dedicated herself to pushing for a optimistic regulatory framework for crypto over the weekend.

The Republican, from Wyoming, reassured followers on Twitter that she remains to be engaged on proposed regulation, a revamped model of which had been anticipated to flow into in April.

Referencing the elimination of a proposed 30% tax on crypto mining from the current U.S. debt ceiling invoice, Senator Lummis hailed the current victory however mentioned there was extra work to be achieved.

“I’m engaged on a regulatory framework that can permit people and firms to personal and commerce digital belongings in America,” she mentioned. “Keep tuned…”

Her invoice, co-sponsored by New York Democrat Kirsten Gillibrand, was first put ahead final 12 months, however is about to do the rounds once more this 12 months after some revisions.

However the proposed laws, referred to as the Accountable Monetary Innovation Act, comes at a time of more and more tense relations between regulators and crypto companies within the U.S.

Crypto faces U.S. headwinds

Earlier this month, the Securities and Alternate Fee (SEC) introduced separate lawsuits towards market leaders Coinbase and Binance.

Lummis condemned the motion taken towards Coinbase, saying that the SEC had “failed to offer sufficient authorized steerage” and arguing that Congress wanted to go the Lummis-Gillibrand act so as to create a “strong authorized framework” that companies can adjust to.

Now, strain on Congress to enact crypto regulation seems to be to be heating up, as corporations equivalent to Circle implore lawmakers to manage them. Some companies are even exploring the choice of shifting their bases to different international locations.

One of many functions of the proposed invoice can be to obviously outline which digital belongings are commodities, and that are securities, a query which has been on the coronary heart of many regulatory disputes.

It might additionally impose necessities on stablecoin issuers, and successfully ban algorithmic stablecoins.

Whereas work on the invoice was first introduced in March 2022, Lummis mentioned earlier this 12 months {that a} new, “slimmed-down” draft would reply to suggestions from each regulators and the business.

Keep on prime of crypto information, get day by day updates in your inbox.