[ad_1]

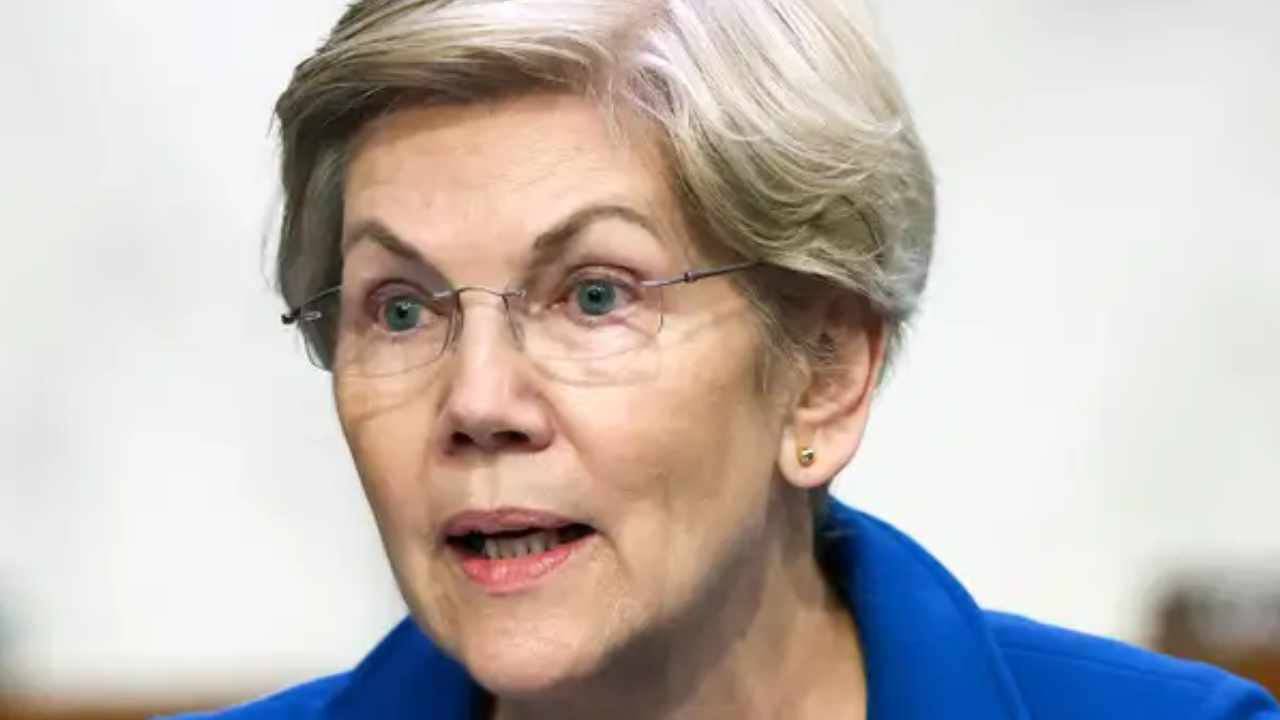

U.S. Senator Elizabeth Warren alleges that Signature Financial institution failed as a result of it “purchased into its get-rich-quick narrative” and “embraced crypto prospects with inadequate safeguards.” Emphasizing that the financial institution took “extreme threat,” the senator demanded solutions from the CEO of Signature Financial institution relating to “the economically disastrous outcomes you created.”

Senator Elizabeth Warren’s Letter to Signature Financial institution’s CEO

U.S. Senator Elizabeth Warren (D-MA) has attributed the failure of Signature Financial institution to its acceptance of crypto prospects with out having enough safeguards, Yahoo Finance reported Thursday. Signature Financial institution was seized by the New York State Division of Monetary Companies final Sunday, changing into the third-largest financial institution within the U.S. to fail.

In a letter to Signature Financial institution CEO Joseph DePaolo, Senator Warren wrote:

You owe your prospects and the general public an evidence for the economically disastrous outcomes you created: you labored onerous to weaken the principles, promised that they ‘bode effectively’ to your financial institution — after which destroyed it with dangerous decision-making and extreme risk-taking.

“Congress and the general public should study the teachings from the failure of Signature Financial institution,” the senator careworn.

The lawmaker argued that Signature Financial institution supported efforts to curtail capital necessities stipulated within the Dodd-Frank Wall Road reform legislation, the publication conveyed, including that the financial institution additionally directed hundreds of {dollars} in marketing campaign contributions to leaders of efforts to calm down financial institution regulation in Congress.

“Regardless of assurances made to Congress that mid-sized banks like Signature Financial institution would have the ability to handle threat independently, it has since grow to be clear that your financial institution was wholly unequipped to take action, and that failure resulted within the financial institution being shut down and brought over by authorities regulators,” the senator informed DePaolo.

Signature Financial institution Allegedly ‘Embraced Crypto Clients With Inadequate Safeguards’

Senator Warren additional alleged that Signature Financial institution took on “extreme threat” to spice up its backside line by serving crypto shoppers, such because the Nasdaq-listed crypto change Coinbase, blockchain infrastructure platform Paxos, and collapsed crypto change FTX. By December final 12 months, crypto shoppers accounted for about 30% of Signature Financial institution’s complete deposits. Warren acknowledged:

Signature Financial institution purchased into its get-rich-quick narrative … Signature Financial institution was caught brief as a result of it embraced crypto prospects with inadequate safeguards.

In response to Bloomberg, the U.S. Division of Justice (DOJ) and the Securities and Change Fee (SEC) have been already investigating Signature Financial institution’s work with cryptocurrency shoppers earlier than regulators took possession of the financial institution final Sunday. The information outlet famous that the DOJ was specializing in whether or not the financial institution had taken ample measures to determine potential cash laundering actions by its shoppers.

What do you consider Senator Elizabeth Warren claiming that Signature Financial institution collapsed as a result of it embraced crypto shoppers with out ample safeguards? Tell us within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any harm or loss induced or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link