[ad_1]

Over 14 years in the past, Satoshi Nakamoto unveiled the Bitcoin community to the world, creating the very first triple-entry bookkeeping system recognized to mankind. This technological surprise, with a present market worth of $540 billion, ingeniously integrates encryption and mathematical formulation to fortify its safety. On this exploration, we delve into two of the mathematical decisions that underpin Bitcoin’s advanced structure, figuring out block rewards, transaction inputs and outputs, and mining issue changes, whereas additionally regulating the tempo at which new blocks are found.

Complete Numbers at Work: A Have a look at Bitcoin’s Use of Integers

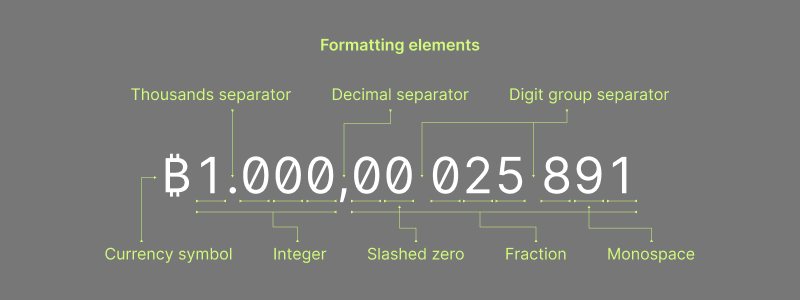

Bitcoin was created utilizing quite a lot of encryption processes and mathematical formulation, every with a selected objective. One design ingredient included into Bitcoin is the usage of integers, or entire numbers and their unfavorable counterparts.

The Bitcoin community makes use of integer math to stop potential disagreements that would come up if decimal or fractional numbers have been used. The usage of entire numbers and their unfavorable counterparts ensures that every one computational units can synchronize extra successfully and agree on particular community modifications.

The usage of integers to take care of Bitcoin’s ruleset contains block rewards and halvings that happen at particular block heights divisible by 210,000. Bitcoin’s mining issue additionally makes use of integers to regulate the problem each 2,016 blocks. Integers, a kind of numerical information ceaselessly utilized in computational software program, are additionally employed in Bitcoin transaction inputs and outputs.

Moreover, integer calculations are typically sooner and fewer vulnerable to error than floating-point numbers. If Bitcoin have been to make use of floating-point numbers, it might introduce rounding errors, resulting in inconsistencies and disagreements between totally different nodes on the community.

Since Bitcoin makes use of integers, the block reward from a future halving will finally be truncated or rounded all the way down to the closest entire quantity utilizing bit-shift operators or a bitwise operation. As a result of the smallest unit of Bitcoin is a satoshi, it makes it unattainable to halve. Consequently, Bitcoin’s much-discussed capped provide of bitcoin will really be lower than 21 million.

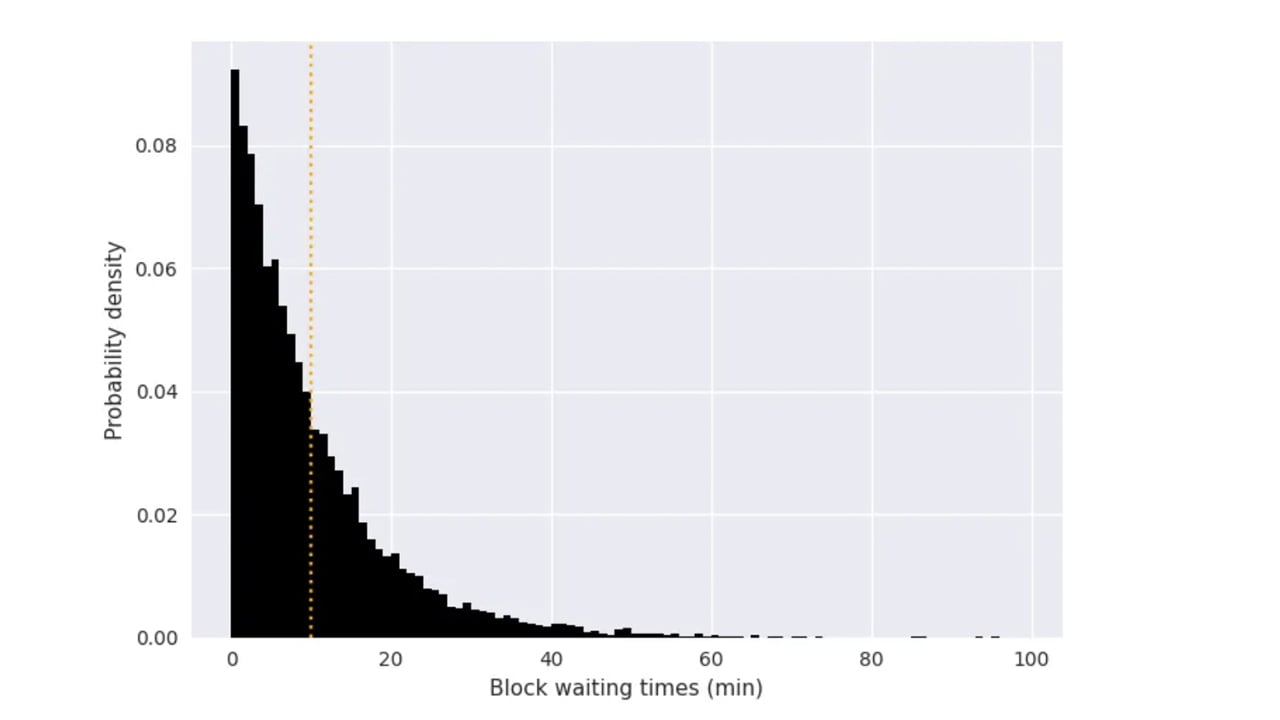

Regulating Block Instances with Poisson Distribution

Along with integers, Bitcoin employs a Poisson distribution-like mathematical components to control block time consistency. The Poisson distribution mannequin was developed in 1837 by French mathematician Simeon Denis Poisson. Utilizing this mannequin, Bitcoin’s design ensures that blocks are found each 10 minutes or so.

The precise time it takes to mine a block can range because of the probabilistic nature of the mining course of, however blocks are usually discovered inside the vary of 8 to 12 minutes. Satoshi included a problem setting each 2,016 blocks utilizing the components to take care of the tough common of 10-minute block intervals.

Each integer math and Poisson distribution are important mathematical instruments in Bitcoin, offering a constant framework for performing calculations and modeling varied facets of the system.

Bitcoin employs quite a few different mathematical mechanisms and encryption schemes to make sure accuracy, consistency, and effectivity of the system as an entire. These embrace ideas and formulation comparable to proof-of-work (PoW), Merkle timber, elliptic curve cryptography, cryptographic hash features, and finite fields, amongst others.

What do you concentrate on the mathematical schemes utilized by the Bitcoin community? Tell us your ideas within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Chart by Suhail Saqan, Integer photograph by Bitcoin Design

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss triggered or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link