[ad_1]

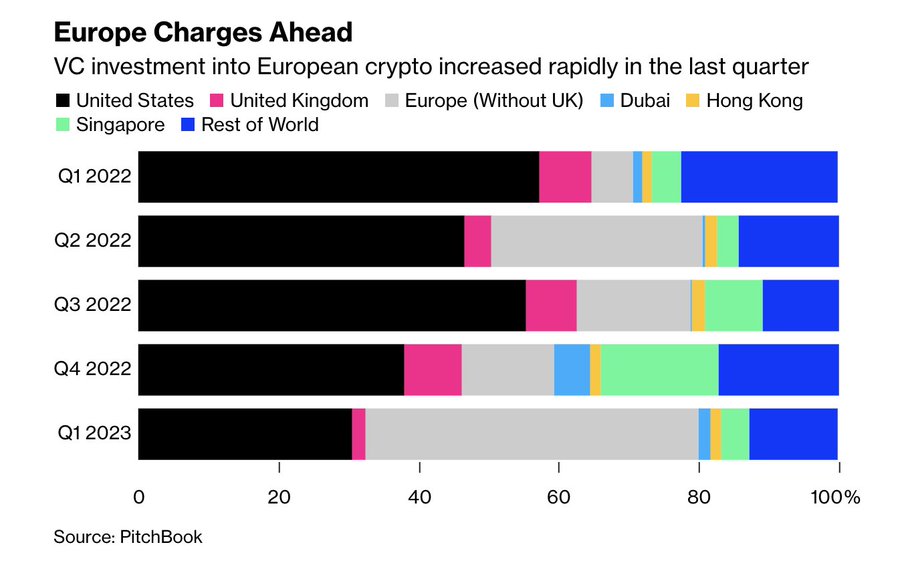

Enterprise capital funding into European crypto initiatives elevated nearly ten occasions previously 12 months, going from 5.9% within the first quarter of 2022 to 47.6% in Q1 of 2023.

Circle Director of Analysis and Coverage Patrick Hansen famous that this improve resulted from the area’s regulatory readability following the European Union passage of the MiCA legislation.

The European Parliament handed the Markets in Crypto Property Legislation (MiCA) in April however is not going to apply till July 2024. The legislation — which has garnered massive curiosity from the crypto group — would enable the E.U. to have a unified strategy to crypto asset regulation throughout 27 member states.

Different areas attracting crypto traders

In the meantime, the E.U. is barely one of many many areas attracting curiosity from crypto traders. Different international locations, just like the United Arab Emirates and Hong Kong, are additionally seeing extra crypto investments.

All these international locations have in frequent their efforts to offer regulatory readability for crypto firms working below their jurisdiction. Hong Kong’s new laws for crypto exchanges providing retail buying and selling will go into impact by June 1.

In the meantime, Dubai and Abu Dhabi have additionally seen curiosity from a number of crypto firms, together with Coinbase. Earlier this week, Coinbase CEO recommended the nation for its progressive regulatory effort. Coinbase is working to acquire licenses for digital belongings companies within the nation.

Issues are totally different in US

In the meantime, a number of crypto companies are leaving the U.S., citing regulatory issues.

From the start of the 12 months, crypto companies like Nexo, Beaxy, Bittrex, and many others., have shuttered their operation, citing regulatory issues. Just lately, Coinbase and Gemini established an offshore trade and are additionally working to broaden to different international locations.

Market makers Jane Avenue and Leap Crypto have begun efforts to cut back their crypto publicity citing regulatory points.

The put up VC investments in European initiatives rise in Q1 2023 appeared first on CryptoSlate.

[ad_2]

Source link