[ad_1]

On-chain information exhibits the Bitcoin change reserve ratio for US versus offshore platforms has continued to say no not too long ago. Right here’s what this tells us.

Bitcoin Trade Reserve Ratio Has Been Falling For A Whereas Now

As defined by an analyst in a CryptoQuant put up, the BTC reserve of the US-based exchanges goes down. The “change reserve” is an indicator that measures the entire quantity of Bitcoin that’s at present sitting within the wallets of a centralized change or a bunch of such platforms.

The metric of curiosity right here just isn’t really the change reserve, however the “change reserve ratio.” As this indicator’s title implies, it tells us in regards to the ratio between the change reserves of two given units of platforms. Within the context of the present dialogue, the 2 units of exchanges are the American and overseas platforms.

When the worth of this ratio will increase, it means the variety of cash sitting on the US-based platforms goes up relative to the provision on the offshore exchanges. This naturally signifies that the American platforms are receiving a better quantity of deposits (or simply decrease withdrawals) than the overseas ones.

Alternatively, the metric’s worth happening suggests the worldwide platforms are seeing greater development of their reserves than the US-based exchanges in the intervening time.

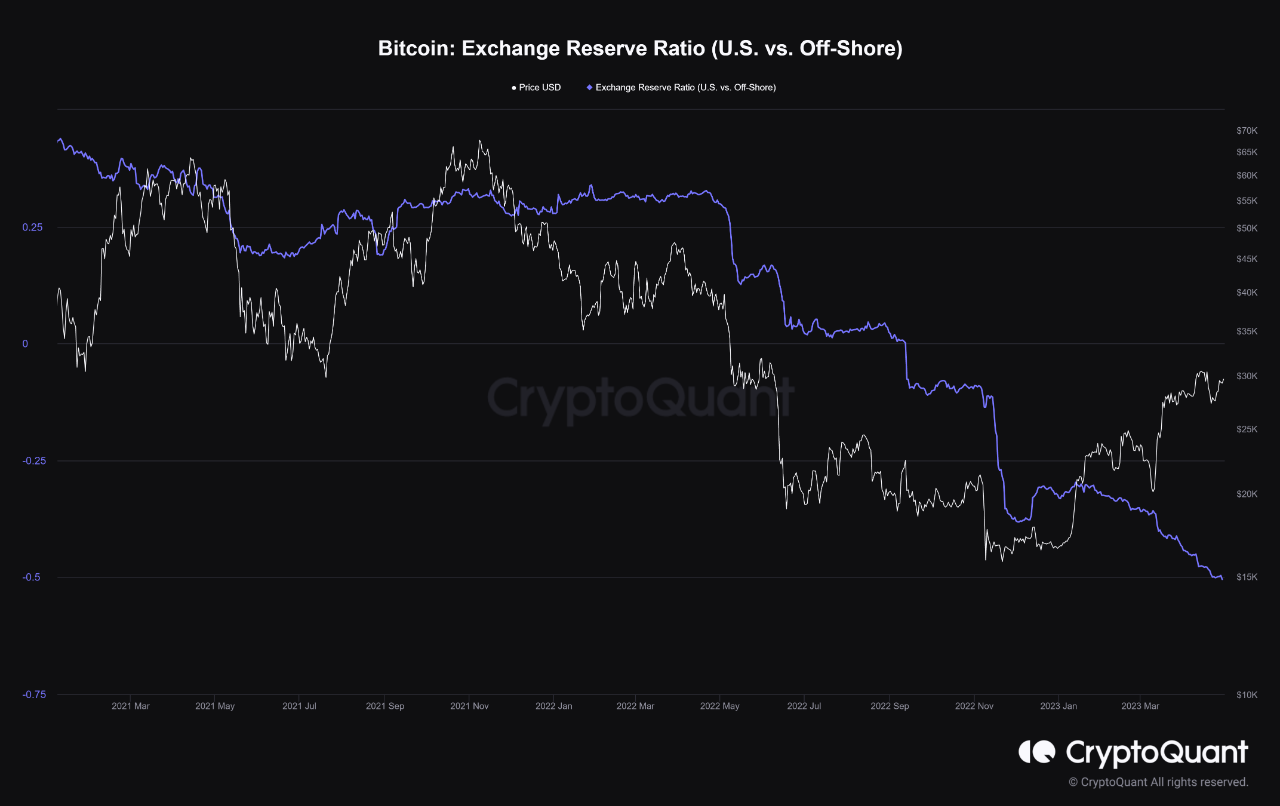

Now, here’s a chart that exhibits the development within the Bitcoin change reserve ratio for the US vs offshore platforms during the last couple of years:

The worth of the metric appears to have been happening in latest days | Supply: CryptoQuant

As you may see within the above graph, the Bitcoin change reserve ratio for these two units of platforms has been falling off for the reason that first half of 2022. This means that the provision on the US-based exchanges has been continuously declining in comparison with that on the overseas platforms.

The decline has been particularly sharp throughout main crashes the place some main platforms have gone bankrupt and FUD has unfold across the market, resulting in traders withdrawing their cash from centralized exchanges.

Although, whereas these crashes could have brought about non permanent accelerations within the drawdown, the entire change provide of Bitcoin has been in a state of decline for an extended whereas now. The decline has additionally been a market-wide phenomenon, that means that each one exchanges are seeing a shrinkage of their provide.

Nonetheless, contemplating that the change reserve ratio has continued to go down, it signifies that the decline has been particularly sharp for the US-based platforms. This could indicate that traders have been fleeing American exchanges at a sooner fee throughout this era.

“Due to regulatory calls for, American traders could not have as a lot religion in exchanges and would reasonably shift their cash to offshore exchanges or their wallets,” the quant explains. “If American policymakers put stress on this trade, they threat falling behind the remainder of the globe.”

BTC Worth

On the time of writing, Bitcoin is buying and selling round $28,500, up 4% within the final week.

BTC has plummeted within the final 24 hours | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link