[ad_1]

The launch of Blur’s ‘Mix’ perpetual lending protocol for NFTs has stirred up combined reactions. In collaboration with Paradigm, Blur launched the peer-to-peer lending protocol on Could 1, which permits NFT collateral. Mix’s creators imagine it offers “financialization to scale.” Moreover, builders of Mix stated that the protocol doesn’t rely on oracles or have any expiries. In addition they declare that no charges could be collected from debtors or lenders. Let’s dive in!

Breaking Down the Mix Protocol

Blur, in collaboration with Paradigm, launched the ‘Mix’ peer-to-peer lending protocol for NFT collateral on Could 1. The launch of Mix, nevertheless, has stirred up combined reactions. However, what really is Mix?

Mix is a perpetual lending protocol, permitting debtors and lenders to increase the mortgage expiration time by default, with out requiring any on-chain transactions. When a lender needs to finish the mortgage earlier than the borrower pays it again, the protocol holds an public sale to discover a new lender who’s keen to refinance the mortgage. This public sale begins with no curiosity and step by step will increase till somebody agrees to take over the mortgage. The public sale begins at 0% refinance curiosity with a steadily rising price.

Builders have defined that Mix has no oracle dependencies or expiries, permitting borrowing positions to open indefinitely till terminated. In addition they declare that the protocol would acquire zero charges from debtors and lenders. In response to Blur, debtors can repay the mortgage at any time on Mix. “If a borrower needs to vary the quantity they’ve borrowed or get a greater rate of interest, they will atomically take out a brand new mortgage towards the collateral and use the brand new principal to repay the outdated mortgage,” they wrote.

At any time when a lender initiates a refinancing public sale and nobody is keen to take over the debt at any rate of interest, Mix permits for the liquidation of an NFT.

Blur Market is one in all (if not) the quickest real-time NFT aggregators within the Ethereum ecosystem. However, Blur’s new lending platform has obtained a spread of reactions from the neighborhood. Nevertheless, it appears that almost all of those reactions are sarcastic and demanding of the platform.

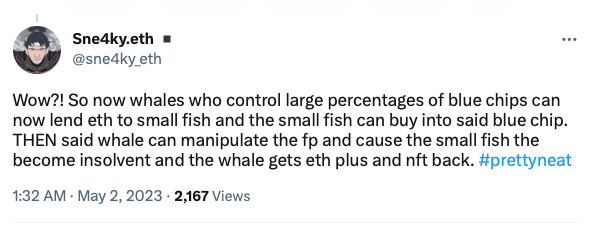

One consumer expressed considerations about how bigger traders may use the platform to control the market and make the most of smaller traders. Their Tweet learn: “Wow?! So now whales who management massive percentages of blue chips can now lend eth to small fish and the small fish should buy into stated blue chip. THEN stated whale can manipulate the fp and trigger the small fish the turn out to be bancrupt and the whale will get eth plus and nft again.”

One other consumer has raised considerations concerning the affect of NFT worth will increase on mortgage repayments. The consumer voiced considerations about whether or not Blur shall be required them to pay extra if this occurs. The neighborhood has additionally raised considerations about potential fraudulent actions like cash laundering and wash-trading on the platform. Bigger traders might make the most of smaller traders, which some customers have criticized. In the end, it’s but to be decided how effectively the platform will carry out in the long term.

All funding/monetary opinions expressed by NFTevening.com usually are not suggestions.

This text is academic materials.

As at all times, make your individual analysis prior to creating any sort of funding.

[ad_2]

Source link

.gif?format=1500w)