[ad_1]

On-chain information reveals that Bitcoin miners have just lately obtained web inflows of about 7,000 BTC. Right here’s what this will imply for the asset.

Bitcoin Miner Netflow Has Registered A Massive Optimistic Spike

As an analyst in a CryptoQuant submit identified, Poolin mining pool appears to have been behind many of the current inflows. The related indicator right here is the “miner netflow,” which measures the online quantity of Bitcoin getting into or exiting the wallets of all miners.

When the worth of this indicator is optimistic, these chain validators at the moment are depositing a web variety of cash into their addresses. Such a pattern can point out that the miners are accumulating at present, which will be bullish for the value.

Alternatively, values of the metric beneath zero suggest this cohort is taking cash out of their wallets. The primary cause why these traders would switch their cash away from their addresses is for selling-related functions. Thus, this sort of pattern can have bearish implications for the asset.

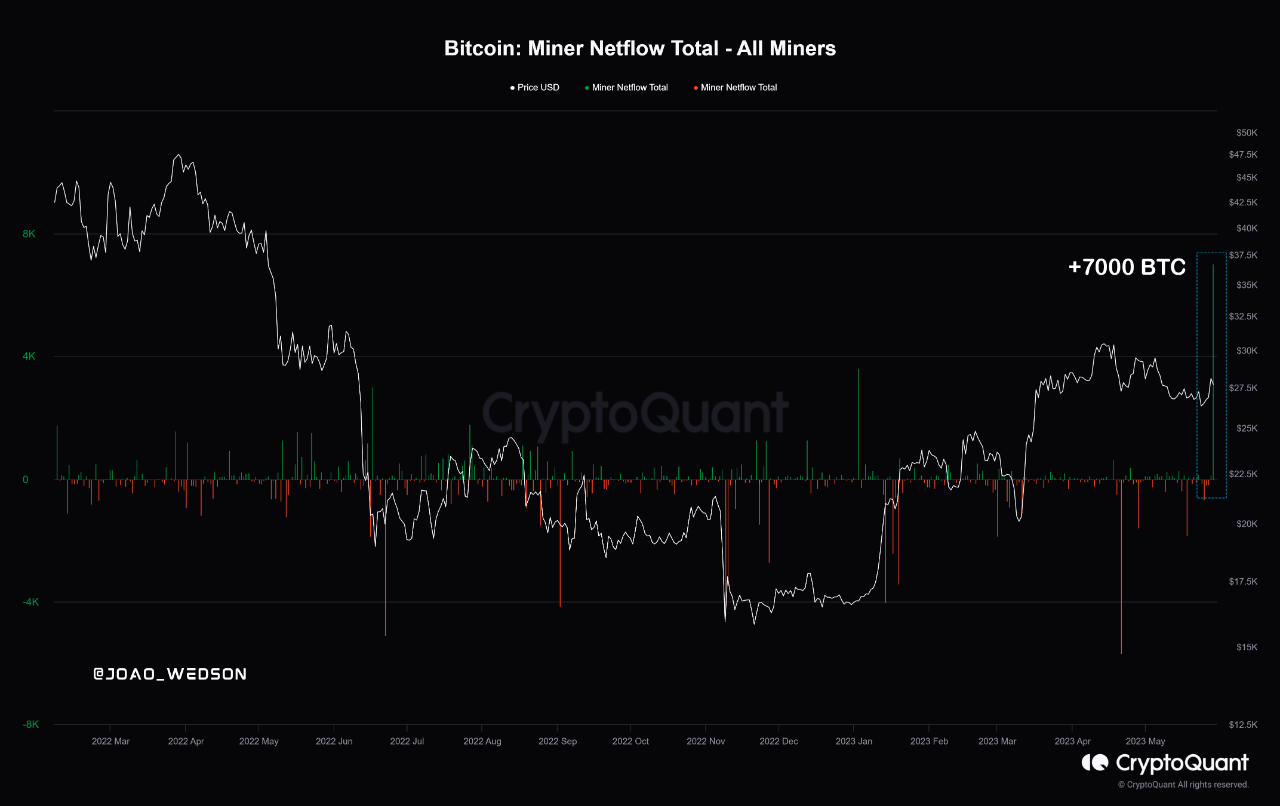

Now, here’s a chart that shows the pattern within the Bitcoin miner netflow over the previous 12 months and a half:

The worth of the metric appears to have been fairly elevated throughout the previous day | Supply: CryptoQuant

The above graph reveals that the Bitcoin miner netflow has noticed a fairly large optimistic spike over the past day or so. With this sharp rise within the indicator, the miners have obtained 7,000 BTC of their wallets.

That is fairly a rare quantity, as no different spike has come shut over the past one and a half years. Naturally, if these web inflows point out that the miners have been shopping for, the cryptocurrency might really feel a bullish enhance.

In January, for instance, the miners participated in some doable shopping for, because the netflow registered a big spike. Following these inflows, the value began its rally.

The quant cautions, nonetheless, “It is very important notice that having such a big inflow of BTC into miners’ wallets doesn’t essentially assure a bullish motion within the worth of Bitcoin. Comparable conditions have occurred prior to now the place there have been important inflows into miners’ wallets, however the worth of Bitcoin subsequently declined.”

The analyst additionally factors out that 99% of those web flows appear to have concerned only one mining pool within the sector: Poolin. The chart beneath reveals the pattern within the mixed holdings of the miners on this pool.

Appears to be like just like the metric has spiked just lately | Supply: CryptoQuant

Because the web Bitcoin inflows are principally to the wallets of this mining pool, it’s unlikely that they characterize the sentiment among the many wider mining business, no matter whether or not they’re an indication of shopping for or not.

From the chart, it’s seen that final month, following the native prime within the asset’s worth, Poolin seems to have offered many cash. These newest inflows appear to have merely taken their holdings again to ranges near these from earlier than this promoting.

BTC Value

On the time of writing, Bitcoin is buying and selling round $27,800, up 2% within the final week.

The asset has surged throughout the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link