[ad_1]

Whereas market consideration is concentrated on the talk over the U.S. debt ceiling, potential implications for crypto markets have garnered much less dialogue.

The Treasury Common Account (TGA), the first operational account of the U.S. Treasury, has been taking part in an important position in offsetting Federal Reserve’s quantitative tightening coverage.

Traditionally, the TGA’s major function has been to help the federal authorities in managing its funds effectively. Nevertheless, within the context of the looming debt ceiling disaster, the account has been step by step drained to make sure the continual servicing of presidency payments.

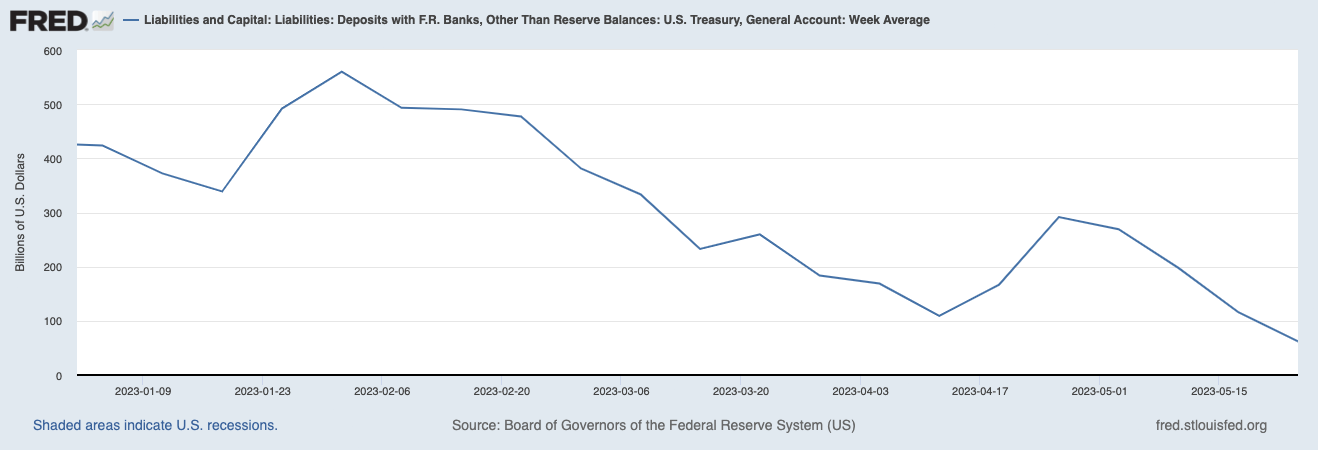

The TGA stability has dwindled from roughly $1.8 trillion in June 2020 to $61.9 billion in Might 2023 — a 96% lower. For the reason that starting of the yr, the TGA stability dropped by over 85%.

The Federal Reserve’s quantitative tightening insurance policies have aimed toward lowering the sum of money in circulation, exerting upward strain on rates of interest to curb borrowing exercise. Nevertheless, the TGA’s draining has offset these tightening measures, successfully injecting liquidity into the market and considerably counteracting the tightening results.

As soon as the debt ceiling is raised, the Treasury has signaled its intention to bolster the TGA stability to its goal of $500 billion. To perform this, it must elevate roughly $440 billion. The first technique for gathering these funds could be issuing Treasury Payments (T-bills), which might inevitably siphon extra liquidity from the market.

In keeping with knowledge introduced by the Treasury Division, the common worth of T-bills issued monthly over the previous three years has hovered round $220 billion. This means that to lift the required $440 billion, the Treasury would want to ramp up T-bill issuance over two months, given the standard issuance volumes.

Nevertheless, this estimate might be topic to fluctuation as the precise timeline would depend upon numerous elements, together with market demand and financial circumstances. Goldman Sachs believes the Treasury might problem as much as $700 billion in T-bills inside six to eight weeks of a debt deal. General, Goldman expects the Treasury to provide the market with over $1 trillion price of T-bills on a web foundation this yr.

This elevated T-bill issuance might double the quantitative tightening impact, posing a major risk to the monetary and crypto markets. As the cash provide shrinks, a liquidity crunch might ensue, probably resulting in falling asset costs throughout the board. Analysts at Financial institution of America mentioned this might have an equal influence on the economic system as a 25 foundation factors price hike.

The implications of this transfer lengthen nicely into the longer term. T-bills, usually maturing in a single yr or much less, wouldn’t solely take up a considerable quantity of liquidity upon issuance but in addition tie up these funds all through the invoice’s time period. This implies the influence on market liquidity might be felt as much as a yr following the elevated issuance, assuming the Treasury primarily makes use of one-year T-bills to refill the TGA.

The crypto market might expertise a pronounced downturn as buyers’ danger tolerance diminishes in response to tighter financial circumstances.

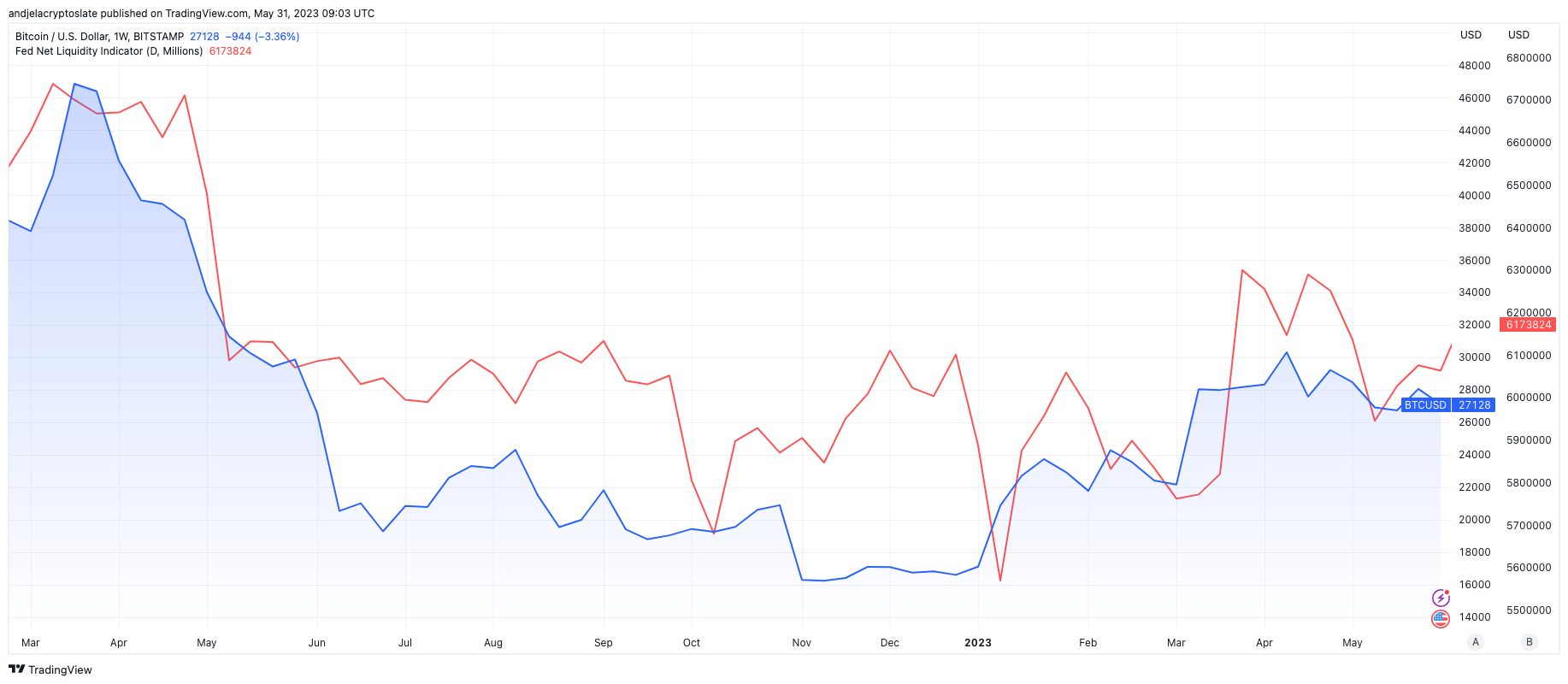

Since 2022, Bitcoin has proven an elevated correlation to web liquidity. A CryptoSlate report from April 22 this yr discovered that a rise within the total sum of money obtainable available in the market correlated to an increase in Bitcoin’s value.

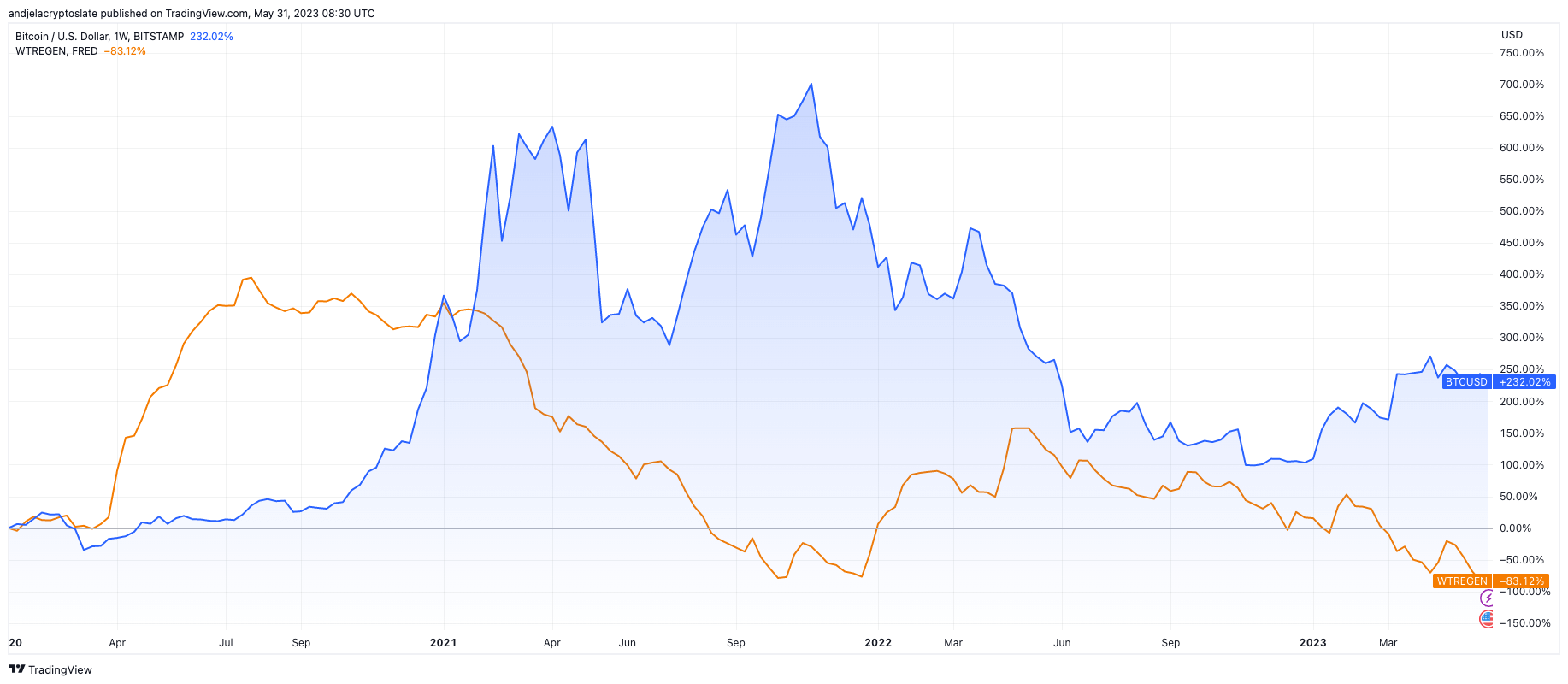

Conversely, Bitcoin has additionally exhibited an inverse correlation to the TGA stability. Since 2020, each enhance within the Treasury Common Account correlated with a drop in Bitcoin’s value.

In conclusion, whereas the market is absorbed within the drama of the U.S. debt ceiling debate, the true story lies within the looming liquidity disaster. The Treasury’s potential T-bill issuance to replenish the TGA stability might drastically tighten the market’s liquidity, prompting asset value depreciation in each monetary and crypto markets. Whereas it’s seemingly that Bitcoin would see a rebound and defy the general market pattern, the short-term results in the marketplace might be extreme.

The put up Crypto markets brace for influence as US debt ceiling debate threatens liquidity crunch appeared first on CryptoSlate.

[ad_2]

Source link