[ad_1]

Be part of Our Telegram channel to remain updated on breaking information protection

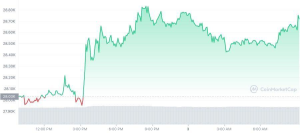

The crypto market is again on the bullish observe, and Bitcoin is main the cost in its ordinary trend.

The foremost crypto asset is exhibiting a optimistic enhance of two.45% within the final 24 hours because it climbs towards the $28,700 worth peg.

Two days in the past, Bitcoin reached a mid-term low of $27,746.85 however has since rebounded with a bullish pattern.

On its present worth trajectory, the bulls are focusing on a psychological threshold of $30,000 within the coming days because the cryptocurrency market makes a long-awaited comeback.

This bullish sentiment is bolstered by the truth that the cryptocurrency at present trades above its short-term 50-day shifting common (MA) worth of $28,650.

Whereas this might sound negligible, the 200-day MA worth of $21,984.83 reveals large potential for a continued upward pattern.

The resurgence of Bitcoin will be attributed to essential macroeconomic occasions which have impacted the worldwide monetary area, significantly the U.S. economic system.

Additionally, the anticipated launch of a brand new rate of interest by the U.S. Federal Reserve in the present day is a much-needed increase for the worth efficiency of the well-known proof-of-work (PoW) digital foreign money.

Feds’ Anticipated Curiosity Fee Hike and PCEI Index Pointing to Swerving Investor Local weather

The U.S. Federal Reserve is anticipated to put a brand new benchmark price for its federal funds price in the present day in its ongoing Federal Open Committee Assembly (FOMC).

In accordance with market consultants, the Feds are anticipated to boost the rate of interest by 25 foundation factors (bps) within the subsequent spherical of hikes.

This may make it the best stage the U.S. central financial institution has raised its rates of interest within the final 16 years.

About 89% of market consultants imagine that Feds’ officers will go together with this new route in its rate of interest choice, whereas 11% imagine that the rate of interest would stay at 5%.

Nonetheless, consultants imagine that the latest hike would be the final for a very long time.

📢💥#FedMeetingAlert💥📢🚨Right this moment marks the extremely anticipated assembly of the Federal Reserve, with a possible rate of interest hike looming. Maintain on tight!💼Likelihood:🔴0bp = 11%🟢0.25bp = 89%#FedWatch #MarketVolatility #InterestRateHike #FederalReserve👇 (Proceed Studying) pic.twitter.com/thsJfbPyvz

— The Unbiased Banker (@Mykhailo_Por) Might 3, 2023

With this new rate of interest, the anticipated determine that banks will commerce amongst themselves will most definitely be within the vary of 5% to five.25%.

The federal funds price is the in a single day rate of interest at which depository establishments commerce federal funds with each other.

The Federal Reserve’s rate of interest hike choice is upon us. Many traders predict a price hike regardless of latest indicators of financial cooling. What do you suppose?

— TipRanks (@TipRanks) Might 2, 2023

With this anticipated hike, mid and regional banks could also be pushed additional right into a nook because the Feds proceed its battle towards inflation.

The most recent rate of interest enhance is the tenth in a collection began by Fed Chair Jerome Powell in March 2022.

Powell has continued to reiterate the necessity to increase curiosity given the U.S. economic system’s unstable situation.

Up to now, a number of banks have capitulated underneath the impression of a price hike throughout the economic system. The most recent is the First Republic Financial institution which has just lately been put into receivership following giant withdrawals.

The Feds try to stop what they take into account the U.S. economic system’s dangerously pivoting axle.

The Fed is anticipated to announce the most recent price hike at 2:00 PM ET, adopted by a press release from Jerome Powell at 2:30 PM.

The latest price hike follows the just lately launched Private Consumption Expenditure Index (PCEI) by the Bureau of Financial Evaluation (BEA).

The PCEI elevated 0.3% after unstable components reminiscent of meals and power prices have been eliminated, in line with the doc.

The PCEI worth index additionally went up 0.1%, placing its general share achieve at 4.6% in March 2023, larger than the 4.2% it posted a 12 months in the past.

The Feds have put their annual inflation for PCEI at 2%.

With the continued pattern, traders are torn on the place to pitch their tents. Up to now, the U.S. inventory market worry and greed index is within the impartial zone, with the DOW Jones down 1.08% up to now day.

The S&P 500 has additionally slumped 1.16%, with NASDAQ rounding up with an analogous determine to the DOW.

Present Curiosity Fee Hikes Feeding Bitcoin’s Bullish Surge

The anticipated price hike could also be taking part in into Bitcoin’s bullish rise, as in the present day’s broader market rally reveals.

Up to now, the most important crypto asset by market cap is buying and selling simply north of the $28,700 worth vary.

If the market continues its exceptional pushback on the bears, Bitcoin might retest the $29,000 vary and simply scale above the $29,916 resistance stage it didn’t beat on April 27, 2023.

This optimistic market sentiment is buoying the foremost cryptocurrency’s relative energy index (RSI) to an oscillator determine of fifty.03, making it largely underbought.

This presents a viable entry level for traders to purchase BTC and journey with the market.

Curiously, its shifting common convergence and divergence (MACD) indicator reveals a promote sign.

Nonetheless, the orange trendline is nosediving sharply, with its blue counterpart main the rise again up.

This might see the purchase sign change positions with the promote sign as soon as the Feds make the anticipated hike official.

Bitcoin would then be on a bull run because it continues to solidify its place within the nascent monetary panorama.

In the meantime, traders trying to find low-cap crypto gems with decrease volatility might simply flip to crypto presales.

These include larger upsides, decrease dangers, and higher publicity to a brand new ecosystem with minimal investments.

Associated Information

AiDoge – New Meme to Earn Crypto

Earn Crypto For Web Memes

First Presale Stage Open Now, CertiK Audited

Generate Memes with AI Textual content Prompts

Staking Rewards, Voting, Creator Advantages

Be part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link