[ad_1]

The marketplace for third-party ensures—which supply public sale homes and sellers a useful gizmo to hedge their bets—is exhibiting no indicators of slowing, reaching a possible report of $3.4bn in 2022. However a darker, lesser recognized market has been found by The Artwork Newspaper whereby third-party backers are promoting off fractions of their ensures to nameless companions, sharing the dangers in addition to any upside.

A number of the largest names within the recreation embody the Nahmad household of artwork merchants, the mega supplier Larry Gagosian and the billionaire collector José Mugrabi, all of whom are recognized to routinely provide third-party ensures, or irrevocable bids, on works in trade for a negotiated monetary price from the public sale home. Whereas Gagosian and Mugrabi are unlikely to want serving to fingers for his or her multi-million-dollar ensures, the pair are understood to commerce ensures forwards and backwards between them.

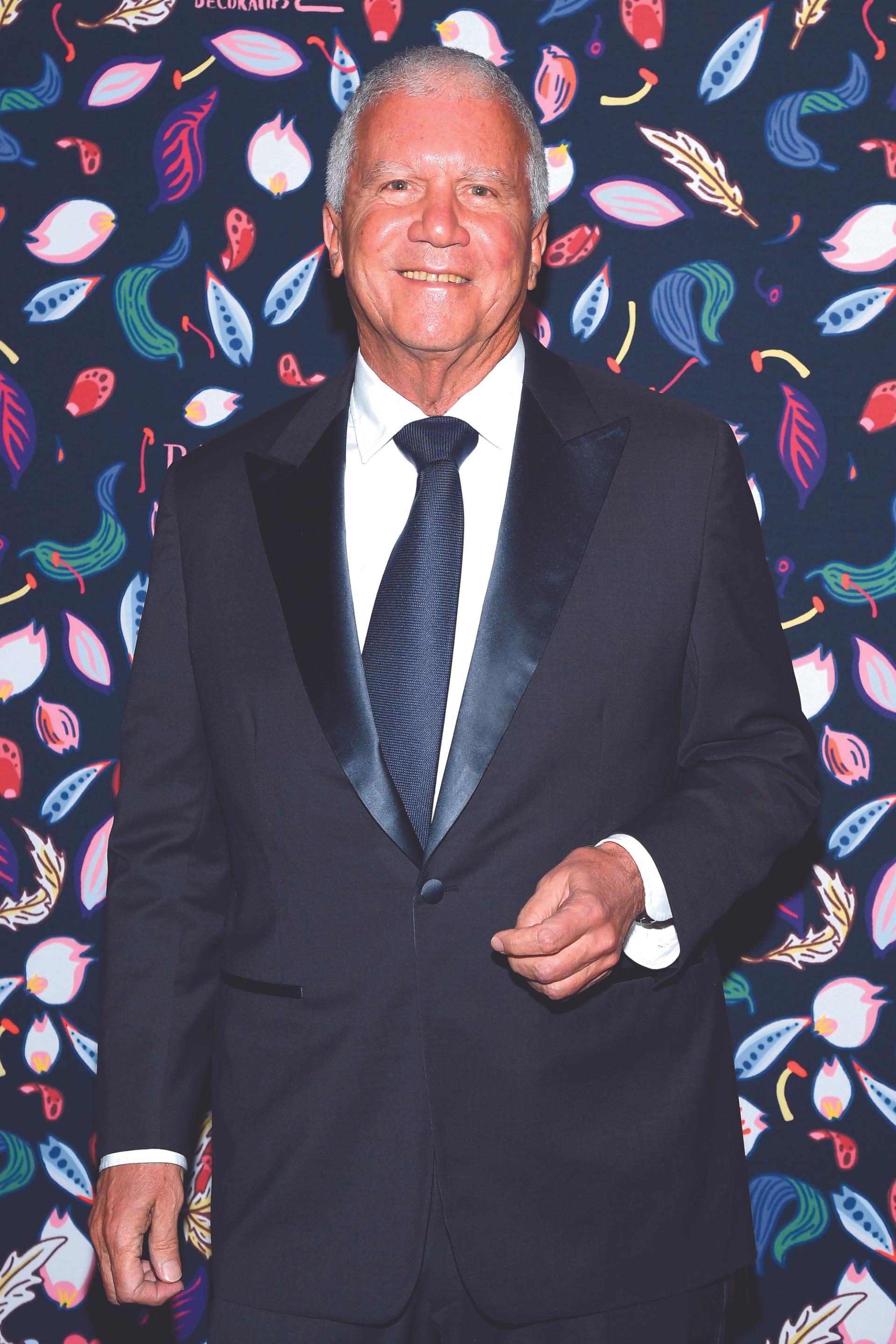

Left: mega supplier Larry Gagosian is alleged to be among the many largest gamers within the third-party assure recreation

Picture: Pascal Le Segretain/Getty Photos

So why is that this secondary marketplace for ensures rising now? Because the worldwide artwork market softens within the wake of world financial insecurity, the attraction of third-party ensures for public sale homes, which may relieve reluctance on the a part of cautious consignors, has grown ever extra engaging. It may be a profitable answer for the guarantor, too, who both buys a piece for an “insured” worth if it fails to promote at public sale, or will get an honest share of the earnings if it sells above the assured worth.

Nevertheless, whereas third-party ensures guarantee a minimal worth regardless of how a piece fares at stay public sale, they carry an growing threat. In accordance with the evaluation agency ArtTactic, the estimated common return on ensures has decreased from the height in 2021 of 21.8%, to a seven-year low of 11.1% in 2022.

Of the creating secondary marketplace for ensures, one distinguished New York lawyer energetic in artwork market negotiations explains: “Third-party guarantors started to put off a few of their very own threat to others; then, given the upside potentialities, a secondary market developed. Folks sought to get in on offers, and guarantors bought off some or all of their upside potential.”

A New York-based non-public supplier, who has orchestrated not less than 20 or extra of those offers, ran this author by means of the steps of getting a third-party assure and what occurs subsequent.

“I’m going by means of the viewing and perform some research after which resolve whether or not to ensure it or not. I method one of many specialists who in flip approaches administration for the potential for a assure. Once they come again to me—typically two days earlier than the public sale—and ask if I’m nonetheless , that’s once I name the folks and ask in the event that they wish to go into it, at what proportion, and so on. It’s often in fours, typically threes, together with myself, so I’ll personal both 25% or 33% of the portray.

“Let’s say I assure it at 20% under the low estimate that’s set at $1.2m and I assure it for $800,000. If it sells for $1m, I get $40,000. If it doesn’t promote, it belongs to me.”

Requested if public sale homes are conscious that secondary offers are being brokered, the supplier says: “They may know unofficially as a result of they see us hanging round collectively, however legally and paperwork-wise, I’m the one one and so they choose it that method.”

Towards auction-house guidelines

This growth and situation flies within the face of, and seemingly violates, public sale home guidelines and language present in third-party guarantor agreements. As an example, in a year-old instance of a Christie’s settlement examined by The Artwork Newspaper between the public sale home and the third-party guarantor, among the advantageous print clearly states: “you shall not share any sums paid to you beneath this Settlement with any third get together; and you haven’t and won’t enter into any settlement with a 3rd get together regarding your curiosity within the Property and obligations pursuant to this Settlement.”

That language is just about boilerplate among the many public sale homes, in line with a number of educated observers. A spokesman for Sotheby’s says the public sale home will not be in a position to remark “on the phrases of our monetary agreements with shoppers”.

Requested about that clause, the nameless guarantor replies—considerably in jest—“If you happen to go letter by letter, nobody would ever signal it.” He provides: “All I care about is the 20%, 25% or 30% or regardless of the quantity we agree on.”

Satirically, this comparatively current phenomenon has appeared and presumably flourished only a yr after New York Metropolis unilaterally eradicated rules on auctions and, with it, any official oversight of the artwork trade, together with the requirement for the public sale homes to announce once they have a monetary stake in a chunk being bought.

Nonetheless, proof of those hedged third-party assure sell-offs will not be extensively acknowledged or recognised. “I’ve no examples of it,” says Jean-Paul Engelen, the president of Phillips. “However it’s completely potential. Is it that a lot completely different from sellers shopping for stuff collectively as companions? It’s a hedge towards a hedge so I wouldn’t be shocked if it occurred.”

The New York artwork lawyer Thomas Danziger of Danziger, Danziger & Muro says he has “heard up to now of individuals partnering up on this stuff” however provides: “I can’t inform you it’s a brand new factor; it sounds nearly like a brokering of an irrevocable bid. It’s just like the public sale homes giving a assure to a consignor after which going off to unload threat to a 3rd get together which is the irrevocable bidder.”

Danziger says he has not noticed first hand the selling-off of third-party ensures, “however has it occurred? Positive”.

It doesn’t matter what kind they take, third-party ensures are evidently right here to remain and have graduated from the notion of a decade or extra in the past {that a} marking of such within the catalogue was a knock on the image.

As Engelen observes, “They’re an necessary think about at present’s public sale market, 100%.”

[ad_2]

Source link