[ad_1]

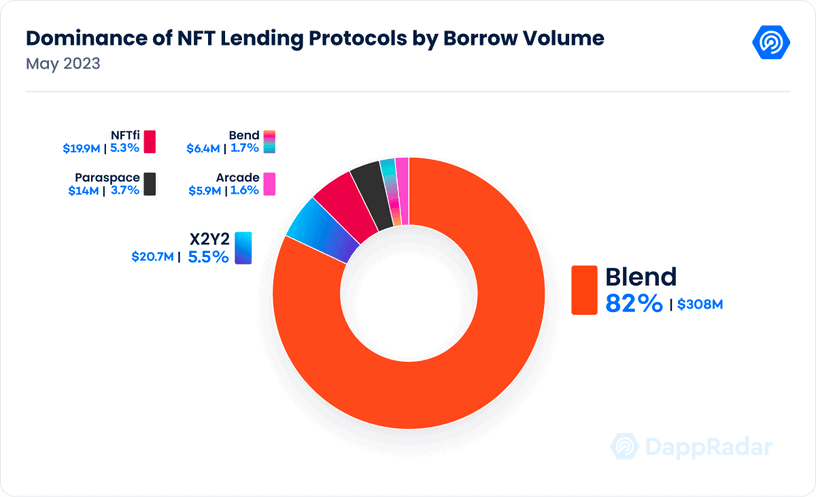

Since its launch on Could 3, Blur’s lending protocol Mix is presently main the NFT lending market share with an 82% dominance, based on a brand new report by DappRadar. Mix is a peer-to-peer lending protocol in-built partnership with VC agency, Paradigm.

Paradigm’s whitepaper introduces Mix as a “peer-to-peer perpetual lending protocol that helps arbitrary collateral, together with NFTs.” Because of this the collateral accepted by a lender may be any asset or type of worth so long as it meets sure standards set by the lender.

At the moment, Mix helps loans backed by Miladys, Azukis, DeGods, and wrapped CryptoPunks, with lending assist for CloneX introduced on Could 25.

Per DappRadar’s report, Mix noticed a mortgage quantity of 169,900 ETH ($308 million) in 22 days. Mix’s weekly mortgage quantity even outperformed different centralized platforms by nearly thrice. Since its launch, Mix has secured 82% of the borrowing quantity throughout all lending protocols.

On the primary day of its launch, Mix reached $5.21 million in Complete Worth Locked (TVL). In simply three weeks, the TVL has grown 360% to nearly $24 million. This, in flip, fueled the general TVL of Blur, which which rose from $119 million to $146 million. Nonetheless, $19 million of the $146 million has been wash traded prior to now week.

Mix’s success follows within the footsteps of Blur, which beat OpenSea in weekly buying and selling quantity shortly after launching in October final yr, based on Dune Analytics knowledge.

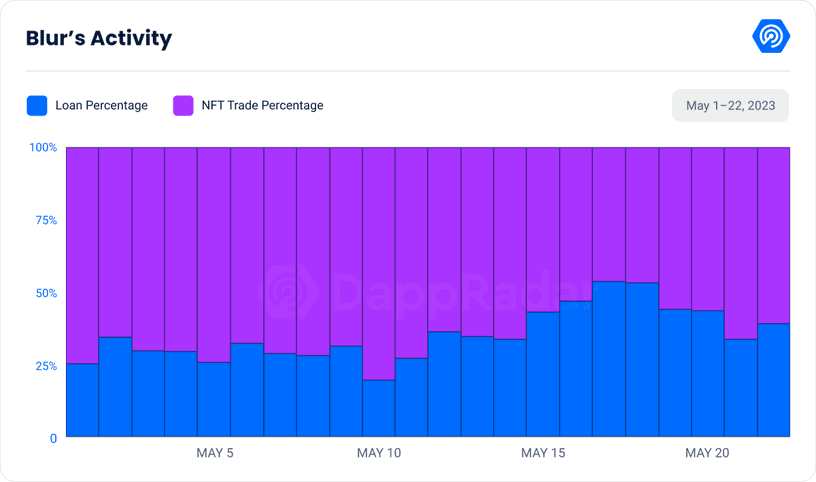

With Blur’s buying and selling quantity over the previous seven days at $104.35 million, a 15.93% decline from the previous week, DappRadar means that the platform is shifting from buying and selling to lending. Within the final seven days, 46.20% of Blur’s exercise originated from NFT loans, transacted by a median of 306 distinctive every day customers.

Mix’s variety of every day distinctive customers has additionally been rising. The platform registered 218 customers on its first day and noticed the quantity improve to 358 by Could 22. Mix’s whole mortgage quantity over 22 days surpasses that of its rivals like NFTfi and BendDAO. Launched in 2020, NFTfi has facilitated a mortgage quantity of $427 million, whereas BendDAO noticed a complete mortgage quantity of $315 million since launching in April 2022.

Following Mix’s success, Binance additionally introduced its Ethereum NFT lending program because the crypto alternate seeks to compete within the NFT lending market.

Learn extra:

[ad_2]

Source link