[ad_1]

Information reveals the present Bitcoin cycle is the primary one within the historical past of the cryptocurrency to deviate from a longtime sample of transaction charges.

The Newest Bitcoin Cycle Has Seen Much less Cumulative Charges Than The Earlier One

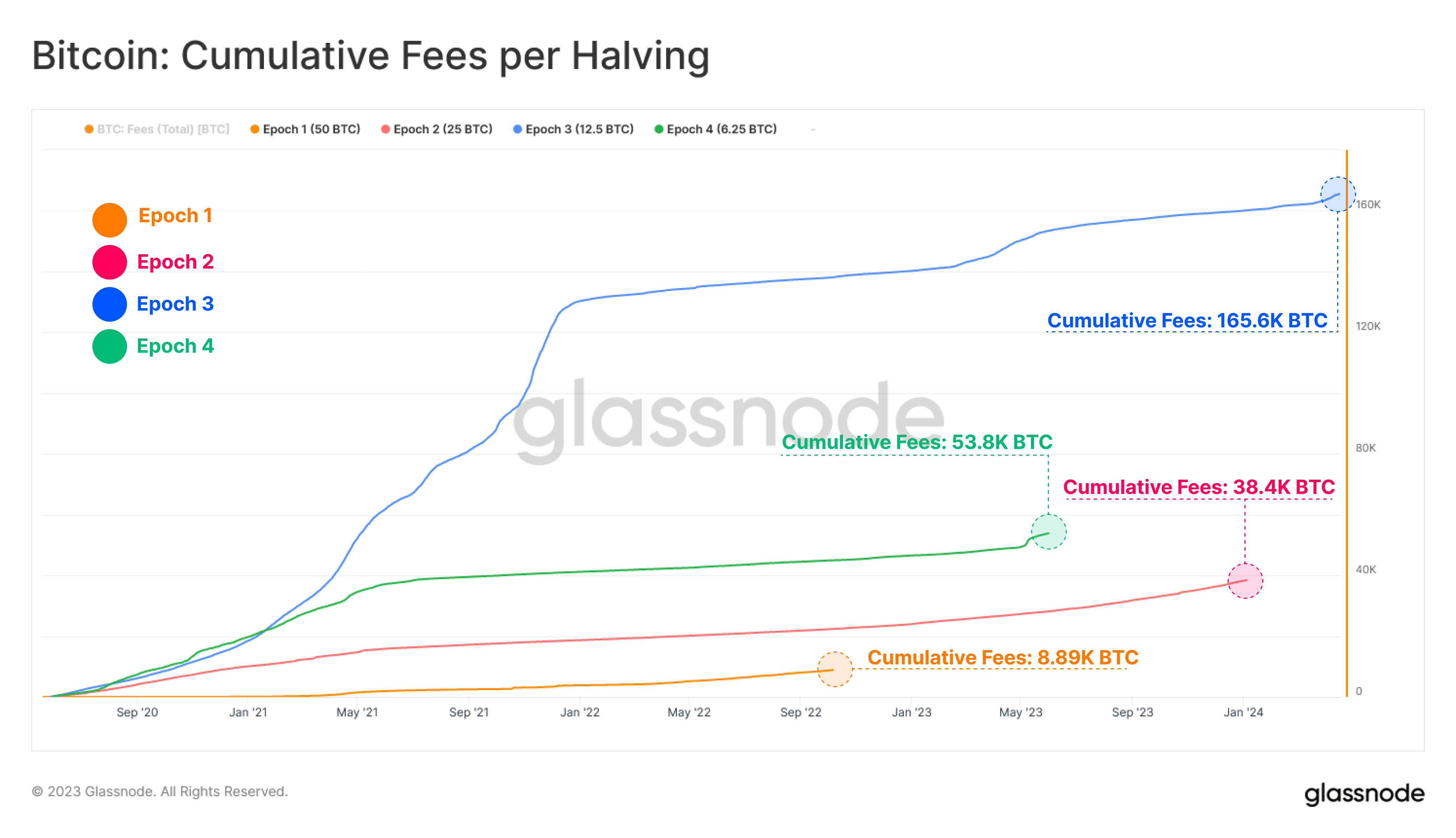

In keeping with information from the on-chain analytics agency Glassnode, the cryptocurrency has seen cumulative charges of simply 53,800 BTC because the final halving. The “halving” right here refers to a periodic occasion the place the block rewards (that’s, the rewards that the miners obtain for fixing blocks on the community) are completely minimize in half.

The halvings are all the time fairly vital for Bitcoin because the block rewards are the one means new BTC is produced/minted, so their being halved tightens the manufacturing of the asset.

The narrative related to halvings additionally carries fairly the punch, as bull markets have traditionally adopted them. Halvings happen roughly each 4 years.

Given their periodicity and significance out there, the halvings have emerged as a preferred solution to outline the beginning and finish factors of what constitutes a Bitcoin cycle or “epoch.”

Within the context of the present dialogue, the varied cycles of the cryptocurrency have been in contrast on the premise of the cumulative transaction charges that they’ve noticed. The “transaction charges” listed here are naturally the quantity that the miners obtain for dealing with particular person transactions.

Now, here’s a chart that reveals the pattern within the cumulative charges for every of the earlier epochs, in addition to for the present cycle to this point:

How the cumulative transaction charges for BTC has modified over the epochs | Supply: Glassnode on Twitter

As you’ll be able to see within the above graph, the very first Bitcoin cycle noticed the miners obtain a complete quantity of 8,890 BTC in transaction charges. The second epoch then noticed this worth leap by a couple of components, because it registered 38,400 BTC in charges.

The subsequent cycle additionally adopted this sample, because the cumulative transaction charges as soon as once more noticed a pointy progress with its worth hitting 165,600 BTC. The rise within the cumulative charges all through these cycles is sensible, because the asset has solely turn into extra adopted because the years have passed by, so the demand for the transactions has naturally elevated.

Nevertheless, the most recent epoch has deviated from this sample, because the cumulative quantity of charges obtained by the miners in it to this point has solely been 53,800 BTC, which is simply one-third of that seen within the final cycle.

Clearly, the present epoch isn’t over but, so theoretically this pattern may maybe change and return to the norm. Nevertheless, contemplating that the upcoming halving is simply subsequent yr, it might seem extremely unlikely that the cumulative charges can shut the present massive hole.

As for the explanation for this divergence, Glassnode explains, “This drop in charges is principally pushed by enhancements in transactional effectivity similar to SegWit and Transaction Batching, largely adopted throughout our present Epoch.”

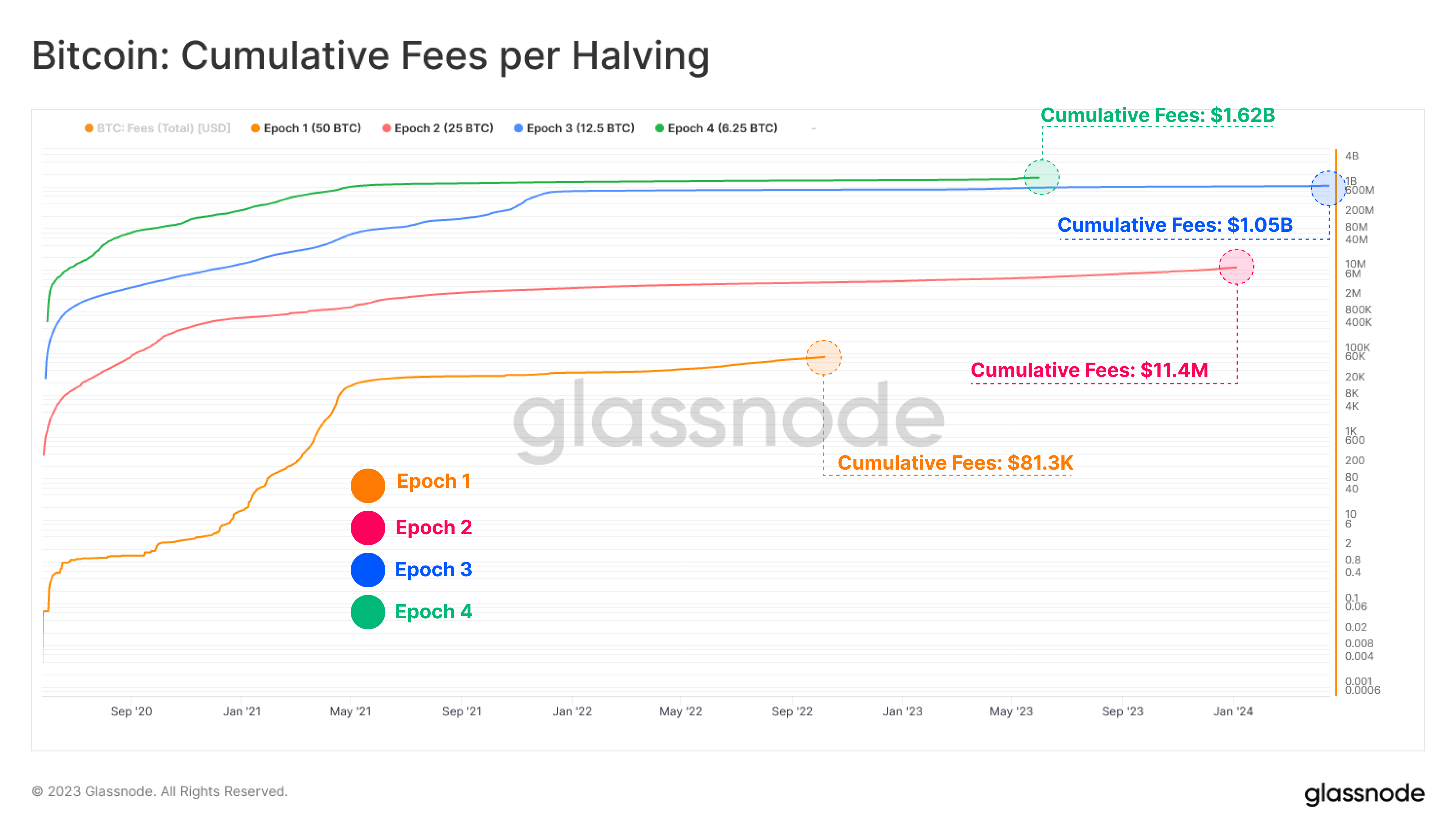

Appears to be like like the continuing epoch is on the high | Supply: Glassnode on Twitter

By way of the USD worth of the transaction charges, although, the sample remains to be being maintained, as the present cycle’s cumulative charges have been price $1.62 billion, greater than some other epoch.

BTC Worth

On the time of writing, Bitcoin is Buying and selling round $27,100, up 2% within the final week.

BTC continues to consolidate | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link