[ad_1]

Digital belongings supervisor CoinShares says institutional buyers are possible taking income on markets as Bitcoin (BTC) and altcoins undergo main outflows for the seventh week in a row.

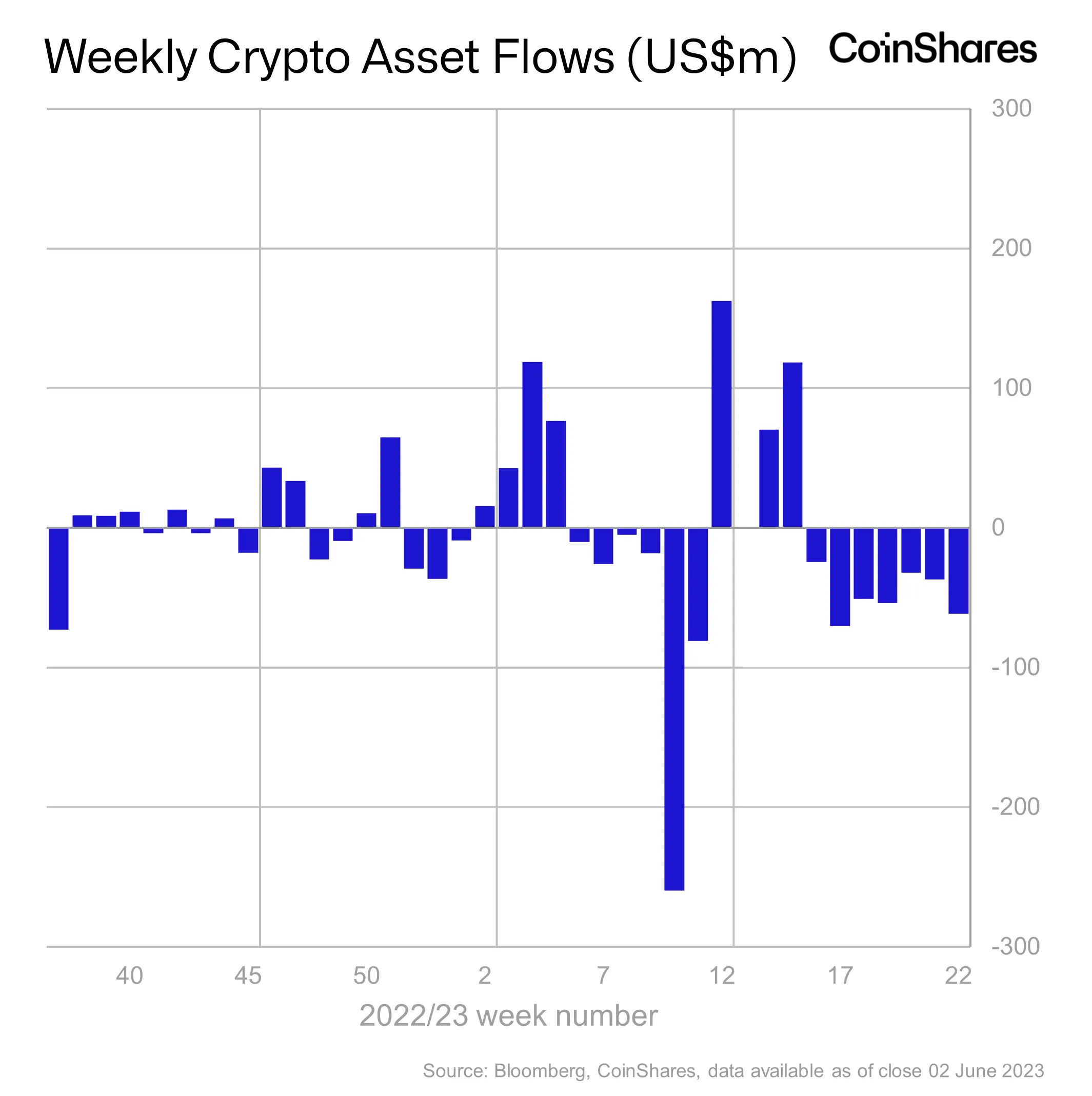

In its newest Digital Asset Fund Flows Weekly Report, CoinShares finds that institutional buyers offered off $62 million in crypto holdings final week, proportionally just like the key sell-offs early in 2022.

“Digital asset funding merchandise noticed outflows totaling US $62 million, marking the seventh consecutive week of outflows that now totals US $329 million, representing 1% of whole belongings underneath administration (AuM).

From a proportional perspective, this now matches the run of outflows seen firstly of 2022.”

BTC misplaced $2.7 million in outflows, the identical as Ethereum (ETH), in response to CoinShares. Nevertheless, brief Bitcoin merchandise, which purpose to revenue off of downward strikes in BTC, noticed much more outflows at $6.3 million.

“Whereas absolutely the outflows for short-bitcoin are smaller, the entire outflow over the past 6 weeks symbolize 44% of whole AuM, in comparison with simply 0.9% for long-bitcoin. This means buyers have been taking income and exiting brief positions reasonably than implying a structural downshift in sentiment for the asset.”

One Ethereum rival took the most important hit of all of the digital market area final week although, in response to CoinShares. Tron (TRX) suffered $51 million in outflows final week.

“Tron, the good contracting platform, was the first focus, seeing outflows totaling US $51 million final week, representing 70% of whole AuM. We consider this was a single funding product supplier eradicating seed capital reasonably than something extra ominous.”

XRP and Polygon (MATIC) merchandise loved inflows of $0.6 and $0.4 million, respectively.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Verify Newest Information Headlines

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal danger, and any loses you might incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in internet online affiliate marketing.

Featured Picture: Shutterstock/Aleksandr Kukharskiy

[ad_2]

Source link