[ad_1]

On Friday, Michael Barr, the vice chair for supervision on the U.S. Federal Reserve, revealed a report on the vulnerabilities that led to the last word failure of Silicon Valley Financial institution (SVB). As well as, Marshall Gentry, the chief threat officer of the Federal Deposit Insurance coverage Company (FDIC), launched the same report on Signature Financial institution’s collapse and its overreliance on uninsured deposits.

Fed Is Assured Supervisory Suggestions ‘Will Result in a Stronger and Extra Resilient Banking System’

The Federal Reserve and the FDIC revealed studies on Friday in regards to the fall of the second and third-largest U.S. financial institution failures in historical past. The primary report, revealed by the Fed’s vice chair for supervision Michael Barr, claims the central financial institution’s supervisors failed to acknowledge the extent of vulnerabilities at Silicon Valley Financial institution (SVB) because it grew in measurement and complexity. Barr wrote that SVB had 31 open supervisory findings whereas different banks had a lot fewer as compared.

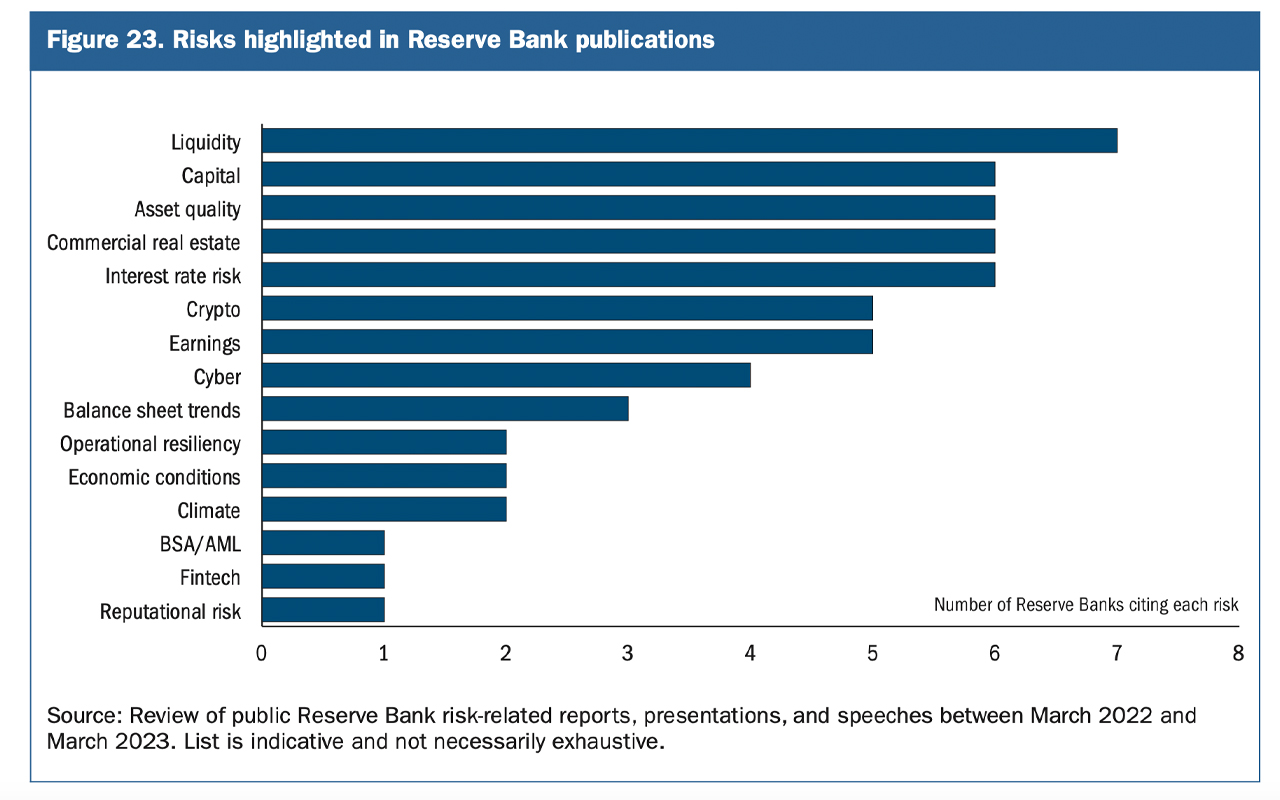

The report provides a complete perspective, noting that the Federal Reserve’s supervisory method failed to totally ponder the ramifications of rising rates of interest. Then a slowing exercise within the know-how sector, finally paved the way in which for the demise of SVB. “The supervision of SVB didn’t work with ample pressure and urgency, and contagion from the agency’s failure posed systemic penalties not contemplated by the Federal Reserve’s tailoring framework,” Barr mentioned. Barr’s report mentions crypto thrice and one occasion is positioned on a bar chart describing dangers.

“As I’ve beforehand introduced, the Federal Reserve has begun to construct a devoted novel exercise supervisory group to deal with the dangers of novel actions (equivalent to fintech or crypto actions) as a complement to current supervisory groups,” Barr acknowledged.

FDIC Report Discusses Crypto Dangers and SBNY’s ‘Flurry of Damaging Press’

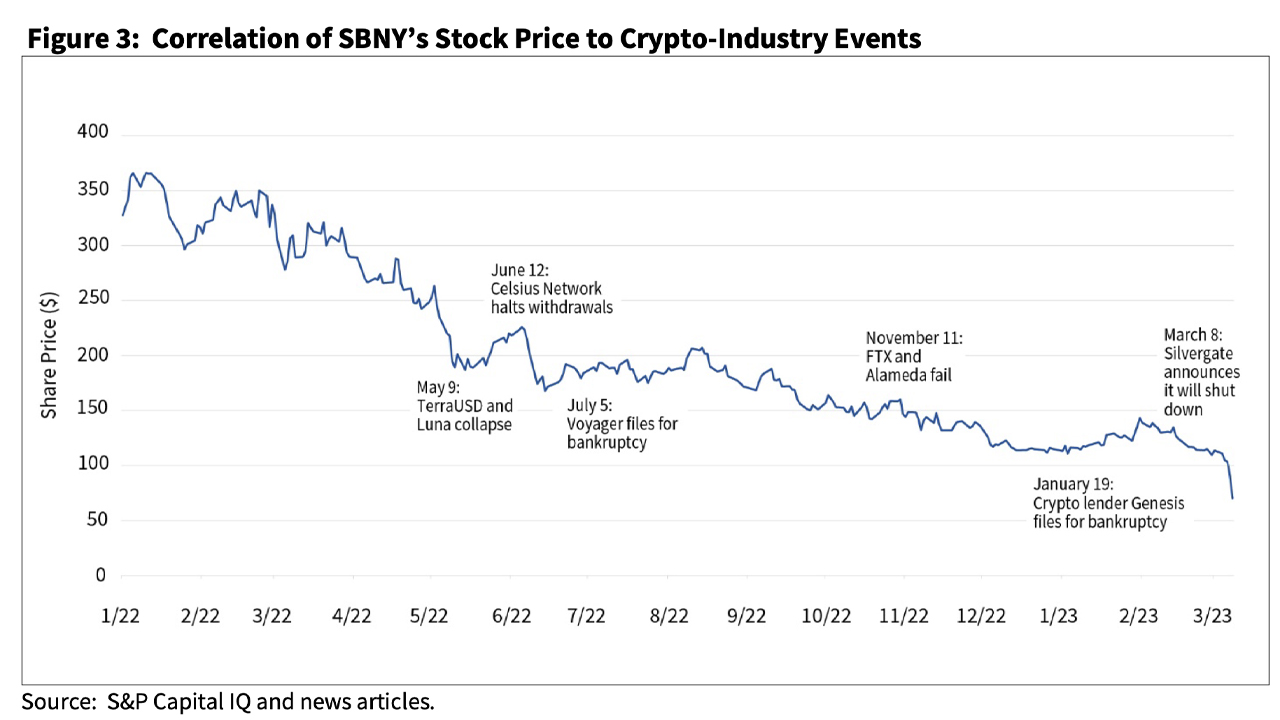

The FDIC revealed its report on Signature Financial institution’s (SBNY) collapse and the report authored by Marshall Gentry talks much more about crypto belongings and the FTX failure. All through the report, Gentry discusses how liquidity threat administration witnessed withdrawals of uninsured deposits rise to vital ranges. On web page 13, the FDIC report goes into nice element in regards to the crypto trade turmoil that bolstered SBNY’s failure. ”The technique uncovered SBNY to larger susceptibility to liquidity, fame, and regulatory threat because of the uncertainty and volatility of the digital asset house,” Gentry defined.

The report describes how two cryptocurrencies collapsed in Could 2022 (terrausd and luna), resulting in further turbulence within the trade and additional discusses the collapse of FTX. It famous that SBNY’s shares have been correlated with the crypto trade. “Because of its fame as a banker to many within the crypto trade, SBNY’s inventory worth carefully tracked these tumultuous occasions within the crypto trade house and dropped considerably throughout 2022,” the report notes. Each studies have been permitted by the Fed’s chair Jerome Powell and the FDIC’s chair Martin Gruenberg.

What’s your tackle the studies revealed by the Federal Reserve and the FDIC on the autumn of Silicon Valley Financial institution and Signature Financial institution? Tell us your ideas within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss induced or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link