[ad_1]

sponsored

The worldwide crypto market is increasing steadily regardless of latest bearish sentiments. Over 119 million individuals worldwide began proudly owning cryptocurrencies in 2022, marking a 39% rise in whole possession. It displays a rising demand for different cost strategies and funding devices.

Extra individuals now imagine within the potential of futuristic asset courses like crypto. Notably since innovators are bringing novel utilities to the desk. However the highway forward isn’t all rosy. We should overcome a number of challenges earlier than crypto-based belongings bloom totally.

One key concern is the dearth of easy, user-friendly, and secure devices for newbie and professional traders. For example, index investing, regardless of its sturdy observe document in conventional finance, is generally inaccessible to the crypto group. This exposes traders to market-related dangers like excessive volatility, decreasing their scope for diversification and producing suboptimal returns.

J’JO supplies an answer to those issues with its superior index-based funding service for crypto markets. Apart from making crypto investing safer and extra accessible, the service helps enhance monetary planning for traders throughout the board.

Why crypto wants easier funding devices

Cryptocurrencies have proven a meteoric rise in recognition. That is nice from the angle of how this asset class supplies worth throughout industries and market segments. From digital currencies to luxurious gadgets and actual property, we now have unexpected income streams and transaction strategies.

However the journey to utilizing crypto effectively entails a steep studying curve. It’s fairly completely different from legacy belongings and conventional investments, although they’ve some fundamental rules in frequent. That’s why most crypto traders, with little or no expertise, find yourself placing cash in unreliable, half-baked belongings. The unstable markets burn them because of this, usually demotivating future endeavors.

This may’t go on. Stakeholders of the nascent crypto trade should guarantee long-term adoption. And to try this, we should study some classes from our conventional counterparts. Providing simpler investments for retail customers has been a key to the success of legacy monetary methods. Crypto has to up its recreation on this regard.

Some cryptocurrency exchanges and platforms do supply related companies. However these are largely hidden from customers resulting from flawed positioning. J’JO thus launched its service for public use in Might 2023, as a response to this disaster. It supplies the simplicity, stability, and ease of entry that crypto traders want.

J’JO’s service is for everybody, newbie or professional

Boosting monetary inclusion has been certainly one of crypto’s fundamental targets from the very starting. It was probably the most essential side of Satoshi Nakamoto’s imaginative and prescient for Bitcoin. That’s why J’JO has developed a cryptocurrency index investing platform with an intuitive and hassle-free interface accessible to everybody.

The service leverages a strong index investing precept, i.e., CCi30. Carlo Sevoly, the CS&P President, and Igor Riven, a Temple College & Regis professor, developed this precept in 2017, which now varieties the premise for J’JO’s flagship index, JJO35.

JJO35 is a mixture of conventional knowledge and experience with innovation, guaranteeing the very best monitoring of crypto markets. It algorithmically invests within the top-35 cryptocurrencies by market cap, in order that traders can start their journey in underneath 5 minutes.

The service is accessible in 12 languages throughout 200 nations worldwide. Traders can thus diversify their portfolios by securely investing in crypto from virtually wherever. In addition they get a number of cost choices, together with Visa, Mastercard, and native companies.

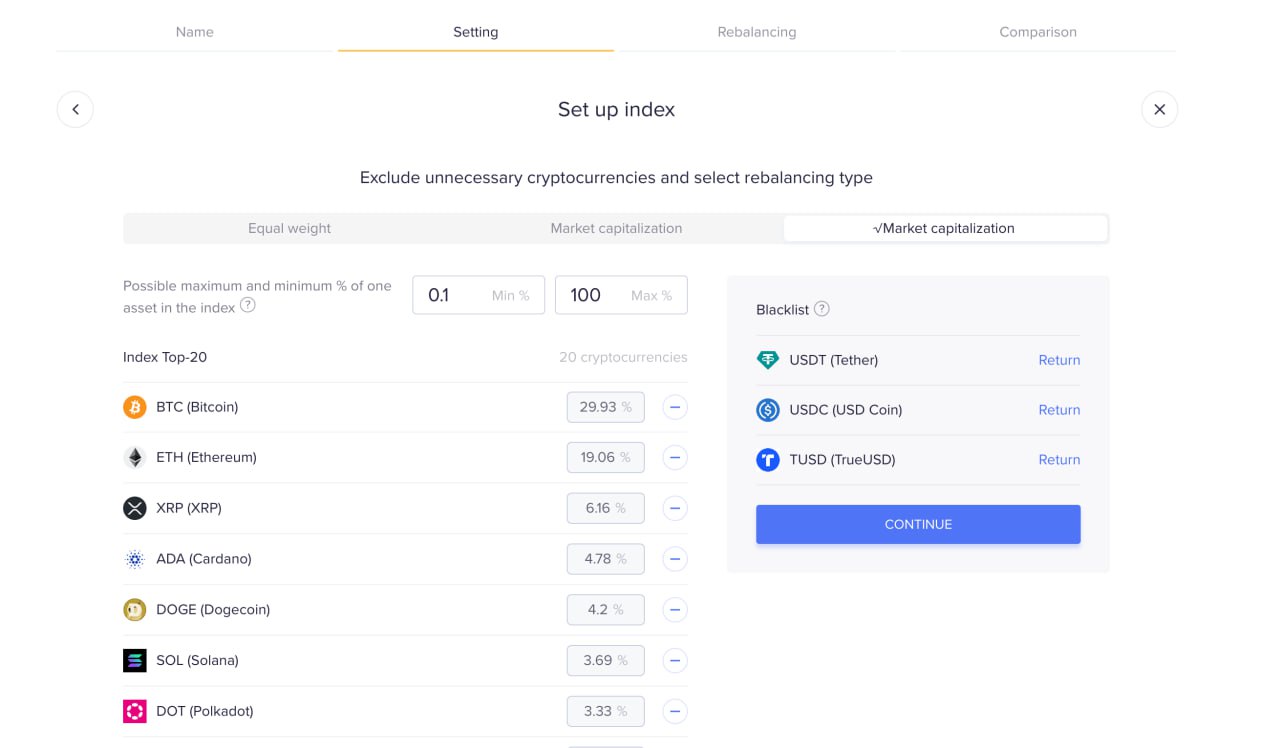

Furthermore, J’JO’s API-based structure connects with all main exchanges, which additional heightens its interoperability. These options present traders with a seamless, user-friendly, and readymade index investing, monetary planning, and danger administration service. Skilled traders can even create customized indices utilizing their favourite cryptocurrencies.

Supply: J’JO

Traders stay in management with J’JO

J’JO is a non-custodial platform the place traders stay in full management of their funds. They merely join customers’ change accounts to begin investing in crypto indices, virtually in actual time and without spending a dime with deposits underneath $500.

The algorithm mechanically analyzes and rebalances funds to attenuate the effort for traders. It thus sells belongings that fall off the Prime-35 record, reinvesting promptly in new progress leaders. The funds by no means depart the person’s change account because the system features by way of APIs. Nevertheless, skilled traders can even use the customized rebalancing and asset monitoring settings obtainable on J’JO for even larger management.

Having mentioned that, traders should notice J’JO, like another market-driven service, can not predict future outcomes with 100% accuracy. It additionally doesn’t “assure” income, although historic knowledge exhibits how JJO35 has grown 5.5x up to now three years, in comparison with Bitcoin’s 3x progress.

Traders should, subsequently, use J’JO with affordable expectations and a fundamental understanding of the dangers and limitations of crypto investments generally. J’JO isn’t a instrument for short-term speculations, however somewhat an instrument for long-term progress and monetary planning.

With that in thoughts, J’JO customers can get rid of guesswork from their investing course of to take advantage of out of cryptocurrencies. This paves the highway to the longer term, which finally results in sustainable adoption of crypto belongings and progress for traders.

It is a sponsored publish. Learn to attain our viewers right here. Learn disclaimer beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss precipitated or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link