[ad_1]

Bitcoin, the world’s largest cryptocurrency by market capitalization, has been in a consolidation part for the previous few weeks. Whereas this may increasingly appear to be a interval of relative stability, on-chain intelligence platform Glassnode co-founder Yann Allemann means that it may point out an impending value motion.

Previously, related consolidation intervals have usually been adopted by value swings, and traders are carefully anticipating any indicators of the place the market could be headed.

Whereas some traders could also be nervous in regards to the current consolidation, others see it as a possibility to purchase in earlier than the following huge transfer. Because the market awaits the following Bitcoin value motion, analysts and lovers alike are speculating on what would possibly come subsequent for the main cryptocurrency.

Components Indicating A Constructive Outlook For Bitcoin Value

Amidst the present state of the Bitcoin market, a number of components have been recognized by Allemann on Twitter, which contribute to the prediction of a constructive future for the cryptocurrency. These components embrace the depletion of short-sellers’ assets, the reinforcement of help ranges, and the expectation of an general bullish pattern.

Shorts getting exhausted the longer #BTC holds $26.8k… huge transfer coming

The worth explodes at any time when #Bitcoin consolidates under the MA. Bands are already tight. The clock is ticking.https://t.co/t20rwaMxPB pic.twitter.com/5UG6UB9KQn

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) Might 17, 2023

Bitcoin’s value has been fluctuating inside the vary of $26,500 and $27,100, a interval characterised by the prevalence of “excessive worry” sentiment amongst market members.

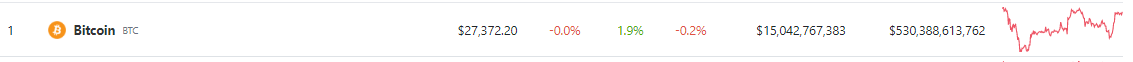

On the time of writing CoinGecko exhibits Bitcoin’s value stands at $27,372, reflecting a modest 1.9% improve over the previous 24 hours. Nonetheless, it’s value noting that the cryptocurrency has additionally skilled a slight decline of 0.2% over the course of the earlier seven days.

Supply: Coingecko

Nonetheless, Allemann highlights that this sample usually serves as a precursor to upward actions out there. One compelling commentary is the resilience of Bitcoin’s value in sustaining ranges above the 50 and 200 Easy Transferring Averages (SMAs), which now function sturdy help ranges which have confirmed their power by 5 separate checks.

These technical indicators not breaking down additional signify a constructive pattern out there and add to the general optimism surrounding Bitcoin’s future efficiency.

Debt Ceiling Uncertainty Might Affect Bitcoin Value

One other issue that might doubtlessly influence Bitcoin’s value within the coming days is the continued debate surrounding the debt ceiling in america.

The debt ceiling is a restrict on the sum of money that the US authorities can borrow to fund its operations. If the federal government fails to lift the debt ceiling, it may lead to a default on its debt obligations, which may have critical penalties for the worldwide monetary system.

Crypto whole market cap barely unchanged at $1.10 trillion. Chart: TradingView.com

The uncertainty surrounding the debt ceiling debate may result in elevated volatility within the monetary markets, together with the cryptocurrency market. Traditionally, Bitcoin has demonstrated a constructive correlation with the inventory market, significantly throughout occasions of financial uncertainty.

Subsequently, any opposed results on the inventory market ensuing from the debt ceiling debate may doubtlessly spill over into the cryptocurrency market and trigger vital value fluctuations.

-Featured picture from Bitcoinik

[ad_2]

Source link