[ad_1]

Information exhibits the sharks and whales of the most important stablecoins have been accumulating, one thing which will become bullish for Bitcoin.

Sharks & Whales Have Been Loading Up On Stablecoins Lately

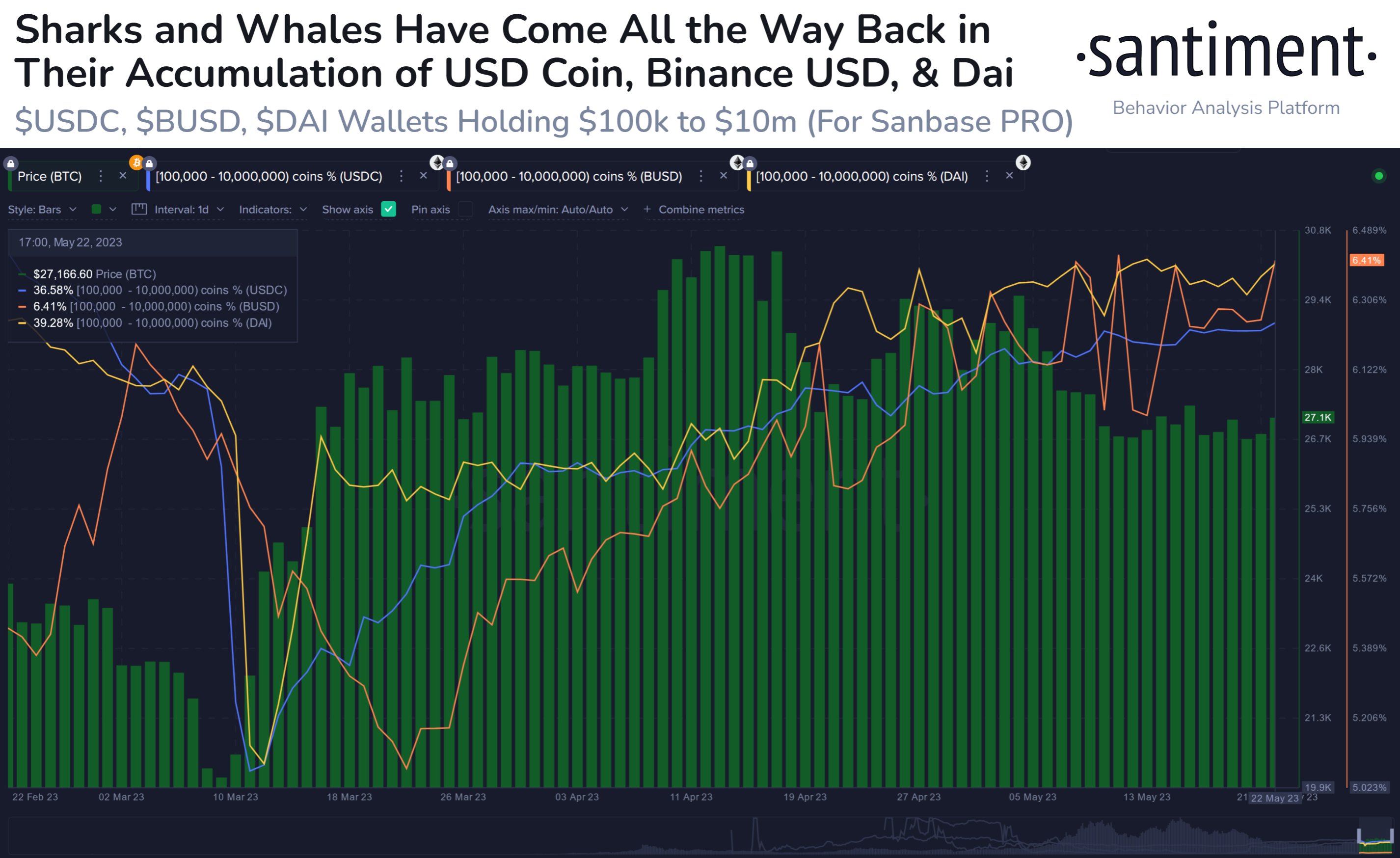

In response to knowledge from the on-chain analytics agency Santiment, the sharks and whales have lately improved their share of the entire provide of stablecoins like USD Coin (USDC), Dai (DAI), and Binance USD (BUSD).

The related indicator right here is the “Provide Distribution,” which tells us what proportion of a cryptocurrency’s complete circulating provide is being held by which pockets group out there.

Addresses are divided into these “pockets teams” primarily based on the entire variety of tokens that they’re holding in the intervening time. Within the context of the present dialogue, the 100,000 to 10 million cash cohort is of curiosity.

This group naturally consists of the wallets of all of the traders who’re carrying a stability of at the very least 100,000 and at most 10 million tokens. Because the belongings in query listed below are USD-pegged stablecoins (which means that their worth is mounted at $1), the bounds of this vary convert to $100,000 and $10 million, respectively.

As these quantities are large, solely the most important of the traders out there could be sitting on these addresses. The sharks and whales are two such cohorts which can be giant sufficient to cowl these wallets.

These teams might be fairly influential out there, as they’ve the ability to maneuver a notable quantity of cash directly. Clearly, the whales could be the extra essential group of the 2, as they’re the bigger cohort.

Now, here’s a chart that exhibits the pattern within the Provide Distribution of those sharks and whales for 3 of the most well-liked stablecoins within the sector:

All three of those provides appear to have gone up in latest weeks | Supply: Santiment on Twitter

As displayed within the above graph, the provides of those three stablecoins hit a low again in March, however have since then noticed a rise. Which means sharks and whales of the respective tokens have been accumulating throughout this era.

Usually, traders use stables at any time when they need to keep away from the volatility related to different belongings like Bitcoin. So, sharks and whales choosing up these cash is usually a signal that they’ve been exiting the opposite belongings lately.

Ultimately, nevertheless, such traders who’ve taken protected haven in stablecoins might alternate these tokens again for the risky cash, as soon as they really feel that costs are proper to leap in.

Each time these holders swap their stables, the costs of the belongings that they’re shifting into can naturally observe a shopping for stress. This suggests that the presently piled-up stablecoin provides of the sharks and whales might be checked out because the potential dry powder that could be deployed into belongings like Bitcoin.

Within the final couple of weeks, the USDC, DAI, and BUSD provides of those humongous holders have flatlined, which means that they might have slowed down their exit from the risky cash. If the pattern now reverses they usually begin scooping up the opposite cryptocurrencies with their stables, BTC might probably really feel a bullish impact.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $26,700, down 1% within the final week.

BTC has erased the good points from yesterday | Supply: BTCUSD on TradingView

Featured picture from NOAA on Unsplash.com, charts from TradingView.com, Santiment.internet

[ad_2]

Source link