[ad_1]

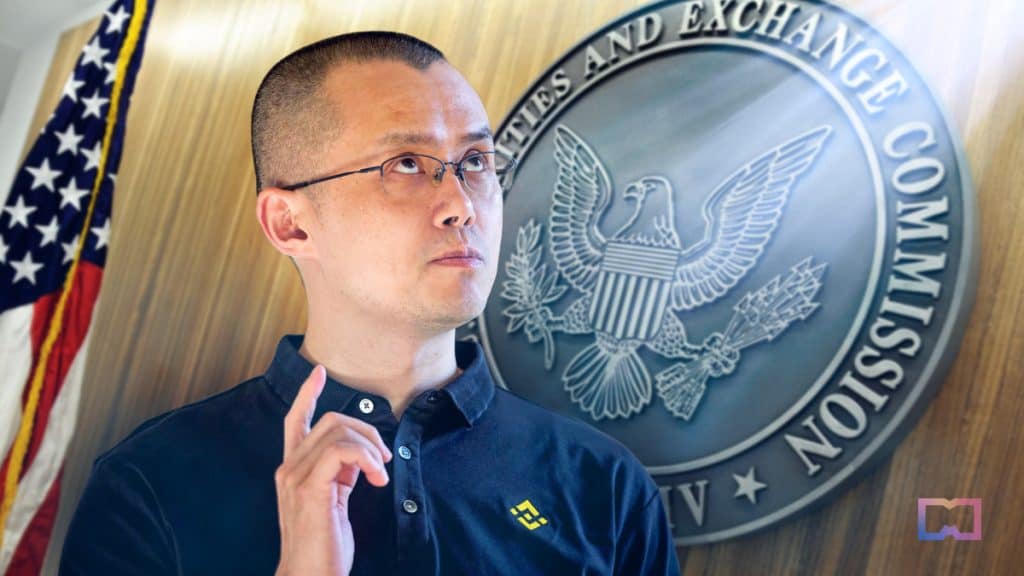

Binance has issued a response to the SEC criticism filed in opposition to the crypto trade on Monday. The criticism accused the crypto trade of offering unregistered buying and selling platforms for crypto asset securities and placing “the protection of billions of {dollars} of U.S. investor capital in danger.”

In Binance’s official assertion, the crypto trade hit again at SEC, saying that the federal company filed the lawsuit unilaterally to outline the crypto market construction on an emergency foundation. Binance claims that it has been participating in good-faith discussions with the SEC to resolve the investigations, however the SEC refused to productively have interaction with the platform.

Binance criticized the regulatory physique’s enforcement and litigation techniques, arguing for a extra considerate and nuanced strategy in the direction of the dynamic and sophisticated expertise of cryptocurrencies.

The crypto trade mentioned that the SEC’s transfer to label sure tokens and companies as securities unilaterally, even in circumstances the place different U.S. authorities have claimed jurisdiction, exacerbates the present challenges within the crypto area and fails to handle the necessity for a complete regulatory framework.

Based on Binance, SEC’s actions may probably undermine America’s place as a worldwide chief in monetary innovation. With digital asset laws nonetheless underdeveloped in lots of elements of the world, Binance argues that counting on regulation by enforcement is just not one of the best ways ahead. As an alternative, the trade asserts that an efficient regulatory framework must be characterised by collaborative, clear, and considerate coverage engagement – a path it believes the SEC has deserted.

Binance additional emphasised that allegations relating to the protection of person belongings on the Binance.US platform are unequivocally false. The trade assured that each one person belongings, together with these on Binance and its affiliate platforms, are safe and that there is no such thing as a justification for the SEC’s actions, given the ample time the Fee had for its investigation. Binance vowed to defend itself vigorously in opposition to any allegations on the contrary.

“It appears primarily based on these developments that the SEC’s aim right here was by no means to guard buyers; if that have been really the case, the Workers would have thoughtfully engaged with us on the information and in our efforts to display the protection and safety of the Binance.US platform. The SEC’s actual intent right here, as an alternative, seems to be to make headlines,”

Binance mentioned in a press release.

Binance mentioned that it’ll proceed to cooperate with regulators within the U.S. and across the globe.

The latest lawsuit filed in opposition to Binance has triggered a stir on Crypto Twitter, with SEC Chair Gary Gensler’s tweet on the matter drawing robust reactions from customers. Many customers expressed their dissent by responding to Gensler’s tweet with a barrage of clown memes and emojis.

Some Twitter customers identified that Gensler “shilled” Algorand in 2019 and people who purchased ALGO at $2.30 then have since misplaced 94% of their investments.

Learn extra:

[ad_2]

Source link